South Korea Logistics Software Market Size, Share, and COVID-19 Impact Analysis, By Software Type (Warehouse Management, Labor Management, Transportation Management, and Data Management), By End User (Automotive, Government and Defense, Healthcare, Telecommunication and IT, Industrial, Engineering and manufacturing, Oil and Gas, and Others), and South Korea Logistics Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologySouth Korea Logistics Software Market Insights Forecasts to 2035

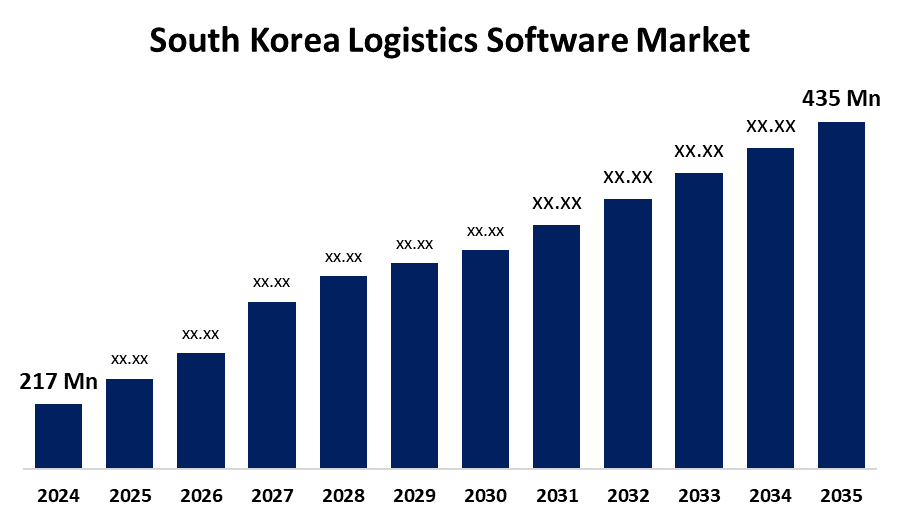

- The South Korea Logistics Software Market Size was Estimated at USD 217 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.53% from 2025 to 2035

- The South Korea Logistics Software Market Size is Expected to Reach USD 435 Million by 2035

Get more details on this report -

According to a Research Report published by Spherical Insights & Consulting, the South Korea Logistics Software Market Size is Anticipated to reach USD 435 Million by 2035, Growing at a CAGR of 6.53% from 2025 to 2035. Increasing the need for real-time delivery and inventory systems. Furthermore, supply chains are becoming more automated, efficient, and sustainable thanks to government-backed smart logistics programs and the use of AI, IoT, and cloud-based platforms.

Market Overview

The South Korea logistics software market refers to the industry in South Korea that creates, markets, and makes use of software solutions to oversee and improve supply chain and logistics operations is known as the "South Korea logistics software market." Numerous software tools are available in this market that are intended to enhance the effectiveness, visibility, and coordination of the movement of goods at different stages, from production to delivery. Additionally, government initiatives to upgrade infrastructure and technology in the logistics sector, as well as the country's strategic location that facilitates trade and logistics, are significant market drivers. Investment in smart logistics systems is rising as a result of the necessity for automation and real-time data analytics. Furthermore, as interest in sustainability in logistics grows, companies are looking into ways to lessen their environmental impact, like eco-friendly modes of transportation and effective route planning. Cloud-based logistics solutions, which offer companies more flexibility in scaling their operations, are becoming more and more popular.

Report Coverage

This research report categorizes the market for the South Korea logistics software market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea logistics software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea logistics software market.

South Korea Logistics Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 217 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.53% |

| 2035 Value Projection: | USD 435 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 130 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Software Type, By End User and COVID-19 Impact Analysis. |

| Companies covered:: | SRPOST Inc., SpaceRiver Co., ZIM Solution Co., SCA Inc., Vengine Co. Ltd, Windmillsoft and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Advanced logistics solutions are required in light of the increase in e-commerce in order to optimize shipping, manage inventory, and raise customer satisfaction. The demand for logistics software is being further driven by major e-commerce companies like Coupang and Gmarket, who are using it to improve delivery efficiency, streamline operations, and provide real-time order tracking. Further, the logistics industry must adapt to preserve competitive advantages as more and more customers shop online, which bodes well for the South Korean logistics software market.

Restraining Factors

The logistics software market in South Korea is hampered by a number of factors, including high implementation costs, problems integrating legacy systems, cybersecurity risks, data privacy regulations, a lack of digital skills, resistance to change, fragmented supply chains, a lack of standardization, slow adoption in rural areas, complicated regulatory compliance, vendor lock-in, low SME investment, infrastructure gaps, interoperability issues, and a lack of awareness of the advantages of the cloud.

Market Segmentation

The South Korea logistics software market share is classified into software type and end user.

- The warehouse management segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea logistics software market is segmented by software type into warehouse management, labor management, transportation management, and data management. Among these, the warehouse management segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Optimizing inventory levels, enhancing order fulfillment, and simplifying warehouse operations all depend on warehouse management systems. The expansion of e-commerce and distribution networks is driving the need for strong warehouse solutions, which is in line with South Korea's strategic location as a logistics hub in Northeast Asia.

- The automotive segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea logistics software market is segmented by end user into automotive, government and defense, healthcare, telecommunication and IT, industrial, engineering and manufacturing, oil and gas, and others. Among these, the automotive segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rise of electric cars and improvements in supply chain management have made the automotive industry stand out, demonstrating a heavy reliance on logistics software for effective operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea logistics software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SRPOST Inc.

- SpaceRiver Co.

- ZIM Solution Co.

- SCA Inc.

- Vengine Co. Ltd

- Windmillsoft

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Logistics Software Market based on the below-mentioned segments:

South Korea Logistics Software Market, By Software Type

- Warehouse Management

- Labor Management

- Transportation Management

- Data Management

South Korea Logistics Software Market, By End User

- Automotive

- Government and Defense

- Healthcare

- Telecommunication and IT

- Industrial

- Engineering and manufacturing

- Oil and Gas

- Others

Need help to buy this report?