South Korea Naphthalene Market Size, Share, and COVID-19 Impact Analysis, By Source (Coal Tar and Petroleum), By Application (Plasticizer, Pesticide, Surfactant, and Wetting Agent), and By End-User Industry (Agriculture, Building & Construction, Textile, Chemical, Polymer, and Pharmaceutical), and South Korea Naphthalene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Naphthalene Market Insights Forecasts to 2035

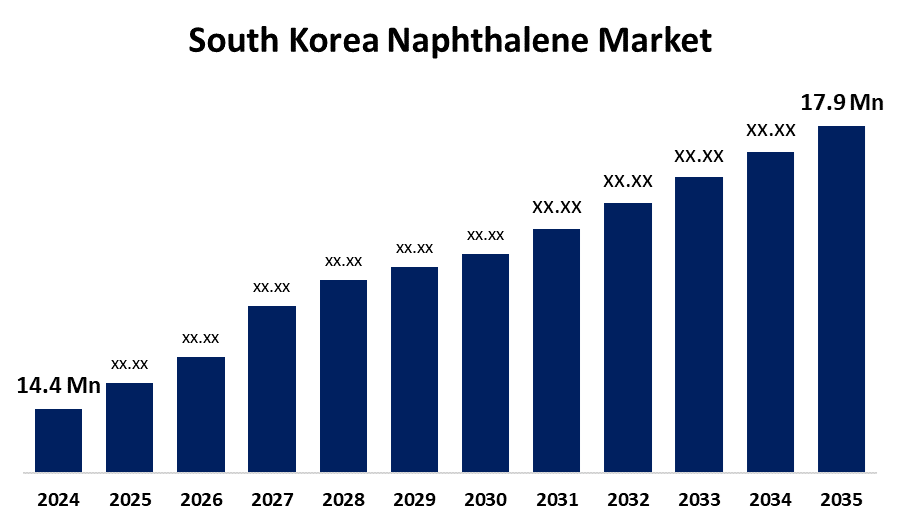

- The South Korea Naphthalene Market Size Was Estimated at USD 14.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.00% from 2025 to 2035

- The South Korea Naphthalene Market Size is Expected to Reach USD 17.9 Million By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Naphthalene Market is anticipated to reach USD 17.9 Million by 2035, Growing at a CAGR of 2.00% from 2025 to 2035. South Korea naphthalene market expansion has been significantly facilitated by the rising need for naphthalene derivatives across a range of industries, especially in the manufacturing of dyes, pigments, and plasticizers.

Market Overview

The naphthalene market encompasses the global demand for naphthalene, a polycyclic aromatic hydrocarbon, for various industrial and commercial applications. Naphthalene, primarily derived from coal tar and petroleum, is utilized in producing phthalic anhydride, which is essential for manufacturing plasticizers, dyes, and resins. Moreover, the demand for naphthalene is driven by its applications in concrete admixtures, textile manufacturing, and agriculture, where it serves as a soil fumigant and pesticide. The market drivers include the expansion of the chemical industry, increased construction activities, and technological advancements in naphthalene production. The development of bio-based and environmentally friendly naphthalene alternatives, as well as innovations in production processes to enhance efficiency and reduce environmental impact. The South Korea government has implemented initiatives like the Emissions Trading Scheme (KETS) and green growth policies to promote sustainable industrial practices. These measures encourage industries to adopt cleaner technologies and reduce greenhouse gas emissions, aligning with global sustainability goals.

Report Coverage

This research report categorizes the market for the South Korea naphthalene market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea naphthalene market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea naphthalene market.

South Korea Naphthalene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.00% |

| 2035 Value Projection: | USD 17.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Source, By Application, By End-User Industry and COVID-19 Impact Analysis |

| Companies covered:: | Hanwha Total Energies Petrochemical, Kumho Petrochemical Co. Ltd, Hyosung Chemical Corporation, KCC Corporation, Taekwang Industrial Co. Ltd., Kolon Industries Inc., Polymirae Company Ltd., Samnam Petrochemical Co. Ltd., SH Energy & Chemical Co. Ltd., Young Jin Industrial Co. Ltd., Dong Suh Chemical Ind Co. Ltd., Homeedition Myungjin Co. Ltd. and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for phthalic anhydride, a vital intermediate in producing plasticizers, alkyd resins, and dyes. The booming construction industry drives the use of naphthalene-based superplasticizers in concrete admixtures, enhancing workability and durability. Moreover, its use in pesticides and fumigants supports the agricultural sector, particularly in crop protection. Industrial expansion and urban development in South Korea also contribute to higher consumption of naphthalene derivatives. Supportive infrastructure, robust chemical manufacturing capabilities, and increasing investments in R&D foster innovation and broaden the application scope of naphthalene. Despite environmental concerns, the market continues to grow due to these strong industrial linkages and consistent downstream demand across various sectors.

Restraining Factors

The volatility in raw material prices, particularly coal tar and petroleum, poses a risk to production costs and profit margins. Fluctuations in these prices can lead to unpredictable manufacturing expenses, affecting the overall stability of the market. The growing public awareness of chemical risks has led to increased scrutiny and preference for eco-friendly alternatives. This shift in consumer behaviour pressures manufacturers to invest in sustainable practices and products, which may not always align with the traditional naphthalene production methods.

Market Segmentation

The South Korea naphthalene market share is classified into source, application, and end-user industry.

- The coal tar segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea naphthalene market is segmented by source into coal tar and petroleum. Among these, the coal tar segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Coal tar distillation and separation are the most common processes for producing naphthalene, which will accelerate market expansion overall.

- The plasticizer segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea naphthalene market is segmented by application into plasticizer, pesticide, surfactant, and wetting agent. Among these, the plasticizer segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The construction and automotive industries especially depend on plasticizers to increase the flexibility and durability of plastics.

- The building & construction segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The South Korea naphthalene market is segmented by end-user industry into agriculture, building & construction, textile, chemical, polymer, and pharmaceutical. The building & construction segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The demand for the construction industry is driven by the growing use of naphthalene superplasticizers in building materials and the manufacturing of PVC plastics for infrastructure development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea naphthalene market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hanwha Total Energies Petrochemical

- Kumho Petrochemical Co. Ltd

- Hyosung Chemical Corporation

- KCC Corporation

- Taekwang Industrial Co. Ltd.

- Kolon Industries Inc.

- Polymirae Company Ltd.

- Samnam Petrochemical Co. Ltd.

- SH Energy & Chemical Co. Ltd.

- Young Jin Industrial Co. Ltd.

- Dong Suh Chemical Ind Co. Ltd.

- Homeedition Myungjin Co. Ltd.

- Others

Recent Development:

- In 2024, South Korea exported USD 5.16M of Naphthalene, being the 2,130th most exported product (out of 5,432) in South Korea, and imported USD 2.16M of Naphthalene, being the 3,689th most imported product (out of 5,432) in South Korea. The fastest growing origins for Naphthalene imports in South Korea between 2022 and 2023.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea naphthalene market based on the below-mentioned segments:

South Korea Naphthalene Market, By Source

- Coal Tar

- Petroleum

South Korea Naphthalene Market, By Application

- Plasticizer

- Pesticide

- Surfactant

- Wetting Agent

South Korea Naphthalene Market, By End-User Industry

- Agriculture

- Building & Construction

- Textile

- Chemical

- Polymer

- Pharmaceutical

Need help to buy this report?