South Korea Orthokeratology Lens Market Size, Share, and COVID-19 Impact Analysis, By Product (Overnight Ortho-K Lenses and Daytime Ortho-K Lenses), By Distribution Channel (Hospitals and Optometry Clinics), By Indication (Myopia, Presbyopia, Hypermetropia, and Astigmatism), and South Korea Orthokeratology Lens Market Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Orthokeratology Lens Market Insights Forecasts to 2035

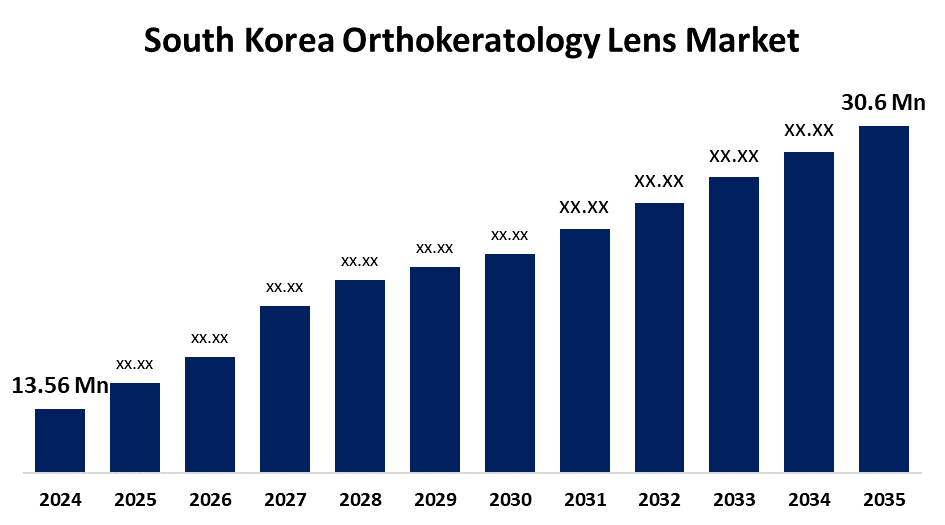

- The South Korea Orthokeratology Lens Market Size Was Estimated at USD 13.56 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.68% from 2025 to 2035

- The South Korea Orthokeratology Lens Market Size is Expected to Reach USD 30.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Orthokeratology Lens Market Size is anticipated to reach USD 30.6 Million by 2035, growing at a CAGR of 7.68% from 2025 to 2035. Growing awareness of managing myopia and an increase in refractive defects are driving the market for orthokeratology lenses, which is expanding quickly. Demand is being driven by the release of sophisticated overnight ortho K lenses and additional FDA approvals. Additionally, demand in these non-surgical solutions is growing due to the frequency of digital eye strain and an aging population.

Market Overview

The orthokeratology (Ortho K) lens market involves specially designed gas permeable contact lenses that temporarily reshape the cornea to correct refractive errors, primarily myopia. Worn overnight, these lenses provide clear daytime vision without the need for glasses or surgery. The non invasive myopia control, convenience for active lifestyles, and reversibility. The rising prevalence of myopia, especially among children and adolescents, along with growing awareness of non surgical vision correction. Technological advancements in lens design and fitting tools further support adoption. Government initiatives in countries like South Korea, including school based vision screening programs, public awareness campaigns, and subsidies for pediatric eye care, are enhancing early detection and intervention, fueling demand for effective solutions like Ortho K lenses.

Report Coverage

This research report categorizes the market for South Korea orthokeratology lens market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea orthokeratology lens market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea orthokeratology lens market.

South Korea Orthokeratology Lens Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13.56 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.68% |

| 2035 Value Projection: | USD 30.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Distribution Channel and By Indication |

| Companies covered:: | Lucid Korea, Global OK Vision, The One Optech Co., Ltd., Procornea, Euclid Systems Corporation, Paragon Vision Sciences, Brighten Optix, Alpha Corporation (Menicon), Contex Inc., Autek, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of myopia, particularly among children and adolescents, due to rising screen time and limited outdoor activity. Growing awareness of non surgical myopia management options boosts demand for ortho K lenses. Parents and healthcare providers prefer them for their safety, effectiveness, and reversibility. Technological advancements in lens materials and fitting techniques enhance comfort and outcomes.

Restraining Factors

Ortho K requires custom fittings and ongoing follow ups, often costing multiple times more than standard contact lenses, with little to no insurance reimbursement. Rigorous device approval processes and mandated practitioner credentials slow market entry and increase compliance costs. Fittings demand specialized equipment and training, and general consumer awareness remains low, hindering wider acceptance.

Market Segmentation

The South Korea orthokeratology lens market share is classified into product, distribution channel, and indication.

- The overnight ortho-K lenses segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea orthokeratology lens market is segmented by product into overnight ortho K lenses and daytime ortho K lenses. Among these, the overnight ortho K lenses segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Their convenience and effectiveness in temporarily correcting myopia during sleep. These lenses eliminate the need for daytime eyewear, appealing especially to children and active individuals. With rising myopia rates, particularly among school aged children, demand for non-surgical, reversible vision correction is increasing. Support from eye care professionals and growing awareness of myopia control further drive the strong growth of this segment.

- The hospitals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea orthokeratology lens market is segmented by distribution channel into hospitals and optometry clinics. Among these, the hospitals segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. Hospitals offer comprehensive eye care services, including precise fitting and monitoring of ortho K lenses, which enhances treatment outcomes. The growing prevalence of childhood myopia and increased parental trust in hospital based care contribute to higher patient volume. Additionally, government-backed vision health initiatives and hospital partnerships with lens manufacturers support continued growth in this segment during the forecast period.

- The myopia segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea orthokeratology lens market is segmented by indication into myopia, presbyopia, hypermetropia, and astigmatism. Among these, the myopia segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. The high and rising prevalence of myopia, particularly among children and adolescents. Increased screen time, intense academic pressure, and limited outdoor activity contribute to early onset myopia. Orthokeratology lenses offer a non invasive, reversible solution to slow myopia progression, making them a preferred option for parents and eye care professionals. Public health awareness campaigns and clinical endorsements for myopia control further support the segment’s strong growth during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea orthokeratology lens market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lucid Korea

- Global OK Vision

- The One Optech Co., Ltd.

- Procornea

- Euclid Systems Corporation

- Paragon Vision Sciences

- Brighten Optix

- Alpha Corporation (Menicon)

- Contex Inc.

- Autek

- Others

Key Target Audience

- Market Players

- Investors

- End users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea orthokeratology lens market based on the below mentioned segments:

South Korea Orthokeratology Lens Market, By Product

- Overnight Ortho K Lenses

- Daytime Ortho K Lenses

South Korea Orthokeratology Lens Market, By Distribution Channel

- Hospitals

- Optometry Clinics

South Korea Orthokeratology Lens Market, By Indication

- Myopia

- Presbyopia

- Hypermetropia

- Astigmatism

Need help to buy this report?