South Korea Mobile Wallet Market Size, Share, and COVID-19 Impact Analysis, By Type (Proximity, and Remote), By Application (Retail, Hospitality and Transportation, Telecommunication, Healthcare, and Others), and South Korea Mobile Wallet Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologySouth Korea Mobile Wallet Market Insights Forecasts to 2035

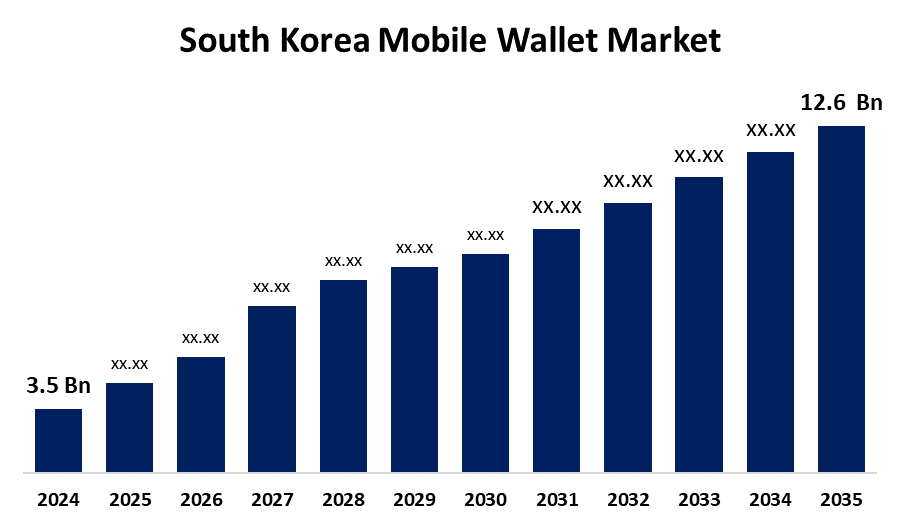

- The South Korea Mobile Wallet Market Size was estimated at USD 3.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.35% from 2025 to 2035

- The South Korea Mobile Wallet Market Size is Expected to Reach USD 12.6 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Mobile Wallet Market is anticipated to reach USD 12.6 billion by 2035, growing at a CAGR of 12.35% from 2025 to 2035. The growing need for added security features like biometric authentication, tokenization, and encryption, which have raised the confidence of users to trust mobile wallets with their financial transactions, is propelling the market.

Market Overview

The South Korea mobile wallet industry is the digital environment that allows consumers to store, manage, and transact with financial assets using smartphones. They support secure, contactless payment for goods and services and peer-to-peer transfers, usually combining features such as loyalty programs, QR code scanning, and digital identification. Additionally, the South Korean mobile wallet market is growing strongly, led by the rising demand for electronic payment methods. To begin with, widespread use of smartphones has greatly enhanced the use of mobile wallets. With more and more consumers possessing smartphones, the ease of having a digital wallet to make frictionless transactions becomes more attractive. In addition, the increasing focus on contactless payments, boosted by the demand for sanitary and convenient payments, is another key driver.

Report Coverage

This research report categorizes the market for the South Korea mobile wallet market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea mobile wallet market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea mobile wallet market.

South Korea Mobile Wallet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.35% |

| 2035 Value Projection: | USD 12.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Kakao Pay, Naver Pay, Samsung Pay, Toss, Payco, Zero pay, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increasing acceptance and awareness of mobile banking services largely contribute to the growth of the mobile wallet market. Besides this, the continued development in technology, including NFC and biometric identification, is important to improve the security and functionality of mobile wallet apps. These advances in technology tackle issues of data security, thus building confidence among users. Also, the overall transformation of the region towards a cashless economy and the widespread use of e-commerce operations is likely to propel the mobile wallet market in South Korea throughout the forecast period.

Restraining Factors

The absence of interoperable infrastructure and commonality between various mobile wallet systems can cause inconvenience for merchants and consumers, preventing smooth transactions.

Market Segmentation

The South Korea mobile wallet market share is classified into type and application.

- The proximity segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea mobile wallet market is segmented by type into proximity and remote. Among these, the proximity segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Use of a proximity wallet, mobile wallet, or NFC wallet is restricted to transactions and authorisation with near parties. The most popular application context is the close proximity relationship between the mobile wallet and the accepting or controlling party. The concept, which is based on card emulation, provides a facility for card data storage. A remote wallet, also referred to as a mobile wallet, cloud wallet, e-wallet, or digital wallet, is different from proximity wallets in that the parties and persons involved in the authorisation and transaction are not co-located to each other.

- The retail segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea mobile wallet market is segmented by application into retail, hospitality and transportation, telecommunication, healthcare, and others. Among these, the retail segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to the nation's robust e-commerce industry and broad use of digital payment methods, mobile wallets are frequently utilized for both in-person and online transactions. Use in retail purchases is further increased by the ease of contactless payments and loyalty program integrations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea mobile wallet market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kakao Pay

- Naver Pay

- Samsung Pay

- Toss

- Payco

- Zero pay

- Others

Recent Developments:

- In August 2024, Customers of Jeonbuk Bank were able to use QR codes to make payments in Cambodia following the launch of a cross-border payment mechanism initiated by South Korea and Cambodia. The program aimed to increase trade and tourism, foster financial inclusion, and strengthen economic relations between the two nations.

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea mobile wallet market based on the below-mentioned segments:

South Korea Mobile Wallet Market, By Type

- Proximity

- Remote

South Korea Mobile Wallet Market, By Application

- Retail

- Hospitality and Transportation

- Telecommunication

- Healthcare

- Others

Need help to buy this report?