South Korea Major Home Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product (Refrigerators, Freezers, Dishwashers, Washing Machines, Cooks, Ovens, Others), By Distribution Channel (Supermarkets & Hypermarkets, Specialist Stores, E-Commerce, Others), and South Korea Major Home Appliances Market Insights Forecasts to 2032

Industry: Consumer GoodsSouth Korea Major Home Appliances Market Insights Forecasts to 2032

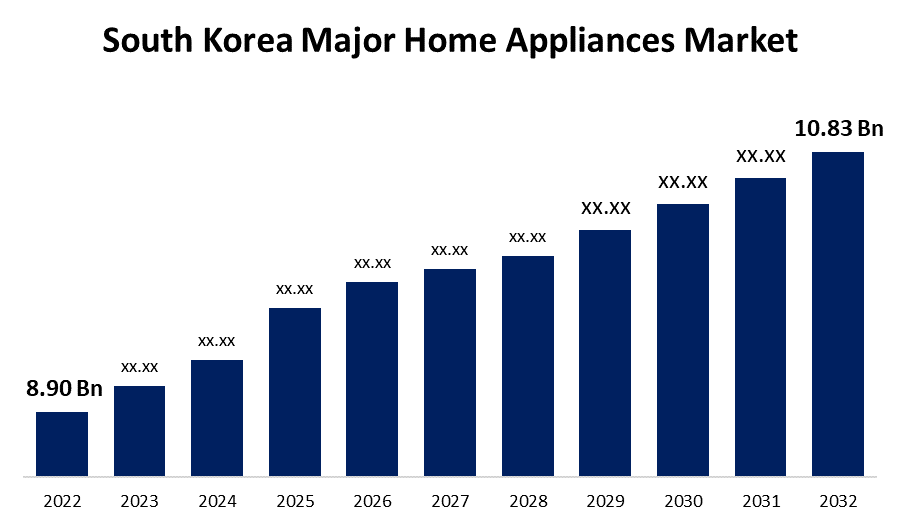

- The South Korea Major Home Appliances Market Size was valued at USD 8.90 Billion in 2022.

- The Market Size is Growing at a CAGR of 1.98% from 2022 to 2032.

- The South Korea Major Home Appliances Market Size is Expected to Reach USD 10.83 Billion by 2032.

Get more details on this report -

The South Korea Major Home Appliances Market Size is expected to reach USD 10.83 Billion by 2032, at a CAGR of 1.98% during the forecast period 2022 to 2032.

Market Overview

A home appliance is a device that helps with household chores like cleaning, cooking, and food preservation. It is also known as a domestic appliance, an electric appliance, or a household appliance. Furthermore, another important factor influencing demand for major home appliances in South Korea is the country's rapid urbanization. There is an increasing demand for small, multipurpose, energy-efficient appliances that fit into smaller living spaces as more people relocate to cities. The home appliance industry also has a lot of opportunities because of South Korea's strong real estate market, which is marked by the building of new homes and the remodelling of existing ones. New appliances will probably be purchased by home renovators and new home buyers, which will stimulate the market even more. The home appliance industry benefits indirectly from government housing policies and initiatives that boost the real estate sector by expanding the pool of potential customers. Moreover, IoT is expanding in the major appliances market owing to product innovations and government initiatives. The rise in single-parent households, product personalization, premiumization, and automation-driven cost reduction are the main factors driving South Korea's home appliance market.

Report Coverage

This research report categorizes the market for South Korea major home appliances market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea major home appliances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea major home appliances market.

South Korea Major Home Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 8.90 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 1.98% |

| 2032 Value Projection: | USD 10.83 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | LG Electronics, Haier Electronics Group Co. Ltd, Mitsubishi Electric Corporation, Gorenje Group, Electrolux AB, Whirlpool Corporation, Dong Yang Diecasting Co., Samsung Electronics, Bosch, Panasonic Corporation, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of its significant home appliance market is largely due to South Korea's position as in innovation and technology. Some of the top electronics companies in the world are based in the South Korea, and they are constantly investing in R&D to produce cutting-edge, smart home appliances. These developments include the incorporation of artificial intelligence (AI)-driven features, energy efficiency, Internet of Things (IoT) technology, and user-friendly interfaces. These developments improve home appliances' usability, practicality, and efficiency, increasing consumer appeal. Furthermore, South Korean producers are emphasizing aesthetic advancements with their sleek designs that complement contemporary interior decor.

Restraining Factors

The chip shortage began before the pandemic, which disrupted several industries. The pandemic led to a worldwide shortage of chips as a result of increased demand for electronics and supply chain disruptions. Microchips enable appliances to perform sophisticated tasks, like establishing connections with other smart devices or creating cutting-edge home automation systems that let users operate appliances with smartphones.

Market Segment

- In 2022, the dishwashers segment accounted for the largest revenue share over the forecast period.

Based on the product, the South Korea major home appliances market is segmented into refrigerators, freezers, dishwashers, washing machines, cooks, ovens, and others. Among these, the dishwashers segment has the largest revenue share over the forecast period. Dishwashers are gaining popularity as home appliance that reduces labor-intensive household chores for South Koreans. In the large home appliance market in South Korea, dishwasher sales are trending upward. To save time, working couples and millennials across the nation are requesting dishwashers.

- In 2022, the e-commerce segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the South Korea major home appliances market is segmented into supermarkets & hypermarkets, specialist stores, e-commerce, and others. Among these, the e-commerce segment has the largest revenue share over the forecast period. This expansion can be attributed, among other things, to the services' numerous practical features, which include door-to-door delivery, a large selection of brands and products, as well as deals and discounts. People can choose the product that best fits their needs by reading through thorough product descriptions and customer reviews. The demand for major home appliances in South Korea is being driven by consumers strong purchasing power and busy work schedules.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea major home appliances market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG Electronics

- Haier Electronics Group Co. Ltd

- Mitsubishi Electric Corporation

- Gorenje Group

- Electrolux AB

- Whirlpool Corporation

- Dong Yang Diecasting Co.

- Samsung Electronics

- Bosch

- Panasonic Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, Samsung Electronics, a South Korean company, and Pohang Iron and Steel Co. (South Korea) have inked a three-year contract for the supply of steel sheets for household appliances through 2026.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korea major home appliances market based on the below-mentioned segments:

South Korea Major Home Appliances Market, By Product

- Refrigerators

- Freezers

- Dishwashers

- Washing Machines

- Cooks

- Ovens

- Others

South Korea Major Home Appliances Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Specialist Stores

- E-Commerce

- Others

Need help to buy this report?