South Korea Neo and Challenger Bank Market Size, Share, and COVID-19 Impact Analysis, By Type (Neo Banks and Challenger Banks), By Services Offered (Payments, Savings Products, Current Account, Consumers Credits, Loans, and Others), By End-User (Business Organizations and Personal Consumers), and South Korea Neo and Challenger Bank Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialSouth Korea Neo and Challenger Bank Market Insights Forecasts to 2035

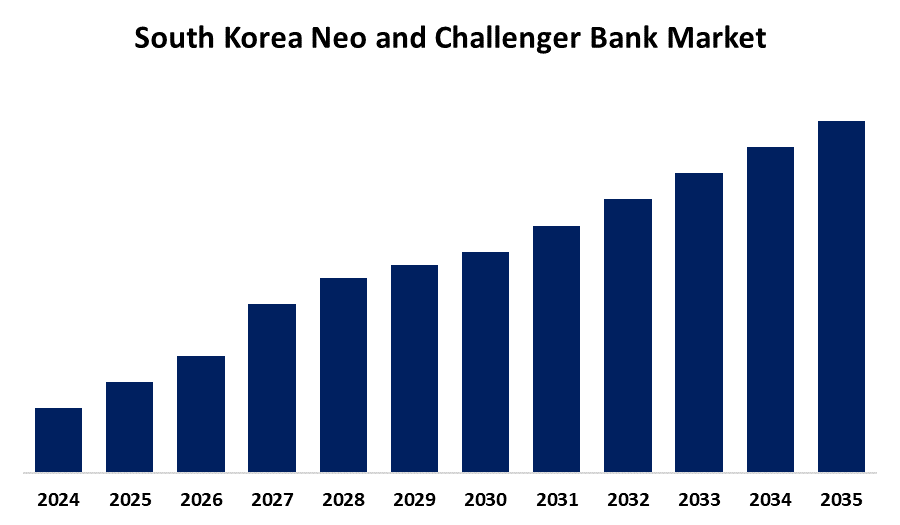

- The South Korea Neo and Challenger Bank Market Size is Expected to Grow at a CAGR of around 3.7% from 2025 to 2035

- The South Korea Neo and Challenger Bank Market Size is expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Neo and Challenger Bank Market Size is anticipated to Grow at a CAGR of 3.7% from 2025 to 2035. The market is driven by increasing smartphone penetration and demand for digital-first banking experiences. Regulatory support for fintech innovation and open banking frameworks further accelerates market growth.

Market Overview

South Korea challenger bank and neo bank market is expanding very fast, fueled by universal smartphone adoption, e-literacy, and the need for convenient, easily accessible, mobile-driven banking. The regulatory efforts towards encouraging internet-only banking and open banking models have encouraged innovation and powered market growth. These banks primarily focus on technologically advanced younger generations and provide easy-to-use products such as digital accounts, real-time lending, mobile payments, and wealth management. Although take-up is high, profitability pressure, stress, intense competition, and regulatory impediments still prevail. Nevertheless, ongoing product innovation priority and growth in under-penetrated markets like foreign residents and SMEs is stabilized to sustain momentum. As digitalization transforms the banking sector, South Korea's challenger and neo banks are expected to revolutionize banking experiences by integrating them in a more personalized and convenient manner.

Report Coverage

This research report categorizes the market for the South Korea neo and challenger bank market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea neo and challenger bank market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea neo and challenger bank market.

South Korea Neo and Challenger Bank Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.7% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Services Offered, By End-User |

| Companies covered:: | KakaoBank, K Bank, Toss Bank, Viva Republica, PayGate, Korea Credit Data, Finset, PeopleFund, Lendit, Rainist, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South Korea neo and challenger banking market is driven by surging consumer demand for digital-first banking, supported by heightened smartphone penetration and a tech-literate young demographic. Facilitative government regulation in the shape of internet-only bank licenses and open banking platforms has fueled fintech development and market access. Efficiency in branchless servicing, real-time service, and smooth mobile platforms are appealing to users pushing for convenience and speed. Moreover, growing demand for tailored financial products and more extensive services to underbanked individuals also fuels the market development.

Restraining Factors

The South Korea neo and challenger bank market is confronted with the challenge of aggressive competition from new-generation digital-born banks and legacy banks, thus facing margin pressures. Compliance with regulations is still complicated, particularly in onboarding foreign customers. Moreover, few sources of revenue outside of lending and fees are challenging long-term profitability. Consumer security and trust issues are also blocking increased adoption and sustained expansion.

Market Segmentation

The South Korea Neo and Challenger Bank Market share is classified into type, services offered, and end-user.

- The challenger banks segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea neo and challenger bank market is segmented by type into neo banks and challenger banks. Among these, the challenger banks segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Challenger banks provide accessible consumer access, reduced costs, and identical services to a traditional bank. Pure neo banks are different because they have no physical branches to provide face-to-face banking services to consumers accustomed to them. Customer focus, through, for example, customized financial products and simple-to-use mobile apps, appeals to technology-conscious consumers.

- The payment segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea neo and challenger bank market is segmented by services offered into payments, savings products, current accounts, consumer credits, loans, and others. Among these, the payment segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It is driven by rising demands for quick, efficient, and convenient payment facilities by consumers. Neo and challenger banks provide end-to-end online payment facilities that attract busy consumers who want an alternative to conventional banking. Their mobile applications support real-time money transfer, peer-to-peer payments, and instant payments, providing a better user experience and convenience. They also offer competitive transaction charges or free transactions, which is their choice option for recurrent payment transactions. The trend towards a cashless economy has also driven growth in the payment segment.

- The business organizations segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea neo and challenger bank market is segmented by end-user into business organizations and personal consumers. Among these, the business organizations segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing need of companies for efficient and inexpensive banking solutions fuels the growth of this sector at a rapid rate. Neo and challenger banks have specified financial products and services committed to business needs, such as simplified payment processing, simple access to credit, and intelligence-driven insights. Digital-first strategy enables companies to manage finance seamlessly by using platforms that integrate with their business applications. Additionally, these banks provide competitive rates and lower fees compared to mainstream banks, and this is appealing to small and medium-sized enterprises (SMEs).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea neo and challenger bank market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- KakaoBank

- K Bank

- Toss Bank

- Viva Republica

- PayGate

- Korea Credit Data

- Finset

- PeopleFund

- Lendit

- Rainist

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Neo and Challenger Bank Market based on the below-mentioned segments:

South Korea Neo and Challenger Bank Market, By Type

- Neo Banks

- Challenger Banks

South Korea Neo and Challenger Bank Market, By Services Offered

- Payments

- Savings Products

- Current Account

- Consumer Credits

- Loans

- Others

South Korea Neo and Challenger Bank Market, By End-User

- Business Organizations

- Personal Consumers

Need help to buy this report?