South Korea Metal Recycling Market Size, Share, and COVID-19 Impact Analysis, By Type (Ferrous Metal, Non-Ferrous Metal), By End Use Industry (Building and Construction, Packaging, Automotive, Industrial Machinery, Electronics and Electrical Equipment, Shipbuilding, and Others), and South Korea Metal Recycling Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Metal Recycling Market Insights Forecasts to 2035

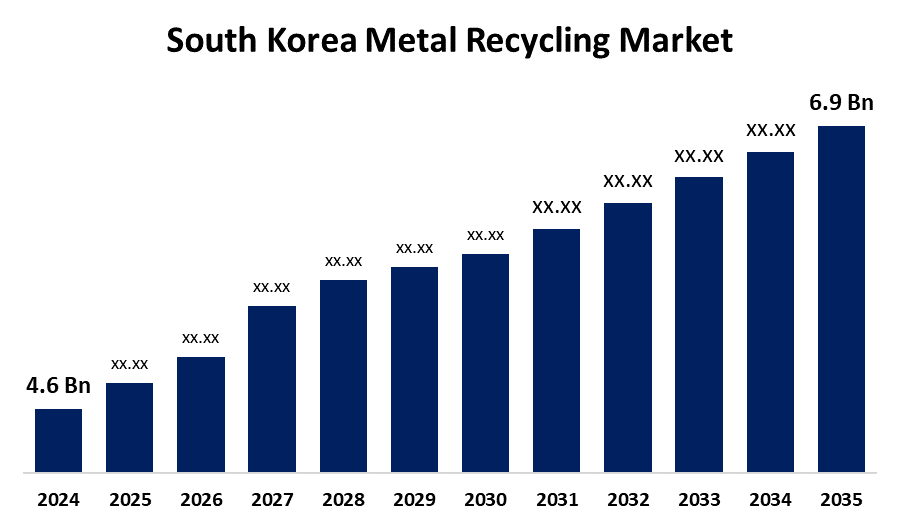

- The South Korea Metal Recycling Market Size was Estimated at USD 4.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.75% from 2025 to 2035

- The South Korea Metal Recycling Market Size is Expected to Reach USD 6.9 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Metal Recycling Market Size is anticipated to reach USD 6.9 Billion by 2035, growing at a CAGR of 3.75% from 2025 to 2035. The market is being driven by the growing demand for metals across a number of industries, such as packaging, electronics, automotive, and construction, which intensifies the need for a steady and sustainable metal supply.

Market Overview

In the South Korean metal recycling market, metals are gathered, processed, and repurposed to make new goods, which helps to preserve resources, lower energy use, and maintain a sustainable environment. The market includes both ferrous and non-ferrous metals, which are used in packaging, electronics, automotive, and construction. Additionally, South Korea's metal recycling market is expanding rapidly, driven mainly by strict waste disposal laws and growing environmental awareness. Sustainable practices are being actively promoted by governments, creating an environment that is conducive to the metal recycling sector. Furthermore, industries are moving toward recycling as a feasible alternative due to the growing demand for raw materials and the limited supply of natural resources. This crucial change is motivated by a shared commitment to lowering carbon footprints and conserving resources. Technological developments are crucial in improving the effectiveness of metal recycling procedures, in addition to regulatory support. The market is growing as such of advancements in sorting and separation technologies that make it possible to extract valuable metals from intricate waste streams.

Report Coverage

This research report categorizes the market for the South Korea metal recycling market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea metal recycling market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea metal recycling market.

South Korea Metal Recycling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.6 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.75% |

| 2035 Value Projection: | USD 6.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 288 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Type and By End Use Industry |

| Companies covered:: | Kwangyang ENS Corp, FAM International Corp., VoltaON, ReSolar Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Industry participation in metal recycling programs is increasing as a consequence of growing awareness of the financial advantages of recycling, including lower costs and energy usage. Since it promotes a closed-loop system in which recycled metals are reintegrated into the production cycle, the circular economy concept has grown in popularity. In addition to conserving resources, this circular approach lessens the negative environmental effects of metal extraction. In conclusion, a combination of government support, technological developments, financial incentives, and a growing dedication to sustainable practices is propelling the metal recycling market in South Korea.

Restraining Factors

Public awareness of appropriate recycling practices remains low despite initiatives to promote recycling. The efficiency of the recycling process is decreased when recyclable materials are contaminated due to misconceptions about what can and cannot be recycled.

Market Segmentation

The South Korea Metal Recycling Market share is classified into type and end use industry.

- The ferrous metals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea metal recycling market is segmented by type into ferrous metal and non-ferrous metal. Among these, the ferrous metals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by strong demand from sectors like shipbuilding, automotive, and construction. The dominance of this market is a result of the extensive use of steel and iron in manufacturing and infrastructure projects.

- The building and construction segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea metal recycling market is segmented by end use industry into building and construction, packaging, automotive, industrial machinery, electronics and electrical equipment, shipbuilding, and others. Among these, the building and construction segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by the increased need for recycled aluminum and steel in urban development and infrastructure projects. Growth in this market is also supported by government programs that promote the circular economy and the drive for sustainable building methods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea metal recycling market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kwangyang ENS Corp

- FAM International Corp.

- VoltaON

- ReSolar Inc.

- Others

Recent Developments:

- In March 2025, At the 4th Supply Chain Stabilization Committee meeting, South Korea's Ministry of Economy and Finance (MOEF) and the Ministry of Environment (MOE) released a policy document titled "Direction Toward the Vitalization of Critical Mineral Recycling."

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea metal recycling market based on the below-mentioned segments:

South Korea Metal Recycling Market, By Type

- Ferrous Metal

- Non-Ferrous Metal

South Korea Metal Recycling Market, By End Use Industry

- Building and Construction

- Packaging

- Automotive

- Industrial Machinery

- Electronics and Electrical Equipment

- Shipbuilding

- Others

Need help to buy this report?