South Korea Optoelectronics Market Size, Share, and COVID-19 Impact Analysis, By Device Type (LED, Laser Diode, Image Sensors, Optocouplers, Photovoltaic Cells, and Other Device Type), By End User (Automotive, Aerospace and Defense, Consumer Electronics, Information Technology, Healthcare, Residential and Commercial, Industrial, and Other), and South Korea Optoelectronics Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsSouth Korea Optoelectronics Market Insights Forecasts to 2035

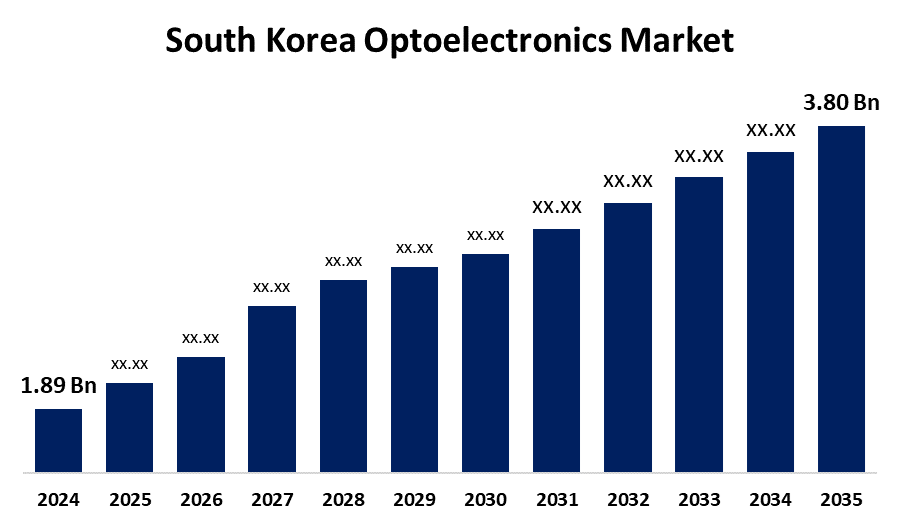

- The South Korea Optoelectronics Market Size Was Estimated at USD 1.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.56% from 2025 to 2035

- The South Korea Optoelectronics Market Size is Expected to Reach USD 3.80 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Optoelectronics Market is anticipated to reach USD 3.80 billion by 2035, growing at a CAGR of 6.56% from 2025 to 2035. The market is seeing the advent of miniaturization and increased performance devices, expansion in GaN-based LED technology, expanding demand for sensors in self-driving cars, and merging optoelectronics into the IoT universe. Creation of high-performance imaging sensors for AR/VR applications is also opening up new growth prospects.

Market Overview

The South Korea optoelectronics market denotes the business covering devices and systems that sense, control, and produce light, including visible, infrared, ultraviolet, and other types of radiation. These devices act as transducers, which transform electrical signals to optical signals and vice versa. They rely mainly on the quantum mechanical effects of light interacting with electronic materials, especially semiconductors. Moreover, the rising trend towards intelligent appliances and the Internet of Things (IoT) is also driving the demand for optoelectronic components. As more connected and intelligent devices are demanded by consumers, manufacturers are being forced to integrate optoelectronic technologies in order to comply with these demands. Furthermore, the government aspirations in the region have assisted in enhancing the training and awareness of expert personnel in the smart factory setting. The South Korean government stated that it would offer assistance to train 40,000 expert workers to run completely automated manufacturing facilities through a variety of training programs while diversifying assistance.

Report Coverage

This research report categorizes the market for the South Korea optoelectronics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea optoelectronics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea optoelectronics market.

South Korea Optoelectronics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.89 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.56% |

| 2035 Value Projection: | USD 3.80 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 192 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Device Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | SK Hynix Inc, Samsung Electronics, Omnivision Technologies Inc, Osram Licht AG, Koninklijke Philips NV, Vishay Intertechnology Inc and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The government encouragement for technological progress, the surging consumer electronics market, the fast expansion of the automotive sector (particularly autonomous cars), the growing use of advanced healthcare technology, and the growing demand for energy-efficient lighting solutions. These all come together to form a dynamic and very promising market landscape.

Restraining Factors

The industry is confronted with issues like high-intensity global competition, price pressure, technological developments involving high R&D expenditure, and possible supply chain interruptions. The sector is also exposed to volatile raw material prices and the requirement to comply with increasingly tough environmental regulations.

Market Segmentation

The South Korea optoelectronics market share is classified into device type and end-user.

- The LED segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea optoelectronics market is segmented by device type into LED, laser diode, image sensors, optocouplers, photovoltaic, cells, and other device type. Among these, The LED segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This market dominance is due to the extensive penetration of LED technology in a number of applications such as automotive lighting, consumer products, and general lighting systems. LEDs are preferred due to their efficiency in using energy, long lifespan, and small size.

- The consumer electronics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea optoelectronics market is segmented by end-user into automotive, aerospace and defense, consumer electronics, information technology, healthcare, residential and commercial, industrial, and other. Among these, the consumer electronics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This supremacy is largely attributed to the widespread use of optoelectronic devices i.e., LEDs, image sensors, and OLED displays within devices such as smartphones, televisions, and digital cameras. Strong consumer electronics manufacturing within the nation, spearheaded by players such as Samsung and LG, fuels this demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea optoelectronics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SK Hynix Inc

- Samsung Electronics

- Omnivision Technologies Inc

- Osram Licht AG

- Koninklijke Philips NV

- Vishay Intertechnology Inc

- Others

Recent Developments:

- In February 2025, Seoul Semiconductor unveiled its vision of natural light (sunlight) as the future of lighting. On February 27, 2025, the company announced its participation in JAPAN SHOP 2025, the premier exhibition for commercial space design and display in Japan, scheduled for March 4 to 7, 2025, at Tokyo Big Sight. At the event, Seoul Semiconductor showcased its groundbreaking SunLike LED technology, championing the theme "Lighting's Paradigm Shift." SunLike stood out as the world's pioneering next-generation lighting solution, designed to flawlessly mimic the natural light spectrum and offer benefits beyond mere illumination.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea optoelectronics market based on the below-mentioned segments:

South Korea Optoelectronics Market, By Device Type

- LED

- Laser Diode

- Image Sensors

- Optocouplers

- Photovoltaic Cells

- Other Device Type

South Korea Optoelectronics Market, By End User

- Automotive

- Aerospace and Defense

- Consumer Electronics

- Information Technology

- Healthcare

- Residential and Commercial

- Industrial

- Other

Need help to buy this report?