South Korea Methanol Market Size, Share, and COVID-19 Impact Analysis, By Feedstock (Natural Gas, Oil, and Coal), By Derivatives (Formaldehyde, Acetic Acid, Dimethyl Ether, and Others), and By End-use Industry (Transportation, Building, Construction, and Others), and South Korea Methanol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Methanol Market Insights Forecasts to 2035

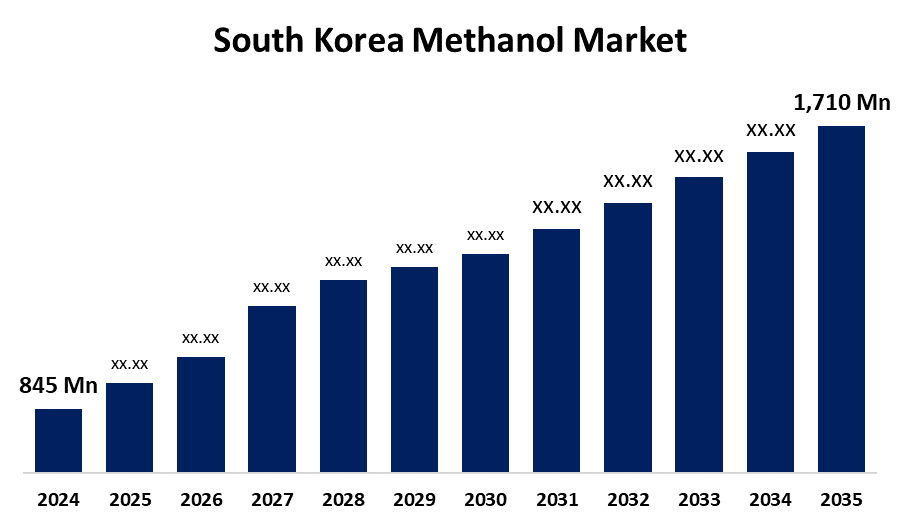

- The South Korea Methanol Market Size Was Estimated at USD 845 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.62% from 2025 to 2035

- The South Korea Methanol Market Size is Expected to Reach USD 1,710 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Methanol Market Size is Anticipated to Reach USD 1,710 Million by 2035, Growing at a CAGR of 6.62% from 2025 to 2035. The demand for methanol as a clean energy fuel alternative has increased dramatically due to the government's growing interest in renewable and sustainable energy sources. This demand is expected to rise further as further technological and commercial developments are made.

Market Overview

The term South Korean methanol market refers to the production, importation, distribution, and use of methanol a commodity chemical that is utilised as a fuel or fuel component as well as a petrochemical feedstock for the production of formaldehyde, acetic acid, olefins, and solvents. In South Korea, methanol is primarily used in the construction, automotive, and petrochemical industries. Moreover, the South Korea methanol market is expanding due to increasing industrial demand, technological advancements, and a strong commitment to sustainability. Methanol serves as a key feedstock in the chemical industry, particularly in producing plastics, synthetic fibers, and pharmaceuticals. It also plays a significant role in the energy sector, being utilized as a clean-burning fuel, hydrogen carrier, and energy storage medium, aligning with South Korea's renewable energy transition goals. Furthermore, opportunities in the market include the development of bio-based methanol production from renewable feedstocks and waste resources, and advancements in carbon capture and utilization technologies. The government has implemented several initiatives to promote the methanol market. The National Hydrogen Strategy and Clean Energy Investment Plan drive investment in hydrogen-related technologies, including electrolysis-based methanol production and hydrogen infrastructure.

Report Coverage

This research report categorizes the market for South Korea methanol market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea methanol market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea methanol market.

South Korea Methanol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 845 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.62% |

| 2035 Value Projection: | USD 1,710 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Feedstock, By Derivatives, and COVID-19 Impact Analysis. |

| Companies covered:: | Korea Gas Corporation, Lotte Chemical, Kumho P and B Chemicals, Daelim Industrial, Krakatau Posco, Mitsui and Co., Hanjin Energy, SK Global Chemical, LG Chem, Korea Petrochemical Ind, Hyundai Chemical, Lotte Advanced Materials, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korea methanol market is experiencing robust growth, driven by several key factors. The chemical industry remains a dominant consumer, utilizing methanol in the production of formaldehyde, acetic acid, and methyl tert-butyl ether (MTBE), which are essential in manufacturing resins, textiles, and fuel additives. Additionally, methanol's role as a clean-burning fuel and hydrogen carrier aligns with South Korea's renewable energy transition goals, further boosting its demand.

Restraining Factors

Fluctuations in feedstock prices, particularly natural gas, can impact production costs and profitability. Additionally, strict environmental regulations and safety standards add complexity and cost to methanol production and distribution. Intense competition from alternative fuels and chemical intermediates poses challenges for domestic producers, necessitating continuous innovation and efficiency improvements.

Market Segmentation

The South Korea methanol market share is classified into feedstock, derivatives, and end-use industry.

- The natural gas segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea methanol market is segmented by feedstock into natural gas, oil, and coal. Among these, the natural gas segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its cost savings, cleaner burning, and environmental advantages. Natural gas is converted into syngas by partial oxidation or steam reforming, which is then utilized to produce methanol. This process generates high volume at a comparatively lower cost, making it a favoured feedstock in the region.

- The formaldehyde segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea methanol market is segmented by derivatives into formaldehyde, acetic acid, dimethyl ether, and others. Among these, the formaldehyde segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is driven by its extensive use in producing resins for construction materials, automotive components, and electronics. The demand for formaldehyde is further bolstered by the growth in these sectors, underscoring its significant role in the country's methanol industry.

- The transportation segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The South Korea methanol market is segmented by end-use industry into transportation, building, construction, and others. Among these, the transportation segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This dominance is driven by methanol's applications as a fuel additive, gasoline extender, and hydrogen source, supporting the transition towards alternative fuels and low-emission vehicles. The increasing demand for cleaner energy solutions in transportation further propels methanol consumption in this sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea methanol market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Korea Gas Corporation

- Lotte Chemical

- Kumho P and B Chemicals

- Daelim Industrial

- Krakatau Posco

- Mitsui and Co.

- Hanjin Energy

- SK Global Chemical

- LG Chem

- Korea Petrochemical Ind

- Hyundai Chemical

- Lotte Advanced Materials

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, South Korea announced plans to launch the world’s first transpacific green shipping route by 2027, using methanol-powered merchant vessels. The trade lane was intended to link the ports of Busan and Ulsan to Seattle and Tacoma in the US, featuring containerships and car carriers capable of running on the alternative fuel, according to a statement by the Ministry of Oceans and Fisheries.

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea methanol market based on the below-mentioned segments:

South Korea Methanol Market, By Feedstock

- Natural Gas

- Oil

- Coal

South Korea Methanol Market, By Derivatives

- Formaldehyde

- Acetic Acid

- Dimethyl Ether

- Others

South Korea Methanol Market, By End-use Industry

- Transportation

- Building

- Construction

- Others

Need help to buy this report?