South Korea Neoprene Market Size, Share, and COVID-19 Impact Analysis, By Grade (General-Purpose Grade, Pre-Crosslinked Grade, Sulfur-Modified Grade, and Slow Crystallizing Grade), By Application (Latex, Elastomers, and Adhesives), By End Use (Building & Construction, Automotive, Electrical & Electronics, Medical, Textiles, and Others), and South Korea Neoprene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Neoprene Market Insights Forecasts to 2035

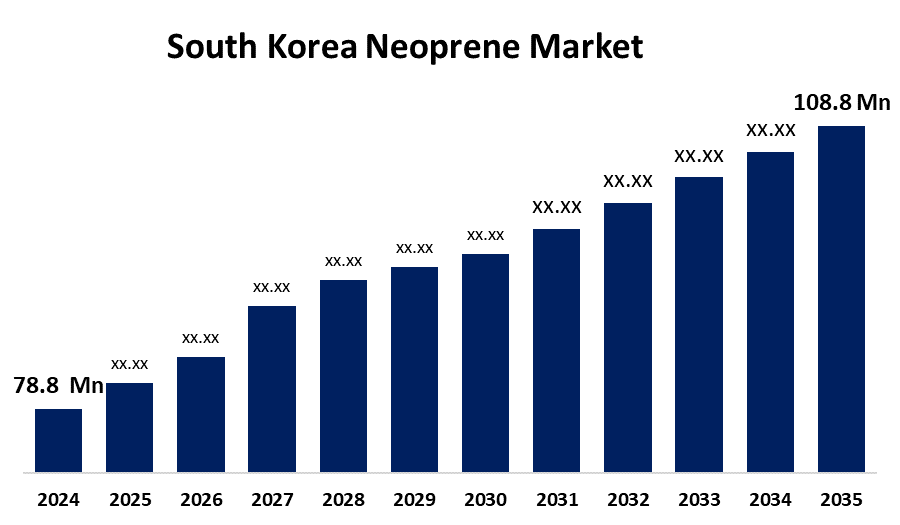

- The South Korea Neoprene Market Size Was Estimated at USD 78.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.98% from 2025 to 2035

- The South Korea Neoprene Market Size is Expected to Reach USD 108.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Neoprene Market is anticipated to reach USD 108.8 million by 2035, growing at a CAGR of 2.98% from 2025 to 2035. The sports and defense industries' growing need for protective gear and wetsuits is driving the market for neoprene.

Market Overview

The sector that includes the manufacturing, distribution, and use of neoprene, a synthetic rubber that is renowned for its adaptability and resilience to a range of conditions, is referred to as the neoprene market. Chloroprene is polymerized to create neoprene, which is prized for its strength, resilience to chemicals, and flexibility over a broad temperature range. Neoprene plays a crucial role in the effectiveness and performance of automobiles by being a component of hoses, belts, gaskets, and seals. Its flexibility and durability, neoprene finds employment in medical-grade applications such as orthopaedic wear, braces, and supports. There are prospects for growth in this industry because neoprene is utilized in construction for insulation and waterproofing, especially in expansion joints, flooring, and roofing materials. Orthopaedic braces and other medical devices are among the healthcare applications that make use of neoprene's qualities. Alternative neoprene product development is being influenced by government programs that encourage the adoption of environmentally friendly materials and sustainable production techniques. The market for neoprene is also being impacted by policies that promote recycling and waste management, especially regarding end-of-life items.

Report Coverage

This research report categorizes the market for South Korea neoprene market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea neoprene market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea neoprene market.

South Korea Neoprene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 78.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.98% |

| 2035 Value Projection: | USD 108.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Grade, By Application, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Kumho Petrochemical, Kumho Polychem, KCC Corporation, Taekwang Industrial, Hyosung Chemical, Kyungbang, ComfieLite Corporation, PACIFIC INDUSTRY CO., Puyoung Industrial Corp., Unovics Enc Co., Ltd., Daeho Industry Co., Ltd., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The rising demand across the automotive, construction, and electronics sectors is due to its durability, chemical resistance, and thermal insulation properties. Growth in water sports and outdoor recreational activities boosts neoprene use in wetsuits and sports gear. Additionally, increasing infrastructure development and industrialization, particularly in emerging economies, fuel market expansion. Advancements in manufacturing technologies and the growing preference for synthetic rubber over natural alternatives further contribute to the market's positive trajectory.

Restraining Factors

The fluctuating raw material prices, particularly petrochemical-based inputs, impact production costs. Environmental concerns and stringent regulations regarding synthetic rubber manufacturing also hinder market growth. Additionally, the availability of eco-friendly and cost-effective alternatives, such as natural rubber and thermoplastic elastomers, poses a competitive challenge.

Market Segmentation

The South Korea neoprene market share is classified into grade, application, and end-use.

- The general-purpose grade segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea neoprene market is segmented by grade into general-purpose grade, pre-crosslinked grade, sulfur-modified grade, and slow crystallizing grade. Among these, the general-purpose grade segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Its broad use in a variety of low-to-moderate performance applications, especially in the production of consumer items and automobiles. Due to its low cost and ease of manufacturing, OEMs are increasingly using this grade for components including shock absorbers, hoses, and seals.

- The elastomers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea neoprene market is segmented by application into latex, elastomers, and adhesives. Among these, the elastomers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. High-resilience materials in electric cars (EVs), especially for parts that are subjected to vibration, heat, and chemicals. Neoprene is used in EV battery casings, mounts, and thermal management systems primarily because of its shown thermal stability and resistance to degradation.

- The building & construction segment dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea neoprene market is segmented by end-use into building & construction, automotive, electrical & electronics, medical, textiles, and others. Among these, the building & construction segment dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. Neoprene is in high demand for expansion joints, window gaskets, and waterproof membranes due to the building and construction industry's increased emphasis on energy efficiency and weather resistance. Developers are actively using neoprene-based components to ensure longevity and comply with increasingly stringent standards for thermal insulation and water intrusion in both residential and commercial buildings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea neoprene market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kumho Petrochemical

- Kumho Polychem

- KCC Corporation

- Taekwang Industrial

- Hyosung Chemical

- Kyungbang

- ComfieLite Corporation

- PACIFIC INDUSTRY CO.

- Puyoung Industrial Corp.

- Unovics Enc Co., Ltd.

- Daeho Industry Co., Ltd.

- Others

Recent Developments:

- In August 2025, South Koreas robust industrial base and growing emphasis on sustainability are driving the neoprene market. Companies like LG Chem are investing in innovative production technologies to cater to the increasing demand for high-performance neoprene. Recent mergers, including LG Chems collaboration with smaller chemical manufacturers, have strengthened the market's competitive landscape.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea neoprene market based on the below-mentioned segments:

South Korea Neoprene Market, By Grade

- General-Purpose Grade

- Pre-Crosslinked Grade

- Sulfur-Modified Grade

- Slow Crystallizing Grade

South Korea Neoprene Market, By Application

- Latex

- Elastomers

- Adhesives

South Korea Neoprene Market, By End Use

- Building & Construction

- Automotive

- Electrical & Electronics

- Medical

- Textiles

- Others

Need help to buy this report?