South Korea Logistics Market Size, Share, and COVID-19 Impact Analysis, By Model Type (2 PL, 3 PL, and 4 PL), By Transportation Mode (Roadways, Seaways, Railways, and Airways), and South Korea Logistics Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationSouth Korea Logistics Market Size Insights Forecasts to 2035

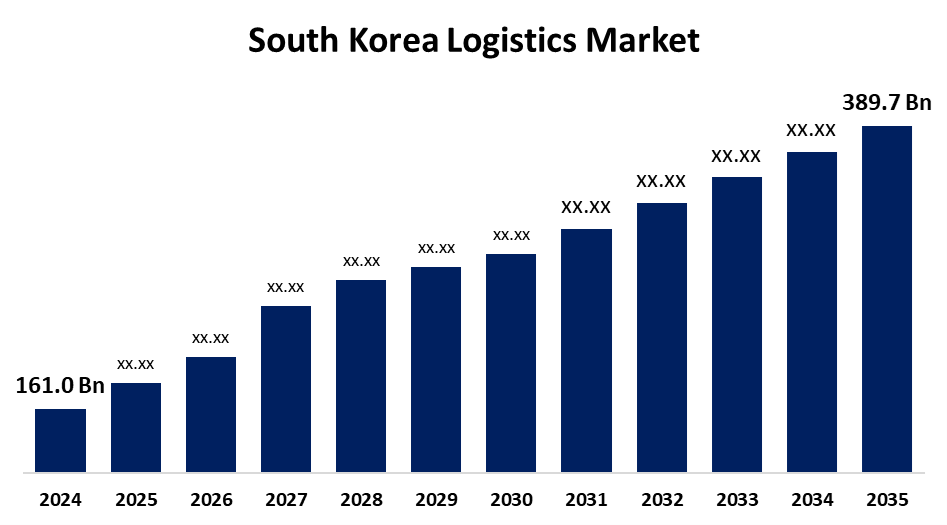

- The South Korea Logistics Market Size was estimated at USD 161.0 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.37% from 2025 to 2035

- The South Korea Logistics Market Size is Expected to Reach USD 389.7 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Logistics Market Sze is anticipated to reach USD 389.7 billion by 2035, growing at a CAGR of 8.37% from 2025 to 2035. Key factors driving the market include the nation's strategic location, thriving e-commerce sector, favorable government policies, adoption of advanced technology, environmental sustainability, rising healthcare demands, and the notable expansion of the aerospace industry.

Market Overview

The South Korea logistics market refers to the network of facilities and services used in the distribution, storage, and transportation of goods throughout both domestic and foreign supply chains is referred to as the South Korean logistics market. It includes a broad range of tasks, such as supply chain coordination, inventory management, warehousing, freight forwarding, and last-mile delivery. Furthermore, the growing use of automation and cutting-edge technology in logistics operations has improved supply chain performance overall, decreased costs, and increased efficiency all of which have aided in the market's growth. Additionally, the market's expansion has been fueled by the government's support of Industry 4.0 initiatives, which have accelerated the integration of technology in logistics. In addition, a move toward environmentally friendly logistics techniques has been spurred by growing environmental concerns and South Korea's dedication to lowering greenhouse gas emissions and advancing sustainable transportation, which has aided in market expansion.

Report Coverage

This research report categorizes the market for the South Korea logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea logistics market.

South Korea Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.37% |

| 2035 Value Projection: | USD 389.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Model Type, By Transportation Mode and COVID-19 Impact Analysis |

| Companies covered:: | CJ Logistics, Hyundai Glovis, Pantos Logistics, Hanjin Transportation, Lotte Global Logistics, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The nation's strong manufacturing and export-focused sectors especially in shipbuilding, electronics, and automotive have produced steady cargo volumes, necessitating effective logistics solutions. The demand for last-mile delivery services and contemporary warehousing facilities has also increased due to the rise of e-commerce and the thriving domestic online retail sector, which has strengthened market growth as consumers increasingly shop online. In addition, there are profitable prospects for market expansion due to the nation's developing cold chain logistics industry, which is being fueled by an increase in the demand for frozen and fresh food items. At the same time, South Korea's extensive ports and airports, as well as its highly developed road and rail system, have improved connectivity both domestically and internationally, which has fueled market expansion.

Restraining Factors

As the population ages, fewer young people are joining the workforce, which is causing a labor shortage in South Korea's logistics industry. Because they are more difficult to automate or outsource, jobs requiring physical labor, such as warehouse operations and last-mile deliveries, are particularly affected by this trend. Because of this, logistics companies are using robotics, automation, and foreign labor to cover important shortages.

Market Segmentation

The South Korea logistics market share is classified into model type and transportation mode.

- The 3 PL segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea logistics market is segmented by model type into 2 PL, 3 PL, and 4 PL. Among these, the 3 PL segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance stems from the nation's thriving e-commerce industry, intricate supply chains, and the rising need for specialized logistics services like inventory control, last-mile delivery, and warehousing.

- The roadways segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea logistics market is segmented by transportation mode into roadways, seaways, railways, and airways. Among these, the roadways segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is dominate as the most popular form of transportation, owing to the nation's effective highway system and extensive urban networks. Road transport is particularly important for domestic freight movement and last-mile delivery, which supports the rapidly expanding retail and e-commerce industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CJ Logistics

- Hyundai Glovis

- Pantos Logistics

- Hanjin Transportation

- Lotte Global Logistics

Recent Developments:

- In April 2025, JD.com had announced on the 24th that JD Korea would open its own logistics centers in Incheon and Icheon and officially begin delivery services. JD Korea was the Korean subsidiary of JD Logistics, the logistics company under China's largest e-commerce corporation, JD.com.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Logistics Market based on the below-mentioned segments:

South Korea Logistics Market, By Model Type

- 2 PL

- 3 PL

- 4 PL

South Korea Logistics Market, By Transportation Mode

- Roadways

- Seaways

- Railways

- Airways

Need help to buy this report?