South Korea Paints and Coatings Market Size, Share, and COVID-19 Impact Analysis, By Material (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, and Others), By Product (Waterborne Coatings, Solvent-Borne Coatings, Powder Coatings, High Solids/Radiation Curing, and Others), and South Korea Paints and Coatings Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsSouth Korea Paints and Coatings Market Insights Forecasts to 2035

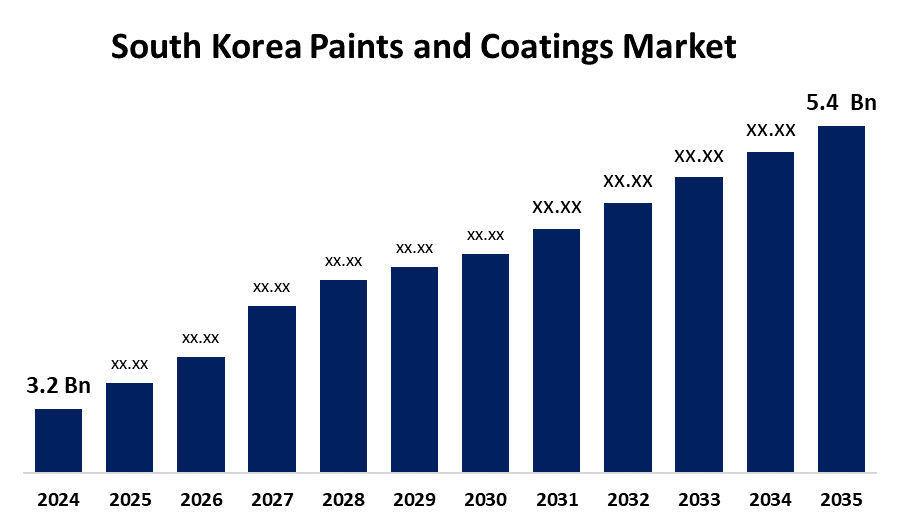

- The South Korea Paints and Coatings Market Size was estimated at USD 3.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.87% from 2025 to 2035

- The South Korea Paints and Coatings Market Size is Expected to Reach USD 5.4 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Paints and Coatings Market is anticipated to reach USD 5.4 billion by 2035, growing at a CAGR of 4.87% from 2025 to 2035. The market is being driven by growing urbanization and industrialization, which raise demand for paints and coatings in commercial, industrial, and residential construction projects.

Market Overview

The South Korea paints and coatings market refers to the industry that produces, distributes, and uses paint and coating products in South Korea is referred to as the South Korea paints and coatings market. These products are used in the commercial, industrial, automotive, and residential sectors to enhance, protect, and decorate the surfaces of different substrates. Additionally, market dynamics have been significantly shaped by technological developments in coating formulations, such as the incorporation of nanotechnology and smart coatings. These state-of-the-art developments further propel market penetration by providing improved performance attributes like self-healing and anti-corrosion qualities. In summary, the South Korean paints and coatings market is a key component of the larger industrial ecosystem, navigating a dynamic landscape driven by a combination of factors ranging from growing construction activities to the pursuit of sustainable and technologically advanced solutions.

Report Coverage

This research report categorizes the market for the South Korea paints and coatings market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea paints and coatings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea paints and coatings market.

South Korea Paints and Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.87% |

| 2035 Value Projection: | USD 5.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Material, By Product and COVID-19 Impact Analysis |

| Companies covered:: | KCC Corporation, Samhwa Paints Industrial Co., Sherwin-Williams Korea, AkzoNobel Korea Ltd., Nippon Paint Korea Co., Ltd., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The South Korean market for paints and coatings is expanding rapidly, mostly due to an increase in construction activity. The need for paints and coatings for both protective and aesthetic reasons has increased due to the growing demand for residential and commercial spaces brought on by urbanization. Furthermore, the growing automobile sector is now a major driver of market expansion. R&D efforts in the paints and coatings industry have been sparked by the automotive industry's continuous search for novel coatings that provide durability and improved aesthetics. In addition, strict environmental laws requiring the use of low-VOC (volatile organic compound) and environmentally friendly formulations have shifted industry attention to sustainable solutions. This environmental awareness has created new opportunities for market expansion in addition to supporting regional initiatives to lower carbon footprints.

Restraining Factors

Price fluctuations for essential inputs such as solvents, resins, and titanium dioxide can reduce profit margins and cause supply chain disruptions.

Market Segmentation

The South Korea paints and coatings market share is classified into material and product.

- The acrylic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea paints and coatings market is segmented by material into acrylic, alkyd, polyurethane, epoxy, polyester, and others. Among these, the acrylic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Acrylics are frequently used in water-based formulations, which satisfy South Korea's strict environmental laws and the country's consumers' desire for environmentally friendly, low-emission goods.

- The waterborne coatings segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea paints and coatings market is segmented by product into waterborne coatings, solvent-borne coatings, powder coatings, high solids/radiation curing, and others. Among these, the waterborne coatings segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Strict VOC (volatile organic compound) regulations enforced by the South Korean government have promoted the transition from solvent-based to waterborne coatings for use in industrial and architectural settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea paints and coatings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- KCC Corporation

- Samhwa Paints Industrial Co.

- Sherwin-Williams Korea

- AkzoNobel Korea Ltd.

- Nippon Paint Korea Co., Ltd.

- Others

Recent Developments:

- In December 2023, I-Tech AB signed a licensing agreement with International Paints Korea, a subsidiary of AkzoNobel Protective Coatings, for the commercial use of Selektope. It was I-Tech’s sixth commercial deal with major paint manufacturers operating in the South Korean market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Paints and Coatings Market based on the below-mentioned segments:

South Korea Paints and Coatings Market, By Material

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

South Korea Paints and Coatings Market, By Product

- Waterborne Coatings

- Solvent-Borne Coatings

- Powder Coatings

- High Solids/Radiation Curing

- Others

Need help to buy this report?