South Korea Mobile Payment Market Size, Share, and COVID-19 Impact Analysis, By Type (Proximity Payment, Remote Payment), By Application (BFSI, Entertainment, Energy & Utilities, Healthcare, Retail, Hospitality &Transportation, Others), and South Korea Mobile Payment Market Insights Forecasts to 2032

Industry: Electronics, ICT & MediaSouth Korea Mobile Payment Market Insights Forecasts to 2032

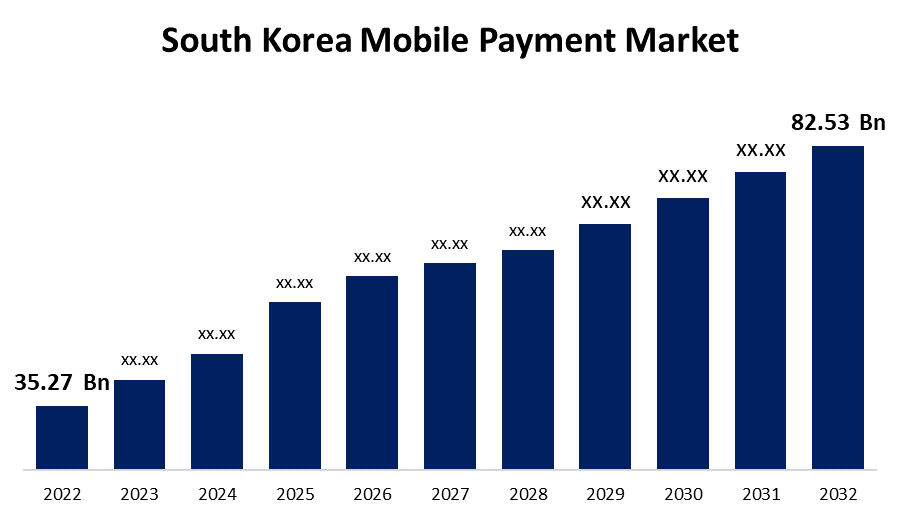

- The South Korea Mobile Payment Market Size was valued at USD 35.27 Billion in 2022.

- The Market is Growing at a CAGR of 8.87% from 2022 to 2032.

- The South Korea Mobile Payment Market Size is expected to reach 82.53 Billion by 2032.

Get more details on this report -

The South Korea Mobile Payment Market Size is expected to reach USD 82.53 Billion by 2032, at a CAGR of 8.87% during the forecast period 2022 to 2032.

Market Overview

Mobile payment is the transfer or payment of money, usually using a mobile device to execute and confirm the payment, to an individual, merchant, or business for bills, goods, and services. A SIM toolkit or mobile menu, a mobile browser, or a digital (virtual or e-) wallet can all be used as the payment tool. Furthermore, the growing e-commerce sector, the growing focus on mobile payments using QR codes, and the widespread adoption of mobile-friendly payment methods by businesses are the main drivers of the South Korean mobile payments market. Additionally, the country's market is growing due to the presence of significant market vendors and the increasing penetration of foreign market vendors. In recent years, there has been a notable increase in the use of mobile payment systems in South Korea, as more and more customers choose contactless payment methods over conventional credit cards.

Report Coverage

This research report categorizes the market for South Korean mobile payment market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korean mobile payment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korean mobile payment market.

South Korea Mobile Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 35.27 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.87% |

| 2032 Value Projection: | USD 82.53 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Type, By Application |

| Companies covered:: | Kakao Pay, Samsung Pay, Toss, PayCo, SK Group, L Pay, ZeroPay Pvt. Ltd., Coupang, SSG.com Corp, Naver Pay, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South Korea is seeing a positive impact on market growth due to the emergence of various mobile payment vendors drawn by the booming e-commerce and smartphone penetration. The fintech has integrated its service with Toss Pay e-wallets and local cards issued in South Korea. Using a card or an account connected to the Toss app to make purchases is made simpler with Toss Pay, the company's e-wallet solution. Furthermore, businesses are beginning to provide cashback and rewards to customers who choose to transact through mobile channels. Once these reward programs are in place, consumers are more likely to pay for all of their transactions using mobile apps. The businesses provide users with an app to track their points. For example, Samsung Pay rewards smartphone users with points for each transaction they make. Products from Samsung can be bought with reward points. Mobile apps featuring rewards and coupons are becoming increasingly popular among customer-focused industries, including travel and tourism, dining establishments, retail stores, and the hospitality sector.

Restraining Factors

The bulk of end users are still entirely dependent on cash for their everyday activities, even though mobile payment solutions offer various advantages like improved operability, dependability, and flexibility. People are hesitant to adopt new technologies because they have been using the conventional payment method for several years. Because of their habits, customers feel more comfortable making large purchases using the traditional method of payment. Additionally, the payment method saves personal data like address, balance, purchase history, card PIN, and other specifics. Customers' concerns about security are raised as well and the possibility of this personal data being used without authorization increases. This will probably hamper the expansion of the South Korean market.

Market Segment

- In 2022, the proximity payment segment accounted for the largest revenue share over the forecast period.

Based on the type, the South Korean mobile payment market is segmented into proximity payment and remote payment. Among these, the proximity payment segment has the largest revenue share over the forecast period. The Near Field Communication (NFC) and QR code payment sub-segments make up the proximity payment segment. Proximity payments are predicted to generate the most market revenue for the QR code segment. Smartphone-based in-store payment options are referred to as proximity payment options. Because proximity payments allow for instantaneous payments, they are experiencing rapid growth in the market. Within the proximity payment industry, Near Field Communication, or NFC, is expanding quickly. Numerous telecommunications companies offer SIM-based NFC that can be instantly operated at the Point of Sale (POS).

- In 2022, the BFSI segment is expected to hold the largest share of the South Korean mobile payment market during the forecast period.

Based on the application, the South Korean mobile payment market is classified into BFSI, entertainment, energy & utilities, healthcare, retail, hospitality & transportation, and others. Among these, the BFSI segment is expected to hold the largest share of the South Korean mobile payment market during the forecast period. The industry is expanding as a result of the aggressive efforts made by several banks to implement mobile payments. Companies are also concentrating on implementing a tailored set of all-inclusive payment solutions, which assists in resolving particular difficulties in the lending, insurance, and wealth management industries. Banks can now reach a sizable portion of the unbanked population in developing nations and provide their current clientele with even more convenience through to mobile banking and payments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korean mobile payment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kakao Pay

- Samsung Pay

- Toss

- PayCo

- SK Group

- L Pay

- ZeroPay Pvt. Ltd.

- Coupang

- SSG.com Corp

- Naver Pay

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, Apple Pay was introduced in South Korea by the company to broaden its offerings in digital payments. The company hopes to capitalize on the rising acceptance of digital payments in the nation with the introduction of Apple Pay.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korean mobile payment market based on the below-mentioned segments:

South Korea Mobile Payment Market, By Type

- Proximity Payment

- Remote Payment

South Korea Mobile Payment Market, By Application

- BFSI

- Entertainment

- Energy & Utilities

- Healthcare

- Retail

- Hospitality &Transportation

- Others

Need help to buy this report?