South Korea Logistics Automation Market Size, Share, and COVID-19 Impact Analysis, By Function (Warehouse and Storage Management, Transportation Management), By Enterprise Size (Small and Medium-sized Enterprises, Large Enterprises), and South Korea Logistics Automation Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologySouth Korea Logistics Automation Market Insights Forecasts to 2035

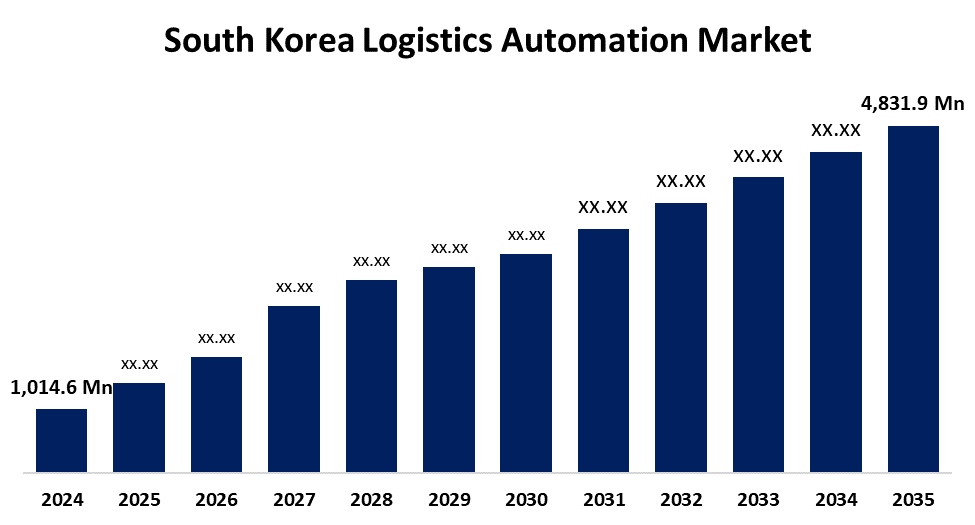

- The South Korea Logistics Automation Market Size was estimated at USD 1,014.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.24% from 2025 to 2035

- The South Korea Logistics Automation Market Size is Expected to Reach USD 4,831.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Logistics Automation Market Size is anticipated to reach USD 4,831.9 Million by 2035, growing at a CAGR of 15.24% from 2025 to 2035. Some of the main factors propelling the market are the growing popularity of collaborative robots (cobots), the growing adoption of cutting-edge technologies like artificial intelligence (AI), the internet of things (IoT), and machine learning (ML), as well as people's preferences for timely and efficient deliveries.

Market Overview

The South Korea logistics automation market refers to the ecosystem of tools, platforms, and services that automate logistics tasks like order fulfillment, transportation, inventory control, and warehousing is referred to as the South Korean logistics automation market. Moreover, logistics companies are being encouraged to invest in automation by the increasing backing of the governing authorities through financial incentives, subsidies, and regulatory frameworks. Furthermore, the nation's market is expanding due to the growing acceptance of collaborative robots, or cobots, which are used to increase safety and productivity. Additionally, these cobots help create a more flexible and efficient workforce by performing tasks like palletizing, packaging, and quality control. Also, people's increasing desire for personalization and customization options is driving the use of automation to handle customized orders efficiently and guarantee that every package is precisely put together and delivered in accordance with the requirements. Further, the growing popularity of just-in-time (JIT) inventory management necessitates automation to guarantee that stock levels are precisely in line with demand, lowering excess stock and storage expenses.

Report Coverage

This research report categorizes the market for the South Korea logistics automation market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea logistics automation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea logistics automation market.

South Korea Logistics Automation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,014.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.24% |

| 2035 Value Projection: | USD 4,831.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Function, By Enterprise Size |

| Companies covered:: | CJ Logistics, LG CNS, Hyundai Glovis, SFA Corporation, Eugene Robot, Hanjin Transportation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the key factors driving the market expansion in South Korea is the growing number of online shopping platforms and consumer preferences for prompt and effective deliveries. Automation is being used by logistics companies more and more to streamline their operations. In order to manage the increase in e-commerce orders, this includes intelligent route optimization, automated warehouses, and robotic order picking systems. Furthermore, the country's market is being positively impacted by the increasing use of cutting-edge technologies, such as artificial intelligence (AI), the internet of things (IoT), and machine learning (ML) in logistics automation, real-time data analysis, predictive maintenance, and intelligent decision-making.

Restraining Factors

Many logistics firms continue to use antiquated systems that were not designed to interface with contemporary automation technologies, which creates integration challenges. It can be difficult and time consuming to create custom interfaces or modifications for these older systems when robotics, artificial intelligence, or new software are introduced. Especially for companies without specialized IT teams, this results in longer deployment schedules and greater implementation expenses.

Market Segmentation

The South Korea logistics automation market share is classified into function and enterprise size.

- The warehouse and storage management segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea logistics automation market is segmented by function into warehouse and storage management and transportation management. Among these, the warehouse and storage management segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. driven by the rise in retail and e-commerce demand, which calls for quicker and more precise order fulfillment. To maximize warehouse efficiency, this demand has led to significant investments in robotics, mobile robots, and automated storage and retrieval systems (AS/RS). Furthermore, through the use of intelligent automation technologies, government and private sector programs are aggressively lowering labor dependency and improving supply chain resilience.

- The large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea logistics automation market is segmented by enterprise size into small and medium-sized enterprises and large enterprises. Among these, the large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. given their larger financial resources, which allow them to make large investments in cutting-edge technologies like AI-driven platforms, robotics, and automated storage and retrieval systems (AS/RS). Many of these businesses oversee sizable distribution hubs and warehouses, where automation is essential for increasing scalability and operational efficiency. They also frequently adopt smart logistics platforms early on, using them to keep a competitive edge in increasingly intricate global supply chains.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea logistics automation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CJ Logistics

- LG CNS

- Hyundai Glovis

- SFA Corporation

- Eugene Robot

- Hanjin Transportation

- Others

Recent Developments:

- In June 2025, Eugene Robot, an autonomous logistics robot and total smart factory solution company, announced on the 23rd that it had been selected as a specialized company for the "AI Factory Project" organized by the Ministry of Trade, Industry and Energy and the Korea Institute of Industrial Technology Planning and Evaluation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Logistics Automation Market based on the below-mentioned segments:

South Korea Logistics Automation Market, By Function

- Warehouse and Storage Management

- Transportation Management

South Korea Logistics Automation Market, By Enterprise Size

- Small and Medium-sized Enterprises

- Large Enterprises

Need help to buy this report?