South Korea Orthopedic Implant Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Metallic, Ceramic, and Others), By Application (Spinal Implants, Reconstructive Joint Implants, Ortho biologics, and Others), and By End User (Hospitals Ambulatory Surgery, Orthopedic Clinics, and Others), and South Korea Orthopedic Implant Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareSouth Korea Orthopedic Implant Market Insights Forecasts to 2035

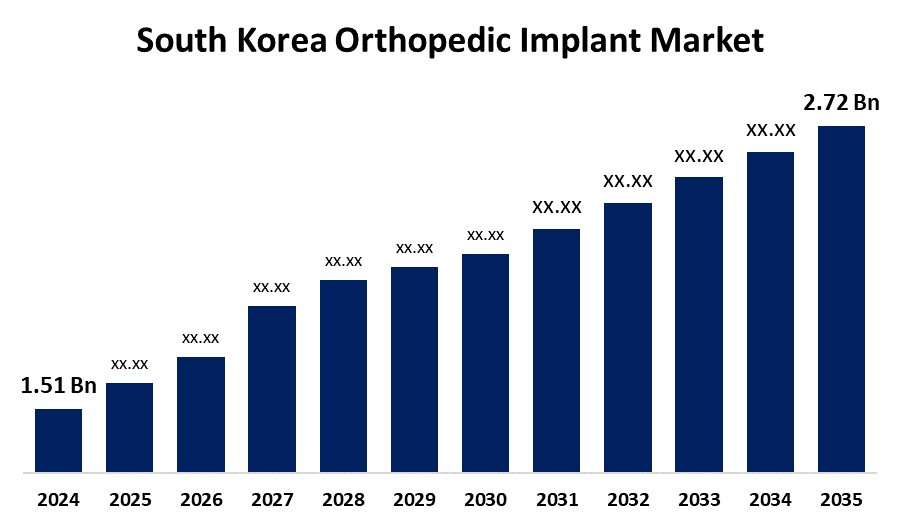

- The South Korea Orthopedic Implant Market Size Was Estimated at USD 1.51 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.50% from 2025 to 2035

- The South Korea Orthopedic Implant Market Size is Expected to Reach USD 2.72 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Orthopedic Implant Market Size is anticipated to reach USD 2.72 Billion by 2035, growing at a CAGR of 5.50% from 2025 to 2035. As a sign of society's dedication to meeting these urgent health requirements, well-known organizations like the Korean National Health Insurance Service are already changing their policies to cover more orthopedic surgeries for the elderly. In the upcoming years, the South Korean orthopedic implant market is anticipated to rise significantly due to the rising number of elderly patients in need of orthopedic procedures.

Market Overview

The market for medical devices intended to replace, support, or improve the function of diseased or injured musculoskeletal structures, such as bones and joints, is included in the orthopedic implants market. Orthopedic implants can greatly lessen discomfort, increase mobility, and make it easier for people to return to their regular activities, all of which can improve their quality of life in general. Faster recovery periods and shorter hospital stays are two benefits of minimally invasive procedures, which are becoming more and more common in the market. Implants can provide relief and increased comfort by efficiently addressing pain related to musculoskeletal disorders and traumas. The demand for implants, especially joint replacements, is mostly driven by the growing population of older persons, who are more vulnerable to orthopedic problems including arthritis and fractures. New designs, materials, and surgical methods such as 3D printing and robotics are improving patient outcomes, shortening recovery periods, and increasing implant longevity, opening up new markets for competitors. Plans from the government center on lowering the cost and increasing the accessibility of orthopedic implants, particularly in rural areas. Demand will be driven by initiatives to raise medical awareness of bone-related illnesses and the advantages of implants among the rural population.

Accessibility is also being enhanced by cost-cutting measures including lowering implant costs and giving free implants to those in need.

Report Coverage

This research report categorizes the market for South Korea orthopedic implant market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea orthopedic implant market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each South Korea orthopedic implant market sub-segment.

South Korea Orthopedic Implant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.51 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.50% |

| 2035 Value Projection: | USD 2.72 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type (Metallic, Ceramic, and Others), By Application (Spinal Implants, Reconstructive Joint Implants, Ortho biologics, and Others), and By End User (Hospitals Ambulatory Surgery, Orthopedic Clinics, and Others) |

| Companies covered:: | Osstem Implant Co., Ltd., MegaGen Implant Co., Ltd., DIO Corporation, Ortho Tech Co., Ltd., TDM Co., Ltd., Woosam Medical, CG Bio Inc., BL Tech, Onsurgical Corp., JEIL Medical Corporation, BioMaterials Korea, Inc., Cybermed Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for implants is derived from the rise in age-related orthopedic disorders such as osteoarthritis, osteoporosis, and fractures that occur as the world's population ages. This is especially noticeable in wealthy nations. As musculoskeletal conditions become more common, there is a greater need for orthopedic therapies, such as implants. Orthopedic operations are becoming more appealing and improving patient results thanks to advancements in surgical methods, materials, and implant design. Orthopedic intervention is frequently necessary for sports-related injuries and traumatic accidents, which further stimulates the implant industry.

Restraining Factors

Particularly in low- and middle-income nations, the high cost of orthopedic implants, procedures, and post-surgery care might affect accessibility and affordability. The release of novel and inventive implants may be delayed by stringent regulatory approval procedures conducted by organizations such as the FDA and EMA. Implant-related risks, such as infections or material allergies, can discourage patients and hinder market expansion. Healthcare systems were upended by the pandemic and the ensuing economic slump, which resulted in a decrease in demand for orthopedic implants and delays in elective surgery.

Market Segmentation

The South Korea orthopedic implant market share is classified into product type, application, and end user.

- The metallic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea orthopedic implant market is segmented by product type into metallic, ceramic, and others. Among these, the metallic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of its strength and longevity, metallic implants are frequently employed in load-bearing applications like hip and knee replacements.

- The spinal implants segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korean orthopedic devices market is segmented by application into spinal implants, reconstructive joint implants, ortho biologics, and others. Among these, the spinal implants segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increasing incidence of spinal problems and the aging population, which frequently requires surgical procedures, make spinal implants essential. The creation and uptake of cutting-edge spinal implant technologies are accelerating as the country's healthcare system grows more skilled and technologically sophisticated, contributing to better patient outcomes and more efficient treatments.

- The hospitals ambulatory segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korean orthopedic devices market is segmented by end user into hospitals ambulatory surgery, orthopedic clinics, and others. The hospitals ambulatory segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because they provide the facilities and resources required for intricate operations, hospitals ambulatory surgery centers are essential to the provision of orthopedic care. The aging population's increased incidence of orthopedic problems and improvements in surgical methods are driving higher demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea orthopedic implant market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Osstem Implant Co., Ltd.

- MegaGen Implant Co., Ltd.

- DIO Corporation

- Ortho Tech Co., Ltd.

- TDM Co., Ltd.

- Woosam Medical

- CG Bio Inc.

- BL Tech

- Onsurgical Corp.

- JEIL Medical Corporation

- BioMaterials Korea, Inc.

- Cybermed Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea orthopedic implant market based on the below-mentioned segments:

South Korea Orthopedic Implant Market, By Product Type

- Metallic

- Ceramic

- Others

South Korea Orthopedic Implant Market, By Application

- Spinal Implants

- Reconstructive Joint Implants

- Ortho biologics

- Others

South Korea Orthopedic Implant Market, By End User

- Hospitals Ambulatory Surgery

- Orthopedic Clinics

- Others

Need help to buy this report?