South Korea Luxury Hotel Market Size, Share, and COVID-19 Impact Analysis, By Type (Business Hotels, Airport Hotels, Suite Hotels, Resorts, and Others), By Room Type (Luxury, Upper-Upscale, Upscale), and South Korea Luxury Hotel Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsSouth Korea Luxury Hotel Market Insights Forecasts to 2035

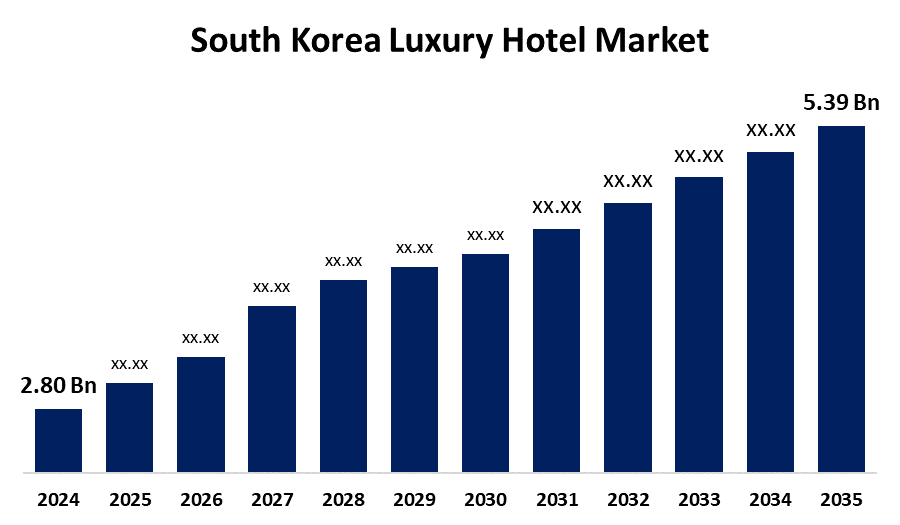

- The South Korea Luxury Hotel Market Size was estimated at USD 2.80 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.13% from 2025 to 2035

- The South Korea Luxury Hotel Market Size is Expected to Reach USD 5.39 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Luxury Hotel Market Size is anticipated to reach USD 5.39 Billion by 2035, growing at a CAGR of 6.13% from 2025 to 2035. The factors propelling the market are the notable growth of the South Korean tourism sector, the development of new luxury hotel properties and the renovation of existing ones, and the new technological advancements that improve the guest experience with automated check-in procedures and in-room smart controls.

Market Overview

South Korea luxury hotel industry is that portion of the hospitality sector that offers upscale accommodation with high-end services, facilities, and experiences for high-spending tourists. They are recognized by their unmatched comfort, customized services, and luxurious touches, typically offering top-shelf dining, spa facilities, and personalized concierge services. The expanding tourist sector is the main driver of the market. Furthermore, the market expansion is being positive impacted by South Korea's growing appeal as a tourism destination. The nation has attracted tourists from all over the world with its thriving culture, extensive history, and breathtaking natural scenery. The desire for opulent lodging options increased as South Korea's international renown grew. Luxury hotels are taking advantage of this trend by providing outstanding amenities and services catered to the needs of discriminating tourists.

Report Coverage

This research report categorizes the market for the South Korea luxury hotel market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea luxury hotel market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea luxury hotel market.

South Korea Luxury Hotel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.80 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.13% |

| 2035 Value Projection: | USD 5.39 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type (Business Hotels, Airport Hotels, Suite Hotels, Resorts, and Others), By Room Type (Luxury, Upper-Upscale, Upscale) |

| Companies covered:: | Hotel Lotte Co., Ltd., Grand Hyatt Seoul, Conrad Hotels & Resorts, Hanwha Hotels & Resorts, ACCOR SA, Josun Hotels & Resorts Inc., and Pyeongchang Alpensia Resort |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The luxury hotels are adopting cutting-edge technologies to improve the guest experience, from automated check-in procedures to in-room smart controls, which is another significant growth-inducing factor. These innovations and technologies also helped to propel the luxury hotel industry's expansion. Additionally, Consistent market expansion is facilitated by rising living standards and tourism. Demand increases are also caused by sporting events, as hotels host teams and spectators. Pet-friendly lodgings serve South Korea's growing pet industry and single-person homes, while luxury hotels provide specialized amenities like spas and gyms.

Restraining Factors

The South Korean luxury hotel industry is constrained by political instability, deceptive pricing behavior, increasing competition from shared accommodation, economic uncertainties, and diminished consumer confidence, affecting occupancy levels and overall market growth.

Market Segmentation

The South Korea luxury hotel market share is classified into type and room type.

- The business hotels segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea luxury hotel market is segmented by type into business hotels, airport hotels, suite hotels, resorts, and others. Among these, the business hotels segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The fusion of business and vacation travel, or "bleisure," is on the rise. Increasingly, professionals are prolonging their business trips for relaxation, creating a growing market for accommodations that can satisfy both work and play requirements.

- The luxury segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea luxury hotel market is segmented by room type into luxury, upper-upscale, upscale. Among these, the luxury segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Luxury hospitality, exquisite dining, and premium travel have all increased as a result of consumers placing a higher value on luxury experiences than products. Furthermore, in order to draw in younger customers, luxury brands concentrated on growing their footprint in developing nations and improving digital interaction.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea luxury hotel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hotel Lotte Co., Ltd.

- Grand Hyatt Seoul

- Conrad Hotels & Resorts

- Hanwha Hotels & Resorts

- ACCOR SA

- Josun Hotels & Resorts Inc.

- Pyeongchang Alpensia Resort

Recent Developments:

- In September 2023, Hilton's fast-growing upscale chain, DoubleTree by Hilton Seoul Pangyo, welcomed guests to South Gyeonggi as the largest full-service hotel and residences complex in the region, featuring 432 hotel rooms and 170 residences across 25 floors.

- In March 2023, JW Marriott opened the JW Marriott Jeju Resort & Spa in Seogwipo, South Korea. The new luxury hotel looked out over the coast of Jeju Island, Korea's Hawaii, from a cliff top.

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea luxury hotel market based on the below-mentioned segments:

South Korea Luxury Hotel Market, By Type

- Business Hotels

- Airport Hotels

- Suite Hotels

- Resorts

- Others

South Korea Luxury Hotel Market, By Room Type

- Luxury

- Upper-Upscale

- Upscale

Need help to buy this report?