South Korea Oral Anti-Diabetic Drug Market Size, Share, and COVID-19 Impact Analysis, By Drugs (Biguanides (Metformin), Alpha-Glucosidase Inhibitors, Dopamine D2 Receptor Agonist (Bromocriptin), SGLT-2 Inhibitors (Invokana (Canagliflozin), Jardiance (Empagliflozin), Farxiga/Forxiga (Dapagliflozin), Suglat (Ipragliflozin)), DPP-4 Inhibitors (Onglyza (Saxagliptin), Tradjenta (Linagliptin), Vipidia/Nesina (Alogliptin), Galvus (Vildagliptin)), Sulfonylureas, Meglitinides), and South Korea Oral Anti-Diabetic Drug Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Oral Anti-Diabetic Drug Market Insights Forecasts to 2035

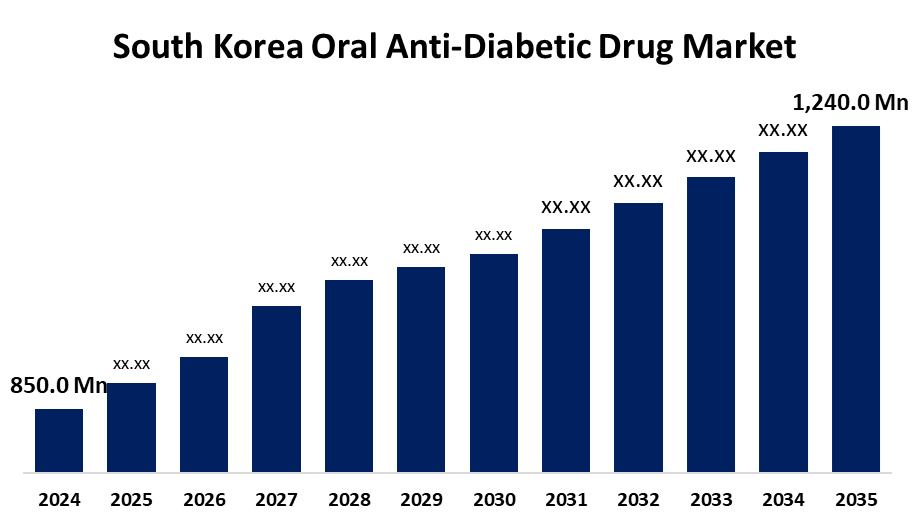

- The South Korea Oral Anti-Diabetic Drug Market Size was estimated at USD 850.0 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.49% from 2025 to 2035

- The South Korea Oral Anti-Diabetic Drug Market Size is Expected to Reach USD 1,240.0 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Oral Anti-Diabetic Drug Market is anticipated to reach USD 1,240.0 million by 2035, growing at a CAGR of 3.49% from 2025 to 2035. Within the major factors driving the market are the rising prevalence of diabetes among the general population as a result of unhealthy diets, the growing integration of smart devices with drug delivery mechanisms, and the growing influence of patient advocacy groups.

Market Overview

The South Korea oral anti-diabetic drug market encompasses the production, distribution, and use of oral drugs intended to control blood glucose levels in consumers with diabetes, especially type 2 diabetes, are all included in the South Korean oral anti-diabetic drug market. When lifestyle changes alone are not enough to control blood sugar levels, these medications are usually prescribed. Additionally, Currently, one of the key factors driving the market's expansion in South Korea is the rising prevalence of diabetes among the general population such of sedentary lifestyle choices and the consumption of unhealthy diets. In addition, the number of patients seeking pharmacological interventions is growing as a result of advancements in healthcare infrastructure and accessibility, as well as increased awareness of the value of early diagnosis and treatment.

Report Coverage

This research report categorizes the market for the South Korea oral anti-diabetic drug market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea oral anti-diabetic drug market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea oral anti-diabetic drug market.

South Korea Oral Anti-Diabetic Drug Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 850.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Drugs and COVID-19 Impact Analysis |

| Companies covered:: | Takeda, Novo Nordisk, Pfizer, Eli Lilly, Janssen Pharmaceuticals, Astellas, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Better disease management is made possible by the real-time monitoring and customized dosing adjustments made possible by the integration of smart devices with drug delivery systems. Additionally, doctors are prescribing combination therapies which combine several drug classes into a single medication to treat the complex nature of diabetes, which helps patients adhere to their treatment plans and improves medication adherence. Additionally, social media's growing role in healthcare and the growing influence of patient advocacy groups are supporting the nation's market expansion. In addition, patients are taking a more active role in their care and are requesting medications that suit their preferences and lifestyle in addition to successfully managing their diabetes. This trend is forcing the nation's pharmaceutical companies to pay attention to patient feedback and create drugs that meet these changing needs.

Restraining Factors

Remote areas of South Korea frequently have limited access to healthcare services, including diabetes management. Rural populations have worse diabetes control and more complications as a result of delayed diagnosis and treatment caused by the lack of healthcare facilities and resources in these areas.

Market Segmentation

The South Korea oral anti-diabetic drug market share is classified into drugs.

- The biguanides segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea oral anti-diabetic drug market is segmented by drugs into biguanides (metformin), alpha-glucosidase inhibitors, dopamine D2 receptor agonist (bromocriptin), SGLT-2 inhibitors (invokana (canagliflozin), jardiance (empagliflozin), farxiga/forxiga (dapagliflozin), and suglat (ipragliflozin)), DPP-4 inhibitors (onglyza (saxagliptin), tradjenta (linagliptin), vipidia/nesina (alogliptin), and galvus (vildagliptin)), sulfonylureas, and meglitinides. Among these, the biguanides segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The demand for oral anti-diabetic medications is being driven by the increasing incidence of type 2 diabetes in South Korea. The aging population, sedentary lifestyles, and dietary practices are some of the factors that are contributing to the rising number of cases. To meet this increasing demand, pharmaceutical companies and healthcare providers are extending treatment options.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea oral anti-diabetic drug market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takeda

- Novo Nordisk

- Pfizer

- Eli Lilly

- Janssen Pharmaceuticals

- Astellas

- Others

Recent Developments:

- In May 2024, Biocon Limited announced an exclusive licensing and supply agreement with Handok, a specialty pharmaceutical company in South Korea. This agreement aimed to commercialize Biocon’s complex drug product, Synthetic Liraglutide, highlighting its vertically integrated approach.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Oral Anti-Diabetic Drug Market based on the below-mentioned segments:

South Korea Oral Anti-Diabetic Drug Market, By Drugs

- Biguanides

- Metformin

- Alpha-Glucosidase Inhibitors

- Dopamine D2 Receptor Agonist

- Bromocriptin

- SGLT-2 Inhibitors

- Invokana (Canagliflozin)

- Jardiance (Empagliflozin)

- Farxiga/Forxiga (Dapagliflozin)

- Suglat (Ipragliflozin)

- DPP-4 Inhibitors

- Onglyza (Saxagliptin)

- Tradjenta (Linagliptin)

- Vipidia/Nesina (Alogliptin)

- Galvus (Vildagliptin)

- Sulfonylureas

- Meglitinides

Need help to buy this report?