South Korea Orthopedic Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Trauma Fixation, Spinal Devices, Joint Replacement, Consumables Disposables, and Bone Repair), By Application (Spine, Trauma and Extremities, Knee, Hip, Foot and Ankle) and By End User (Ambulatory Surgery Centers, Hospitals, and Medical Research Center), and South Korea Orthopedic Devices Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareSouth Korea Orthopedic Devices Market Insights Forecasts to 2035

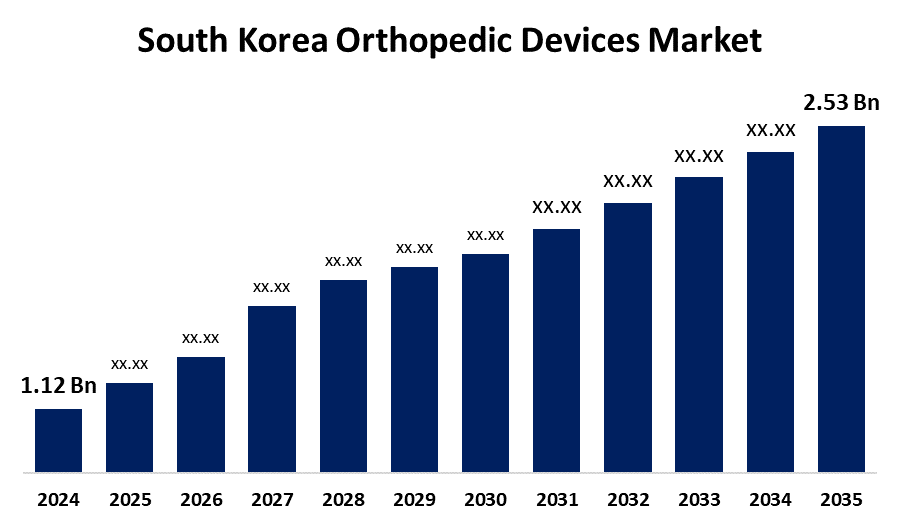

- The South Korea Orthopedic Devices Market Size Was Estimated at USD 1.12 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.69 % from 2025 to 2035

- The South Korea Orthopedic Devices Market Size is Expected to Reach USD 2.53 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Orthopedic Devices Market Size is anticipated to reach USD 2.53 Billion by 2035, growing at a CAGR of 7.69% from 2025 to 2035. The aging population, rising prevalence of orthopedic illnesses, and growing knowledge of cutting-edge medical technology are all driving major trends in the South Korean orthopedic devices market. According to the South Korean government, the country's aging population has increased the prevalence of diseases including osteoporosis and arthritis.

Market Overview

Joint reconstruction, spinal devices, and trauma fixation devices are among the medical devices and accessories used to treat musculoskeletal disorders that are included in the orthopedic market. In addition, it comprises arthroscopy equipment, and more recently, orthobiologics and bone graft alternatives. Millions of people can benefit from orthopedic procedures, such as surgeries and implants, which can increase mobility, lessen discomfort, and enhance quality of life. The need for orthopedic care is growing as a result of aging populations, increased life expectancy, and rising incidence of diabetes and obesity. The orthopedic sector offers businesses that specialize in devices, technology, and services a lot of room to grow. The need for surgeries and equipment is growing as the population ages and the prevalence of fractures, arthritis, and other orthopedic disorders rises. With rising demand and room for creative solutions, hip and knee replacements continue to be an important market. The adoption of minimally invasive operations is fueled by advantages like quicker healing, less discomfort, and shorter hospital stays. A broader spectrum of patients can now afford orthopedic surgeries thanks to this program's financial help for various therapies. Access to orthopedic care is enhanced by government spending on hospitals and other healthcare facilities, particularly in rural areas.

Report Coverage

This research report categorizes the market for South Korea orthopedic devices market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea orthopedic devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each South Korea orthopedic devices market sub-segment.

South Korea Orthopedic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.12 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.69 % |

| 2035 Value Projection: | USD 2.53 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 209 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type (Trauma Fixation, Spinal Devices, Joint Replacement, Consumables Disposables, and Bone Repair), By Application (Spine, Trauma and Extremities, Knee, Hip, Foot and Ankle) and By End User (Ambulatory Surgery Centers, Hospitals, and Medical Research Center) |

| Companies covered:: | OSTEOSYS Co., Ltd., CG Bio Inc., Woosam Medical, T&L Co., Ltd., DUK-IN, SeohanCare Co., Ltd., Solco Biomedical Co., Ltd., Taeyeon Medical, TDM Co., Ltd., U&I Corporation, INFINITT Healthcare, Cybermed Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise in age-related diseases such as osteoarthritis, osteoporosis, and weakening ligaments, the demand for orthopedic devices is significantly influenced by the aging population. The need for spine implants, joint replacements, and other orthopedic remedies grows as life expectancy rises. One in six individuals will be 60 or older by 2030, according to World Health Organization (WHO) projections, which would increase the need for orthopedic care. The need for orthopedic equipment is driven by the increasing prevalence of musculoskeletal conditions, such as osteoporosis, arthritis, and bone fractures. Numerous variables, such as aging, lifestyle decisions, and heredity, might contribute to these disorders.

Restraining Factors

Orthopedic surgery risks include infection, neuroparalysis, and range-of-motion loss might discourage patients and hinder market expansion. In addition to raising expenses and possibly decreasing patient satisfaction, post-operative problems can result in implant failure and the need for reoperation. Common post-operative problems that can hinder market expansion include discomfort, edema, inflammatory skin reactions, and implant loosening. The adoption of cutting-edge technologies may be hampered and surgical delays may result from a shortage of skilled surgeons and medical personnel qualified in orthopedic treatments. Additionally, this shortfall may affect patient outcomes and care quality, impeding market expansion.

Market Segmentation

The South Korea orthopedic devices market share is classified into type, application, and end user.

- The trauma fixation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korean orthopedic devices market is segmented by type into trauma fixation, spinal Devices, joint replacement, consumables disposables, and bone repair. Among these, the trauma fixation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Trauma fixation devices are essential for stabilizing fractures and promoting healing, which reflects the growing demand for efficient treatment options brought on by the high rate of injuries, especially among active populations and the elderly population.

- The spine segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea orthopedic devices market is segmented by application into spine, trauma and extremities, knee, hip, foot and ankle. Among these, the spine segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing number of spinal procedures and treatments targeted at enhancing mobility and reducing pain makes the spine section crucial.

- The ambulatory surgery centers segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea orthopedic devices market is segmented by end user into ambulatory surgery centers, hospitals, and medical research center. The ambulatory surgery centers segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because they may offer outpatient services, ambulatory surgery centers are becoming more and more important because they enable patients to have procedures with shorter hospital stays. This change optimizes healthcare expenses while also improving patient recovery rates.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea orthopedic devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- OSTEOSYS Co., Ltd.

- CG Bio Inc.

- Woosam Medical

- T&L Co., Ltd.

- DUK-IN

- SeohanCare Co., Ltd.

- Solco Biomedical Co., Ltd.

- Taeyeon Medical

- TDM Co., Ltd.

- U&I Corporation

- INFINITT Healthcare

- Cybermed Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea orthopedic devices market based on the below-mentioned segments:

South Korea Orthopedic Devices Market, By Type

- Trauma Fixation

- Spinal Devices

- Joint Replacement

- Consumables Disposables

- Bone Repair

South Korea Orthopedic Devices Market, By Application

- Spine

- Trauma and Extremities

- Knee

- Hip

- Foot and Ankle

South Korea Orthopedic Devices Market, By End User

- Ambulatory Surgery Centers

- Hospitals

- Medical Research Center

Need help to buy this report?