South Korea Meat Market Size, Share, and COVID-19 Impact Analysis, By Meat Type (Pork, Beef, Chicken, Fish & Seafood, and Processed Meat), By Form (Fresh Meat, Frozen Meat, Processed Meat Products, Marinated & Pre-seasoned Meat), and South Korea Meat Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesSouth Korea Meat Market Insights Forecasts to 2035

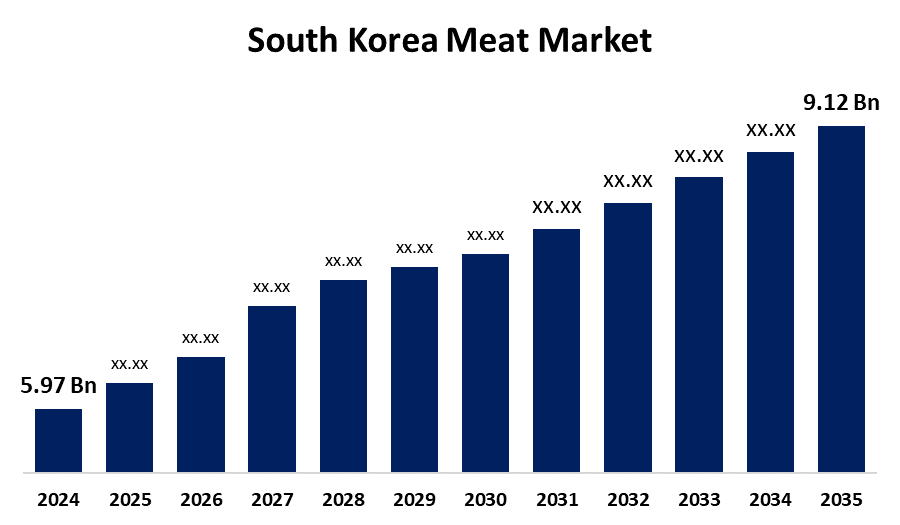

- The South Korea Meat Market Size was estimated at USD 5.97 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.93% from 2025 to 2035

- The South Korea Meat Market Size is Expected to Reach USD 9.12 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Meat Market Size is Anticipated to reach USD 9.12 Billion By 2035, Growing at a CAGR of 3.93% from 2025 to 2035. The growing demand from consumers for quality meat, governmental initiatives in favor of food security, increase in distribution channels, and the growth in popularity of ready-to-eat and precooked meat products are some of the major drivers for the growth of the market.

Market Overview

The South Korean meat industry covers production, processing, distribution, and consumption of different meat products, such as beef, pork, chicken, and processed meat. The industry is impacted by consumer tastes, incomes, lifestyle change, and regulatory updates. Additionally, the increasing demand for processed meat items such as marinated meats, and pre-cooked sausages, the growing impact of food trends, and the growth of e-commerce channels are driving the market expansion. Furthermore, the increasing concern regarding environmental and health factors prompting consumers to look for sustainably and ethically sourced meat is supporting the demand for South Korea meat. Moreover, the market is subject to regulatory challenges, environmental pressures, and competition from alternative proteins. Yet, increasing demand for processed meats, premiumization trends, and the increasing power of e-commerce present opportunities for manufacturers to innovate, differentiate their products, and seek new distribution channels, both at home and abroad.

Report Coverage

This research report categorizes the market for the South Korea meat market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea meat market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea meat market.

South Korea Meat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.97 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Meat Type, By Form and COVID-19 Impact Analysis |

| Companies covered:: | CJ Corp, Hormel Foods Corp, Lotte Group, Dongwon Group, Daesang Corp, Harim Co Ltd, Moguchon Corp, Sajo Industrial Co Ltd, Jinju Ham Co Ltd, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Elevating disposable incomes and shifting consumer preferences propelling the demand for quality, premium meat products, including Wagyu and Hanwoo beef are key to enhancing the South Korea meat market growth. Further, hectic lifestyles and growing single-person households are driving the demand for ready-to-eat (RTE) meat products, thereby supporting market expansion.

Restraining Factors

Increasing health awareness among consumers is creating a switch to lean meats and substitutes such as plant protein. There are issues of use of antibiotics and hormones in farm animals that are driving demand for organic and ethically produced meats. This trend breaks traditional patterns of meat consumption and needs adjustment on the part of producers.

Market Segmentation

The South Korea meat market share is classified into meat type and form.

- The pork segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea meat market is segmented by meat type into pork, beef, chicken, fish & seafood, processed meat. Among these, the pork segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. With 1.2 million tons, or 44.2% of the total meat sales, pork held the largest share of meat sold in South Korea in 2022, based on a report made by Agriculture and Agri-Food Canada. Second was poultry with 0.9 million tons and third was beef at 0.5 million tons. But chicken is anticipated to have the highest growth rate in South Korea Meat Market during the forecast period due to increasing demand for fried chicken in the country.

- The fresh meat segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea meat market is segmented by form into fresh meat, frozen meat, processed meat products, marinated & pre-seasoned meat. Among these, the fresh meat segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Fresh meat is thought to be healthier as it has no added chemicals and is readily found in the domestic market. The availability of numerous wet markets like majang meat market that provides an extensive variety of fresh and affordable types of meat also fuels its market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea meat market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CJ Corp

- Hormel Foods Corp

- Lotte Group

- Dongwon Group

- Daesang Corp

- Harim Co Ltd

- Moguchon Corp

- Sajo Industrial Co Ltd

- Jinju Ham Co Ltd

- Others

Recent Developments:

- In November 2024, South Korea's meat industry witnessed thrilling action, especially in plant and cell-cultured meat innovation. A new partnership was established in 2024 to push forward the nation's alternative protein sector, gearing up for the entry of lab-grown meat. Furthermore, a tri-party effort was initiated in 2024 to promote cultivated meat production, ahead of its anticipated market arrival in 2025.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea meat market based on the below-mentioned segments:

South Korea Meat Market, By Meat Type

- Pork

- Beef

- Chicken

- Fish & Seafood

- Processed Meat

South Korea Meat Market, By Form

- Fresh Meat

- Frozen Meat

- Processed Meat Products

- Marinated & Pre-seasoned Meat

Need help to buy this report?