South Korea Major Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product (Washing Machines, Cooktops), By Type (Conventional Appliances, Smart Appliances), By Distribution Channel (Electronic Stores, Online, Hypermarkets & Supermarkets, Exclusive Brand Outlets, and Others), and South Korea Major Appliances Market, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsSouth Korea Major Appliances Market Insights Forecasts to 2035

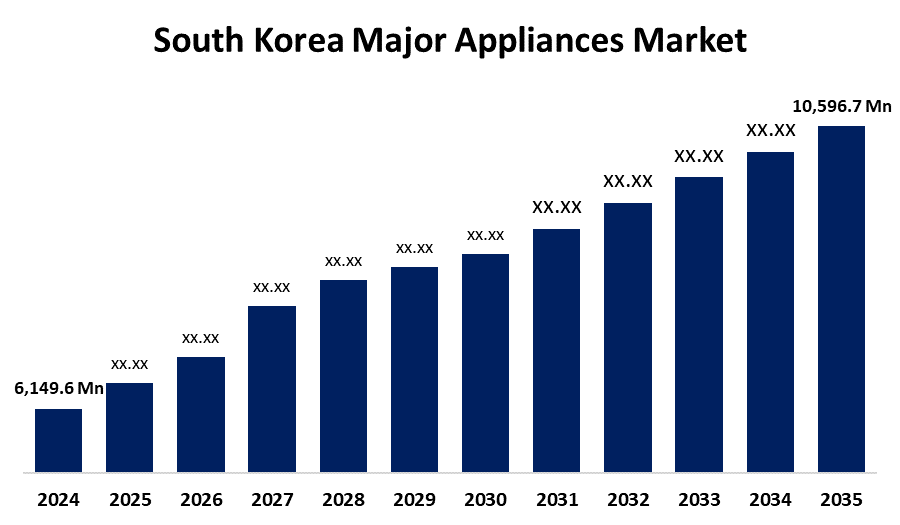

- The South Korea Major Appliances Market Size Was Estimated at USD 6,149.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.07% from 2025 to 2035

- The South Korea Major Appliances Market Size is Expected to Reach USD 10,596.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Major Appliances Market Size is anticipated to reach USD 10,596.7 Million by 2035, growing at a CAGR of 5.07% from 2025 to 2035. Consumer interest is being fueled by the increasing use of smart devices in homes, especially as these products becoming more connected and user-friendly.

Market Overview

The major appliances market includes large household devices such as washing machines, refrigerators, cooktops, and ovens that facilitate daily chores and improve living standards. These appliances offer benefits like enhanced convenience, energy efficiency, and time-saving, contributing to better home management and comfort. The market arises from rising urbanization, increasing disposable incomes, and growing consumer preference for smart and eco-friendly appliances. Governments support market growth through initiatives promoting energy-efficient products, subsidies for adopting green technologies, and regulations encouraging sustainable manufacturing. Additionally, programs aimed at improving rural electrification and household appliance accessibility further expand the market. Such combined efforts drive innovation, boost consumer adoption, and foster a competitive landscape in the major appliances sector.

Report Coverage

This research report categorizes the market for South Korea major appliances market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea major appliances market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea major appliances market.

South Korea Major Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6,149.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.07% |

| 2035 Value Projection: | USD 10,596.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 156 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Product, By Type and By Distribution Channel |

| Companies covered:: | LG Electronics, Samsung Electronics, Coway, Winia, Daewoo Electronics, Cuckoo Electronics, Hyosung TNC, Hanil Electronics, Kyowon Industries, JTC Corporation, Dongbu Daewoo Electronics, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Rising disposable incomes enable consumers to invest in modern, energy-efficient appliances that enhance convenience and quality of life. Urbanization leads to smaller living spaces, increasing demand for compact and multifunctional appliances. Technological advancements, such as the integration of IoT and AI, have led to the popularity of smart appliances offering remote operation and improved energy management.

Restraining Factors

High initial costs of energy-efficient and smart appliances deter budget-conscious consumers, despite long-term savings. Supply chain disruptions, including semiconductor shortages and raw material price volatility, lead to production delays and increased costs. Additionally, environmental concerns over energy consumption and e-waste generation pressure manufacturers to adopt sustainable practices, which may increase production costs.

Market Segmentation

The South Korea major appliances market share is classified into product, type, and distribution channel.

- The washing machine segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea major appliances market is segmented by product into washing machine and cooktops. Among these, the washing machine segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The increasing urbanization, busy lifestyles, and rising disposable incomes, driving demand for time-saving home appliances. Technological advancements like smart and energy-efficient models further boost adoption. Additionally, growing awareness of hygiene and convenience encourages consumers to invest in modern washing machines.

- The conventional appliances segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea major appliances market is segmented by type into conventional appliances, smart appliances. Among these, the conventional appliances segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. Their dependability, affordability, and simplicity, conventional appliances continue to be widely used. They are an affordable option for many households since they offer simple functioning without the extra expense and complexity of smart features. Because they don't require firmware upgrades or technical assistance, these appliances are praised for being simple to use and providing a hassle-free experience.

- The electronic stores segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea major appliances market is segmented by distribution channel into electronic stores, online, hypermarkets & supermarkets, exclusive brand outlets, and others. Among these, the electronic stores segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. Their exceptional capacity to combine the advantages of contemporary technology with the characteristics of conventional retail, electronic stores have become a significant distribution channel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea major appliances market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG Electronics

- Samsung Electronics

- Coway

- Winia

- Daewoo Electronics

- Cuckoo Electronics

- Hyosung TNC

- Hanil Electronics

- Kyowon Industries

- JTC Corporation

- Dongbu Daewoo Electronics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea major appliances market based on the below-mentioned segments:

South Korea Major Appliances Market, By Product

- Washing Machines

- Cooktops

South Korea Major Appliances Market, By Type

- Conventional Appliances

- Smart Appliances

South Korea Major Appliances Market, By Distribution Channel

- Electronic Stores

- Online

- Hypermarkets & Supermarkets

- Exclusive Brand Outlets

- Others

Need help to buy this report?