South Korea LED Lighting Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Lamps, Luminaries), By Application (Residential, Commercial, Industrial), and South Korea LED Lighting Market Insights Forecasts to 2033

Industry: Semiconductors & ElectronicsSouth Korea LED Lighting Market Insights Forecasts to 2033

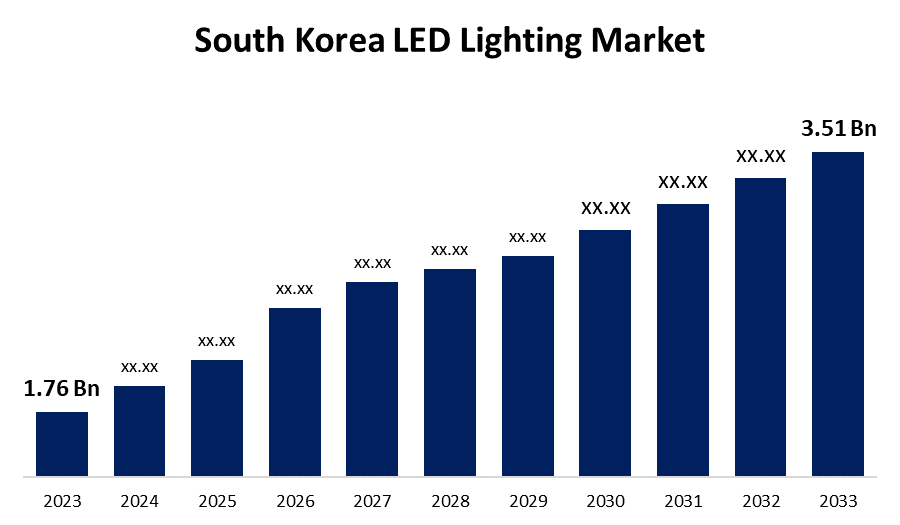

- The South Korea LED Lighting Market Size was valued at USD 1.76 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.15% from 2023 to 2033.

- The South Korea LED Lighting Market Size is Expected to Reach USD 3.51 Billion by 2033.

Get more details on this report -

The South Korea LED Lighting Market Size is Expected to Reach USD 3.51 Billion by 2033, at a CAGR of 7.15% during the forecast period 2023 to 2033.

Market Overview

LED lighting, which stands for Light Emitting Diode lighting, is a revolutionary lighting technology. It is distinguished by the use of diodes, which emit light when an electrical current flows through them. This is in stark contrast to standard incandescent or fluorescent lighting, which is powered by a filament or gas, respectively. The adaptability of LED technology has resulted in a profusion of forms, including typical LED bulbs, panels, tubes, and strip lights, each catering to individual lighting requirements and tastes. LEDs utilize substantially less power than traditional lighting systems, resulting in significant savings in electricity expenditures and carbon footprints. Furthermore, South Korea's construction expansion, driven by the development of residential, commercial, and industrial infrastructure, is also boosting the market. Furthermore, the South Korean government's support in the form of subsidies and incentives for LED lighting adoption in public infrastructure is boosting the market. Aside from that, the visual appeal and versatility of LED lighting are driving its greater use in a variety of industries, including automotive, electronics, and entertainment, hence adding to market growth. In line with the development of smart cities and connected systems in South Korea, LEDs are a vital part of these modern urban setups, providing increased usefulness and efficiency. As a result, this serves another boost the market expansion in South Korea.

Report Coverage

This research report categorizes the market for South Korea LED lighting market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea LED lighting market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the South Korea LED lighting market.

South Korea LED Lighting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.76 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.15% |

| 2033 Value Projection: | USD 3.51 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 147 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Samsung Electronics,, LG Innotek,, Seoul Semiconductors,, Phillips,, Koninklijke Philips N.V.,, KOREA LED AND EQUIPMENT Co., Ltd.,, LG Innotek Co. Ltd.,, Lumileds Holding BV,, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South Korea's market is primarily driven by the country's substantial focus on energy efficiency and sustainability, as well as government laws and attempts to reduce carbon emissions. This preference for environmentally responsible behaviors is driving the adoption of energy-efficient lighting systems. Along with this, significant technological breakthroughs in LED lighting, such as smart lighting systems connected with IoT technology, are benefiting the industry.

Restraining Factors

The primary cost of collecting a single unit of these systems is more than that of standard CFL lighting systems that are already available. The components that make up these systems, such as diodes, transmitters, and capacitors, are expensive, influencing the overall retail price of the system.

Market Segment

- In 2023, the lamps segment accounted for the largest revenue share over the forecast period.

Based on the product type, the South Korea LED lighting market is segmented into lamps and luminaries. Among these, the lamps segment has the largest revenue share over the forecast period. This is since LED lights are used exclusively in track lighting, high bays, troffers, and street lighting installations. The installation of extra track lights and light poles as a result of expanding commercial building space and increasing smart city initiatives is the primary driver of the segment's growth. As a result, the increasing use of LED lights in urban development is expected to have a beneficial impact on market growth.

- In 2023, the commercial segment accounted for the largest revenue share over the forecast period.

On the basis of application, the South Korea LED lighting market is segmented into residential, commercial, and industrial. Among these, the commercial segment has the largest revenue share over the forecast period. The demand for advanced lighting among exhibition, museum, and gallery owners for improved lighting applications is one of the driving reasons behind the South Korea commercial building industry's rapid growth, and it is expected to boost market expansion. The need for high-luminance LED lights is growing primarily because office lighting must comply with government laws and norms, which is driving market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea LED lighting market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung Electronics,

- LG Innotek,

- Seoul Semiconductors,

- Phillips,

- Koninklijke Philips N.V.,

- KOREA LED AND EQUIPMENT Co., Ltd.,

- LG Innotek Co. Ltd.,

- Lumileds Holding BV,

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the South Korea LED Lighting Market based on the below-mentioned segments:

South Korea LED Lighting Market, By Product Type

- Lamps

- Luminaries

South Korea LED Lighting Market, By Application

- Residential

- Commercial

- Industrial

Need help to buy this report?