South Korea Pension Funds Market Size, Share, And COVID-19 Impact Analysis, By Type of Pension Plan (Defined Benefit, Defined Contribution, Reserved Fund, and Hybrid), By End-User (Government, Corporate, and Individuals) and South Korea Pension Funds Market Insights, Industry Trend, Forecasts To 2035

Industry: Banking & FinancialSouth Korea Pension Funds Market Insights Forecasts to 2035

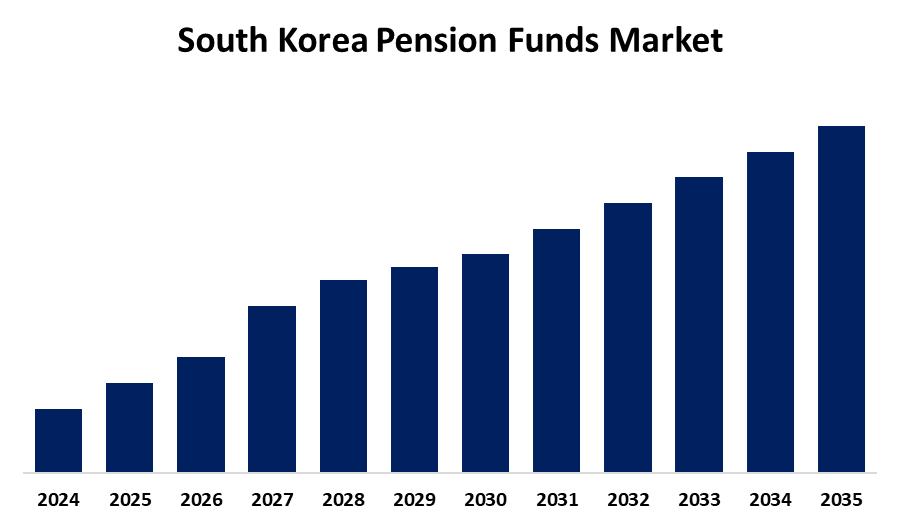

- The South Korea Pension Funds Market Size is Expected to Grow at a CAGR of around 5.1% from 2025 to 2035

- The South Korea Pension Funds Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Pension Funds Market Size is anticipated to Grow at a CAGR of 5.1% from 2025 to 2035. The market is driven by an aging population and the need for sustainable long-term returns through global diversification. Regulatory reforms, ESG integration, and low domestic interest rates further encourage strategic investment shifts and innovation.

Market Overview

South Koreas Pension Fund industry is among the most important supports to the nations heavily dominant pension-driven social security system. The industry is highly significant to providing long-term economic security to the elderly in the face of demographic change and an aging populace. The core public pension fund has focused increasingly in recent years on foreign diversification, investing in foreign equities, fixed income, and alternative assets such as infrastructure and private equity. Strategic requirements involve generating returns with long-term sustainability, particularly in the face of projected future budgetary strain by an aging population. ESG and sustainability are increasingly mainstream investment considerations, and policy is lowering exposure to fossil fuels and increasing green investing. Aside from the national fund, other state public pension funds covering government employees and teachers are also increasing their international presence and investment horizons. They reflect a wider trend towards professionally managed, internationally integrated pension fund management in South Korea.

Report Coverage

This research report categorizes the market for the South Korea pension funds market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea pension funds market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea pension funds market.

South Korea Pension Funds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Type of Pension Plan, By End-User |

| Companies covered:: | JPMorgan Chase & Co., Bank of America Corporation, Deutsche Bank AG, BNP Paribas, Wells Fargo, BlackRock, State Street Corporation, BNY Mellon, Fidelity Investments, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korean pension fund market is fuelled by a fast-growing population that is aging, and long-term financial sustainability is required. Global diversification and regulatory reform enable improved returns as well as risk protection. A low domestic interest rate environment is encouraging funds to move into alternative investments including private equity and real estate. In addition, the greater emphasis on ESG factors is influencing investment choices, and heightened professionalization and sophisticated risk instruments are driving improved fund performance and operating efficiency.

Restraining Factors

The South Korean market of pension funds is confronted with constraints like impending exhaustion of pension savings through low fertility rates and increased longevity. Political opposition tends to put structural reform behind schedule. In addition, globalization against market risks inherent in the exposure to global markets and excessive dependence on alternative investments pose inherent threats, while balancing expected returns with ESG objectives poses continuous investment challenges.

Market Segmentation

The South Korea Pension Funds Market share is classified into type of pension plan and end-user.

- The defined contribution segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea pension funds market is segmented by type of pension plan into defined benefit, defined contribution, reserved fund, and hybrid. Among these, the defined contribution segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. These plans are highly sought after because they are portable and cheaper for the employer, since contributions are prescribed but benefits are not assured, shifting investment risk to the employees. Portability of the plans, where the employees can carry their saved funds when changing jobs, adds to the popularity of these plans. Additionally, the growing tendency to be individually responsible for retirement savings has propelled the use of defined contribution plans. Employers prefer such schemes since they guarantee cost predictability, while staff enjoys the autonomy and possibility of greater returns by making their own investment decisions. All these benefits focus defined contribution plans as the greatest part of the pension funds sector.

- The government segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea pension funds market is segmented by end-user into government, corporate, and individuals. Among these, the government segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Government pension schemes typically have large numbers due to compulsory membership by government employees and the large number of beneficiaries who are covered by them. Government schemes typically have defined benefit plans, which provide a guaranteed retirement payment, thus ensuring economic security for government employees. The reliability and uniformity of government pensions secured by public funds and long-term funding methods make government pensions a pillar of the pension system. Other than that, governments all over also focus on social welfare so that such pension plans are funded and administered appropriately to serve the retiring population. Economic security and extensive coverage explain the government share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea pension funds market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JPMorgan Chase & Co.

- Bank of America Corporation

- Deutsche Bank AG

- BNP Paribas

- Wells Fargo

- BlackRock

- State Street Corporation

- BNY Mellon

- Fidelity Investments

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea pension funds market based on the below-mentioned segments:

South Korea Pension Funds Market, Type of Pension Plan

- Defined Benefit

- Defined Contribution

- Reserved Fund

- Hybrid

South Korea Pension Funds Market, By End-User

- Government

- Corporate

- Individuals

Need help to buy this report?