South Korea Medical Coding Market Size, Share, and COVID-19 Impact Analysis, By System (Healthcare Common Procedure Code System (HCPCS), International Classification of Diseases (ICD), and Current Procedural Terminology (CPT)), By Component (Outsourced and In-House), and South Korea Medical Coding Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Medical Coding Market Insights Forecasts to 2035

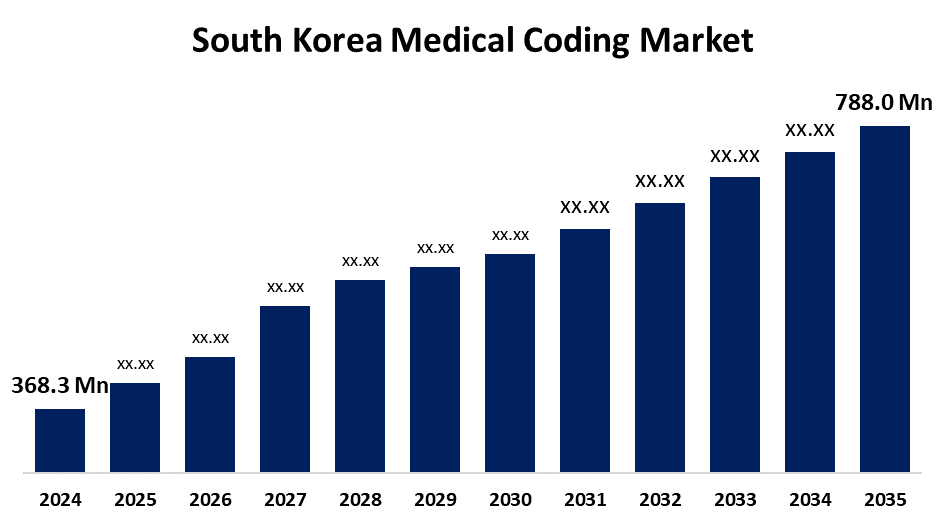

- The South Korea Medical Coding Market Size was Estimated at USD 368.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.16% from 2025 to 2035

- The South Korea Medical Coding Market Size is Expected to Reach USD 788.0 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Medical Coding Market Size is anticipated to reach USD 788.0 Million by 2035, growing at a CAGR of 7.16% from 2025 to 2035. The growing popularity of electronic health records (EHRs), which necessitate precise coding for documentation and billing. The need for standardized coding systems and qualified personnel is also being driven by rising rates of chronic diseases and government expenditures on healthcare IT infrastructure.

Market Overview

The South Korea medical coding market refers to the structured industry devoted to converting medical diagnoses, treatments, and services into standardized codes for billing, data analysis, and regulatory compliance is known as the South Korean medical coding market. Additionally, as more professionals look for opportunities outside of traditional healthcare settings, there is a growing trend toward remote medical coding positions, which provide flexibility and access to a wider talent pool. Adopting international categorization standards, like ICD-10, has become increasingly important in recent years as a means of bringing South Korea's practices closer to international norms. Moreover, this push reflects a market trend toward improving medical coders' skill sets through industry associations' and educational institutions' training programs and certifications. All things considered, the South Korean medical coding market is being shaped by a confluence of demographic changes, technological advancements, and regulatory compliance, which presents both opportunities and challenges for industry professionals.

Report Coverage

This research report categorizes the market for the South Korea medical coding market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea medical coding market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea medical coding market.

South Korea Medical Coding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 368.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.16% |

| 2035 Value Projection: | USD 788.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By System and By Component |

| Companies covered:: | Coreline Soft, HUINNO, MoDooDoc, IBEX Medical Systems, Promedius Inc., MediWhale, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korean medical coding market industry is being greatly impacted by the development of coding software technology. The use of AI-powered medical coding tools has increased dramatically, which helps medical coders work less manually by increasing accuracy and efficiency. Additionally, according to reports from the Ministry of Science and ICT, innovation investments in the healthcare IT industry are increasing by 15% annually. It is anticipated that incorporating machine learning and natural language processing into coding software will improve coding speed and decrease human error, which will ultimately result in more efficient medical billing procedures. Further, the need for sophisticated coding technology becomes critical as healthcare providers aim for operational excellence in the face of an expanding patient base, propelling the market for medical coding.

Restraining Factors

The medical coding market in South Korea is hampered by a number of important factors, including a shortage of skilled workers, expensive training, complicated regulations, language barriers, and a sluggish adoption of cutting-edge coding technologies. These difficulties all work together to make it difficult for healthcare facilities to implement, scale, and comply with regulations.

Market Segmentation

The South Korea medical coding market share is classified into system and component.

- The international classification of diseases (ICD) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea medical coding market is segmented by system into healthcare common procedure code system (HCPCS), international classification of diseases (ICD), and current procedural terminology (CPT). Among these, the international classification of diseases (ICD) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Another essential component of the Classification System is the International Classification of Diseases (ICD), which offers standardized codes that represent medical diagnoses and ailments. By encouraging clear communication among medical professionals, this coding system is essential for monitoring disease prevalence, supporting research, and enhancing patient care.

- The outsourced segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea medical coding market is segmented by component into outsourced and in-house. Among these, the outsourced segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Healthcare facilities can reduce staffing issues and streamline operations by using outsourced coding because it is affordable and provides access to specialized knowledge.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea medical coding market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coreline Soft

- HUINNO

- MoDooDoc

- IBEX Medical Systems

- Promedius Inc.

- MediWhale

- Others

Recent Developments:

- In March 2025, this historic law, which was passed in early 2024 and went into effect in 2025, controlled AI-driven diagnostics, digital therapies, and software used in healthcare. It indirectly increased demand for precise medical coding while offering a formal foundation for digital health solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Medical Coding Market based on the below-mentioned segments:

South Korea Medical Coding Market, By System

- Healthcare Common Procedure Code System (HCPCS)

- International Classification of Diseases (ICD)

- Current Procedural Terminology (CPT)

South Korea Medical Coding Market, By Component

- Outsourced

- In-House

Need help to buy this report?