South Korea Legal Services Market Size, Share, and COVID-19 Impact Analysis, By Service (Taxation, Real Estate, Litigation, Bankruptcy, Labor/Employment, Corporate, and Others), By Mode (Online Legal Services, and Offline Legal Services), and South Korea Legal Services Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSouth Korea Legal Services Market Insights Forecasts to 2035

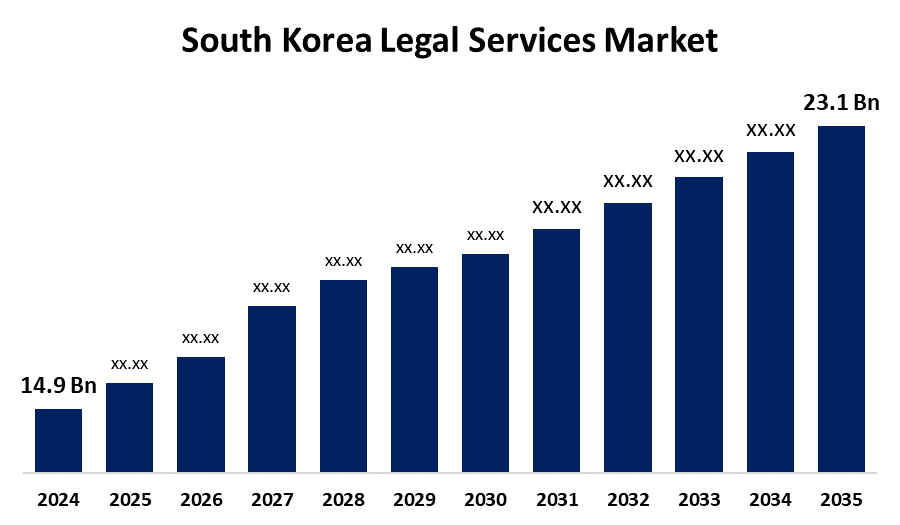

- The South Korea Legal Services Market Size was Estimated at USD 14.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.07% from 2025 to 2035

- The South Korea Legal Services Market Size is Expected to Reach USD 23.1 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Legal Services Market Size is anticipated to reach USD 23.1 Billion by 2035, growing at a CAGR of 4.07% from 2025 to 2035. Some of the major factors propelling the market include the rise in international trade, the influx of multinational corporations and foreign businesses, and the growing use of digital tools and platforms by law firms to increase efficiency and improve client services.

Market Overview

The market for legal services in South Korea includes the offering of expert legal counsel to individuals, companies, and organizations by licensed lawyers and law firms. Legal advice, dispute resolution, contract drafting, compliance counseling, and specialized fields like taxation, real estate, labor, corporate law, and intellectual property are all included in these services. A combination of established legal practices and new legal technology solutions define the market. Additionally, to improve transparency and encourage fair competition, South Korea's governing bodies are implementing regulatory reforms. The need for legal counsel and services pertaining to compliance, regulatory issues, and dispute resolution is being accelerated by these reforms. Accordingly, a number of businesses in the nation are concentrating on protecting their intellectual property, which is boosting the need for legal services pertaining to trademark protection, patent registration, and intellectual property litigation.

Report Coverage

This research report categorizes the market for the South Korea legal services market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea legal services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea legal services market.

South Korea Legal Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.9 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.07% |

| 2035 Value Projection: | USD 23.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 246 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Service and By Mode |

| Companies covered:: | Kim & Chang, Bae, Kim & Lee LLC, Shin & Kim, Yulchon LLC, D’LIGHT Law Group, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for legal knowledge in this field is being exacerbated by the Korean Intellectual Property Office's (KIPO) implementation of various measures to expedite the registration procedure. Accordingly, the need for legal services pertaining to import-export laws, trade dispute settlement, and international trade agreements is being driven by the growth in reginal trade. The need for legal services to handle the complexities of these agreements, such as free trade agreements (FTAs) and bilateral investment treaties (BITs), is also being rekindled by South Korea's growing involvement in international trade agreements and economic partnerships.

Restraining Factors

In South Korea, the legal profession has historically been conservative, with many practitioners reluctant to accept change. The integration of cutting-edge procedures and technologies that could enhance the efficiency and quality of services provided in the legal industry is hampered by this cultural resistance.

Market Segmentation

The South Korea Legal Services Market share is classified into services and mode.

- The corporate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea legal services market is segmented by services into taxation, real estate, litigation, bankruptcy, labor/employment, corporate, and others. Among these, the corporate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The strong demand for legal knowledge in corporate governance, regulatory compliance, and mergers and acquisitions accounts for this segment's dominance. The expansion of corporate legal services in the nation has been further stimulated by the arrival of multinational corporations and foreign investments.

- The offline services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea legal services market is segmented by mode into online legal services and offline legal services. Among these, the offline services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Traditional legal services still predominate despite the growing use of digital tools because of things like client preference for in-person consultations, regulatory compliance, and complicated litigation requirements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea legal services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kim & Chang

- Bae, Kim & Lee LLC

- Shin & Kim

- Yulchon LLC

- D’LIGHT Law Group

- Others

Recent Developments news:

- In March 2024, After the advent of OpenAI’s ChatGPT in 2022, the Korean legal services market, which had previously been hesitant to adopt new technologies, witnessed a surge in the use of generative artificial intelligence (AI), according to industry officials. Major law firms in Korea, along with the prosecution and courts, began collaborating with tech companies to develop AI solutions for legal affairs.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea legal services market based on the below-mentioned segments:

South Korea Legal Services Market, By Service

- Taxation

- Real Estate

- Litigation

- Bankruptcy

- Labor/Employment

- Corporate

- Others

South Korea Legal Services Market, By Mode

- Online Legal Services

- Offline Legal Services

Need help to buy this report?