South Korea Minimally Invasive Surgery Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic Devices, Laparoscopic Devices, Monitoring and Visualization Devices, Robotic Assisted Surgical Systems, Ablation Devices, Laser Based Devices, and Others), By Application (Aesthetic, Cardiovascular, Gastrointestinal, Gynecological, Orthopedic, Urological, and Others) and South Korea Minimally Invasive Surgery Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Minimally Invasive Surgery Devices Market Insights Forecasts to 2035

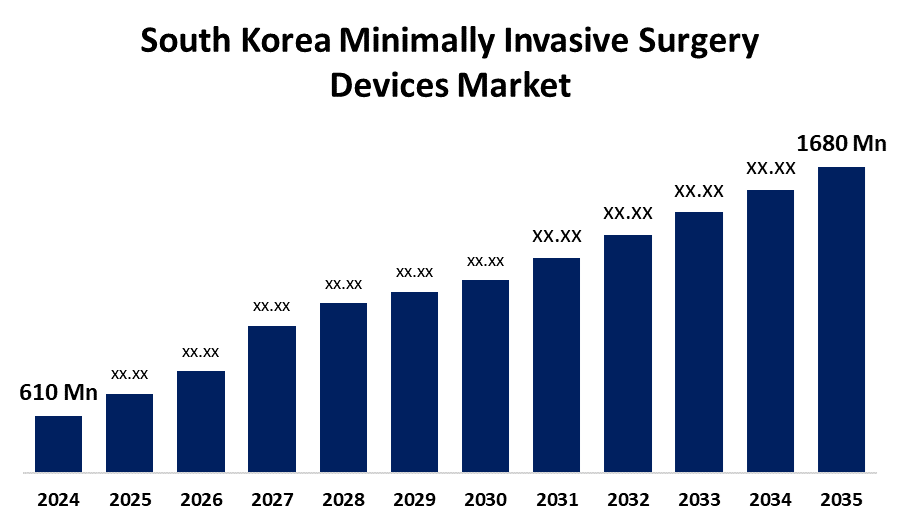

- The South Korea Minimally Invasive Surgery Devices Market Size Was Estimated at USD 610 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.65% from 2025 to 2035

- The South Korea Minimally Invasive Surgery Devices Market Size is Expected to Reach USD 1680 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Domestic Courier, Express, and Parcel Market is anticipated to reach USD 1680 billion by 2035, growing at a CAGR of 9.65% from 2025 to 2035. Ongoing technological innovation in medical devices, increasing demand for different types of surgeries, increasing aging population with higher susceptibility to complications related to conventional open surgeries, and increasing patient awareness and that of physicians are some of the major drivers for the market.

Market Overview

South Korea Minimally Invasive Surgery (MIS) Devices market includes medical devices and instruments aimed at carrying out surgery with minimal cuts, less trauma, and faster recovery than open surgery. These devices allow surgeons to perform procedures by making small cuts, even using body openings, thus increasing accuracy, reducing scarring, and decreasing hospital stays. Additionally, there are also economic reasons. South Korea's advanced healthcare infrastructure and expanding healthcare spending create a conducive environment for the adoption of advanced surgical equipment. Beyond this, the efforts of the government of South Korea to fund research and development in the medical sector are also contributing to market growth. Moreover, environmental factors are gaining importance as well. The shift towards the application of sustainable, bio-compatible materials in medical devices is very much in line with worldwide sustainability trends and is developing a positive market scenario.

Report Coverage

This research report categorizes the market for the South Korea minimally invasive surgery devices market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea minimally invasive surgery devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea minimally invasive surgery devices market.

South Korea Minimally Invasive Surgery Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 610 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.65% |

| 2035 Value Projection: | USD 1680 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | GE Healthcare, Medtronic PLC, Olympus Corporation, Smith & Nephew, Siemens Healthineers AG and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korean market is dominated primarily by the swift development of medical technology, such as advanced laparoscopic devices, endoscopes, and robotic surgical systems. This technological advance comports with South Korea's greater goal of being a world leader in the medical devices market. Another cause is the increasing geriatric population in the nation, which is causing an increase in demand for different kinds of surgeries, especially those that are minimally invasive in nature and provide quicker recovery. With this, minimally invasive surgeries are also being considered increasingly as a best option for the elderly, as they are more prone to complications of conventional open surgeries. Furthermore, the increased awareness of patients and medical professionals regarding the advantages of minimally invasive procedures is also driving market growth.

Restraining Factors

Problems like device malfunction, device incompatibility, or flexibility and reach limitations in intricate procedures may jeopardize the success of surgery and decrease surgeon confidence.

Market Segmentation

The South Korea minimally invasive surgery devices market share is classified into product and application.

- The handheld instruments segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea minimally invasive surgery devices market is segmented by product into handheld instruments, guiding devices, electrosurgical devices, endoscopic devices, laparoscopic devices, monitoring and visualization devices, robotic assisted surgical systems, ablation devices, laser-based devices, and others. Among these, the handheld instruments segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. These consist of instruments like forceps, scissors, and needle holders that are needed for conducting various MIS procedures. Their cross-application for various kinds of surgeries makes them a market leader.

- The orthopedic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea minimally invasive surgery devices market is segmented by application into aesthetic, cardiovascular, gastrointestinal, gynecological, orthopedic, urological, and others. Among these, the orthopedic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment is witnessing strong growth because of the rising incidence of musculoskeletal disorders, the growth of geriatric populations, and the expanding use of MIS techniques for orthopedic procedures. All these factors drive the demand for sophisticated orthopedic MIS devices, thus becoming the leading application segment in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea minimally invasive surgery devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GE Healthcare

- Medtronic PLC

- Olympus Corporation

- Smith & Nephew

- Siemens Healthineers AG

- Others

Recent Developments:

In June 2022, Boston Scientific entered into an agreement with South Korea's Synergy Innovation to acquire its controlling interest in M.I.Tech, a manufacturer and distributor of non-vascular metal stents used in endoscopic and urologic interventions. Boston Scientific bid close to KRW 14,500 (approximately USD 11) per M.I.Tech share, with the acquisition price amounting to KRW 291.2 billion (approximately USD 230 million).

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea minimally invasive surgery devices market based on the below-mentioned segments:

South Korea Minimally Invasive Surgery Devices Market, By Product

- Handheld Instruments

- Guiding Devices

- Electrosurgical Devices

- Endoscopic Devices

- Laparoscopic Devices

- Monitoring and Visualization Devices

- Robotic Assisted Surgical Systems

- Ablation Devices

- Laser Based Devices

- Others

South Korea Minimally Invasive Surgery Devices Market, By Application

- Aesthetic

- Cardiovascular

- Gastrointestinal

- Gynecological

- Orthopedic

- Urological

- Others

Need help to buy this report?