South Korea Molasses Market Size, Share, and COVID-19 Impact Analysis, By Source (Sugarcane, Sugar Beets and Others), By Type (Light, Dark, Blackstrap and Others), By Category (Organic and Conventional), and South Korea Molasses Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesSouth Korea Molasses Market Insights Forecasts to 2035

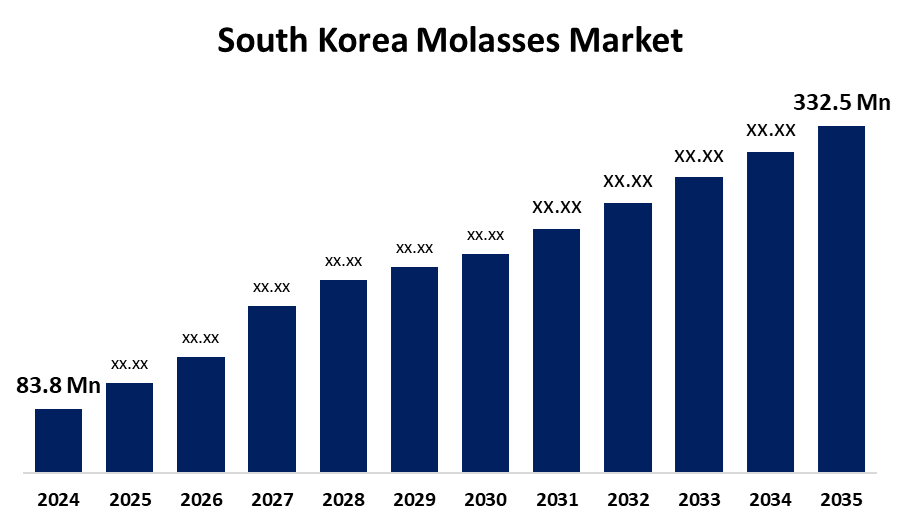

- The South Korea Molasses Market Size Was Estimated at USD 83.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.35% from 2025 to 2035

- The South Korea Molasses Market Size is Expected to Reach USD 332.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Molasses Market is anticipated to reach USD 332.5 Million by 2035, growing at a CAGR of 13.35% from 2025 to 2035. The businesses of food and drink, personal care, medicine, pharmaceuticals, animal feed, and others all use molasses significantly.

Market Overview

The term Molasses Market Size describes the international production and exchange of molasses, a thick, dark syrup that is mostly made from the processing of sugarcane and sugar beets. The production of sugar and is prized for its adaptability to a number of industries, such as biofuels, food, animal feed, and pharmaceuticals. Because it is high in vital minerals including potassium, calcium, magnesium, and iron, molasses is a popular ingredient in foodstuffs that cater to health-conscious consumers. In a variety of food and beverage products, such as baked goods, confections, and prepared meals, molasses is utilized as a natural sweetener and flavoring agent. With its nutritional content (including calcium and iron) and clean-label appeal, molasses is becoming a popular choice as a sweetener and flavoring agent in a variety of food products as consumers look for natural and healthy food alternatives. Molasses is employed as a natural substitute for refined sugars in the plant-based food industry, where this trend is most prevalent. The need for molasses in the food and beverage sector is further increased by the fact that it is a crucial component of baked products, confections, and beverages. Molasses is a crucial feedstock for the manufacturing of ethanol, and the government has been aggressively encouraging the blending of ethanol with gasoline. In order to lessen reliance on fossil fuels and improve energy security, this program encourages the use of molasses in the manufacturing of ethanol.

Report Coverage

This research report categorizes the market for South Korea molasses market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea molasses market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea molasses market.

South Korea Molasses Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 83.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 13.35% |

| 2035 Value Projection: | USD 332.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Source, By Type, By Category |

| Companies covered:: | TTC Co. Ltd, Ashnol Hay Korea, POSCO Co. Ltd, Samwoo T D Co. Ltd, Daesang Corp., Kyung Ki Chemicals, ED&F Man Korea Ltd, HBEP Co. Ltd, CJ CheilJedang Corp., SEJEON Co. Ltd, southkoreayp.com, Korea Mizuho Trading Co. Ltd., southkoreayp.com, Wellsground (importer/distributor), and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand from the food and beverage, animal feed, and biofuel industries. Rising health consciousness has boosted interest in natural sweeteners like molasses, especially in organic form. Its use as a fermentation agent in alcohol production and as a binding agent in animal feed also supports market growth.

Restraining Factors

The increase production costs and introduce supply uncertainty. Strict food-safety and quality regulations raise compliance expenses, burdening manufacturers. synthetic and natural sweetener alternatives like high fructose corn syrup, stevia, honey, and agave erode demand for molasses by offering lower cost or speciality substitutes.

Market Segmentation

The South Korea molasses market share is classified into source, type and category.

- The sugarcane segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea molasses market is segmented by source into sugarcane, sugar beets, and others. Among these, the sugarcane segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Its high sugar content, efficient extraction process, and widespread cultivation in key exporting countries. Its consistent supply and cost-effectiveness drive demand, supporting strong growth. Increasing applications in food, feed, and industrial sectors.

- The light segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea molasses market is segmented by type into light, dark, blackstrap, and others. Among these, the light segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its mild flavor, higher sugar content, and versatility in food applications. Preferred in baking, beverages, and processed foods, it appeals to consumer taste trends. Its broad usability and growing demand in food industries.

- The organic segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea molasses market is segmented by category into organic and conventional. Among these, the organic segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising consumer preference for natural, chemical-free products. Growing health awareness, clean-label trends, and demand for sustainable food sources drive its popularity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea molasses market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TTC Co. Ltd

- Ashnol Hay Korea

- POSCO Co. Ltd

- Samwoo T D Co. Ltd

- Daesang Corp.

- Kyung Ki Chemicals

- ED&F Man Korea Ltd

- HBEP Co. Ltd

- CJ CheilJedang Corp.

- SEJEON Co. Ltd

- southkoreayp.com

- Korea Mizuho Trading Co. Ltd.

- southkoreayp.com

- Wellsground (importer/distributor)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea molasses market based on the below-mentioned segments:

South Korea Molasses Market, By Source

- Sugarcane

- Sugar Beets

- Others

South Korea Molasses Market, By Type

- Light

- Dark

- Blackstrap

- Others

South Korea Molasses Market, By Type

- Organic

- Conventional

Need help to buy this report?