South Korea Life and Non-life Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Type (Life Insurance, Non-life Insurance), By Distribution Channel (Bancassurance, Agents & Brokers, Direct, Online), By End-use (Health Insurance, Motor Insurance, Property & Casualty, Others), And South Korea Life and Non-life Insurance Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSouth Korea Life and Non-life Insurance Market Insights Forecasts to 2035

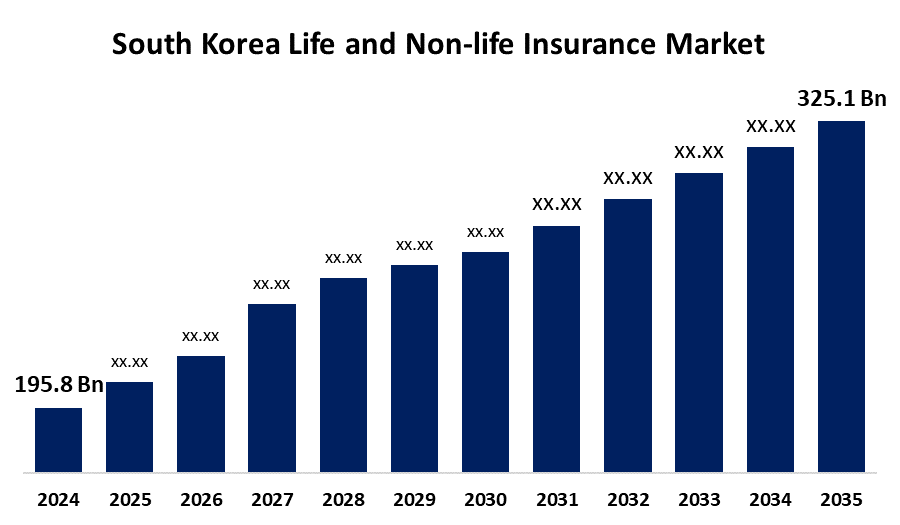

- South Korea Life and Non-life Insurance Market Size Was Estimated at USD 195.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.7% from 2025 to 2035

- South Korea Life and Non-life Insurance Market Size is Expected to Reach USD 325.1 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Life and Non-life Insurance Market is anticipated to reach USD 325.1 billion by 2035, growing at a CAGR of 4.7% from 2025 to 2035. The market is driven by aging demographics, increasing health awareness, digital transformation in insurance services, and mandatory coverage regulations.

Market Overview

South Korean insurance is one of the most advanced in Asia and is supported by strict regulation, penetration of technology, and an educated population. Life insurance is dominated largely by retirement planning, estate planning, and long-term saving products, particularly in one of the world's fastest-aging societies. Non-life insurance has witnessed phenomenal growth in health, automobile, and residential property insurance, driven by urbanization as well as rising healthcare costs. The use of artificial intelligence, telematics, and web-based claim handling is improving the efficiency of services, increasing customer satisfaction, and creating new distribution channels for insurers.

Report Coverage

This research report categorizes the market for South Korea life and non-life insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea life and non-life insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea life and non-life insurance market.

South Korea Life and Non-life Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 195.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.7% |

| 2035 Value Projection: | USD 325.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Insurance Type, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Samsung Life Insurance, Hanwha Life, Kyobo Life, Samsung Fire & Marine Insurance, DB Insurance, Hyundai Marine and, Fire Insurance, Meritz Fire and, Marine, AXA General Insurance Korea, LINA Korea (Chubb Life), KB Insurance, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The South Korean insurance industry is driven by several key factors. The country's low birthrate and aging population generate demand for life insurance products with retirement, annuity, and health coverage. The country's high level of education and financial awareness also generates general insurance awareness and penetration. On the other hand, healthcare expenses and lifestyle diseases are driving consumers into private health insurance, which dominates the non-life business. Motor and health insurance are growth drivers due to government requirements. Higher take-up of advanced analytics and insurtech integration is driving underwriting efficiency and claims settlement accuracy, combating fraud, and customer churn.

Restraining Factors

There are some restraints including low-interest rates impacting savings products of life insurance. Also, stricter regulation on product pricing and solvency levels raised compliance expenses. Also growing, competition from foreign players as well as insurtech players is squeezing the legacy players into adopting digital transformation. Saturation of the market for core life products and consumer reluctance to long-term commitment with economic uncertainty can check growth in certain segments.

Market Segmentation

The South Korea Life and Non-life Insurance Market share is classified into insurance type, distribution channel, and end-use.

- The life insurance segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea life and non-life insurance market is segmented by insurance type into life insurance, non-life insurance. Among these, the life insurance segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The Life Insurance sector includes a range of products such as term life, whole life, endowment schemes, and annuity business products. It has a leading role in the market from the strong growth in South Korea's aging population and growing demand for retirement income protection. Consumers are increasingly looking for life insurance with double savings or investment components. The trend from the government towards self-funded retirement schemes has also aided in increasing usage. Life insurance companies are also adding critical illness riders to their increasingly popular life policies. Increasing numbers of salaried professionals and financially aware young people have propelled the term and unit-linked life product market.

- The bancassurance segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea life and non-life insurance market is segmented by distribution channel into bancassurance, agents & brokers, direct, and online. Among these, the bancassurance segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Bancassurance, the partnership between banks and insurance companies, is still the most preferred in South Korea due to the confidence that consumers have in banks and the ease of purchasing insurance as part of a suite of other financial products. The large insurance companies have exclusive distribution arrangements with big banks. It offers exposure to a broad customer base, especially mature consumers, who are largely reliant on branch banking. Bancassurance is a natural fit for life insurance with huge lump-sum and regular premium products normally sold through this channel. Support of regulation and technology synchronization of insurers' and banks' systems has enabled the scalability and efficacy of this channel.

- The health insurance segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea life and non-life insurance market is segmented by end-use into health insurance, motor insurance, property & casualty, and others. Among these, the health insurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Health insurance holds a significant share in the non-life insurance segment, spurred by the increasing cost of healthcare, the rising prevalence of chronic illness, and growing consumer awareness. Core care is provided by South Korea's national health insurance programme, with consumers buying private coverage, which provides additional hospital cover, surgery benefits, and protection against critical illness. Insurers are providing cancer, heart disease, and long-stay hospitalization-specific policies, which are most sought after by middle-aged and elderly citizens. Young customers are also experiencing increasing demand due to lifestyle diseases. Additions like telemedicine integration, cashless hospitalization networks, and preventive care features are enhancing market penetration.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea life and non-life insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung Life Insurance

- Hanwha Life

- Kyobo Life

- Samsung Fire & Marine Insurance

- DB Insurance

- Hyundai Marine and Fire Insurance

- Meritz Fire and Marine

- AXA General Insurance Korea

- LINA Korea (Chubb Life)

- KB Insurance

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea life and non-life insurance market based on the below-mentioned segments:

South Korea Life and Non-life Insurance Market, By Insurance Type

- Life Insurance

- Non-life Insurance

South Korea Life and Non-life Insurance Market, By Distribution Channel

- Bancassurance

- Agents & Brokers

- Direct

- Online/Digital

South Korea Life and Non-life Insurance Market, By End-use

- Health Insurance

- Motor Insurance

- Property & Casualty Insurance

- Others

Need help to buy this report?