South Korea Laser Diode Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Injection Laser Diode (ILD), Optically Pumped Semiconductor Laser (OPSL)), By Application (Optical Storage and Communication, Industrial Applications, Medical Applications, Military and Defence Applications, Instrumentation and Sensor Applications, and Others), and South Korea Laser Diode Market Insights, Industry Trend, Forecasts to 2035.

Industry: Semiconductors & ElectronicsSouth Korea Laser Diode Market Insights Forecasts to 2035

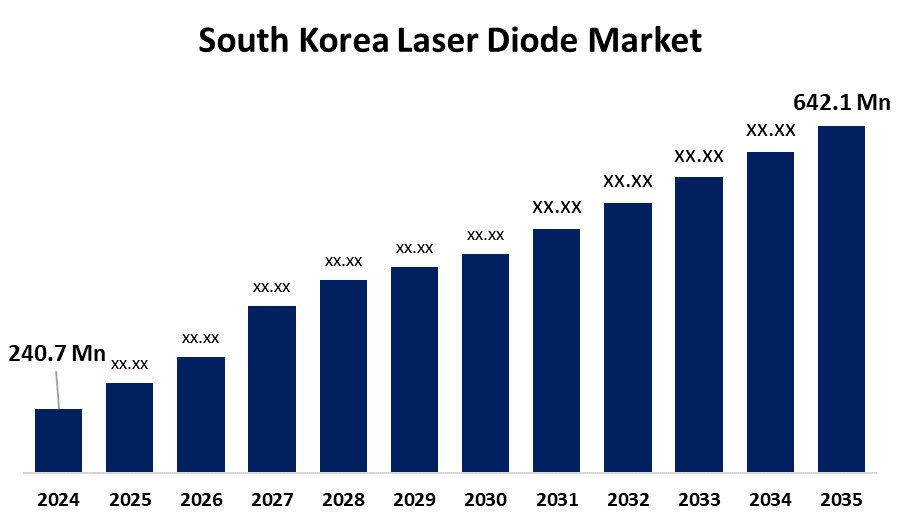

- The South Korea Laser Diode Market Size was estimated at USD 240.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.33% from 2025 to 2035

- The South Korea Laser Diode Market Size is Expected to Reach USD 642.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Laser Diode Market Size is anticipated to reach USD 642.1 Million by 2035, growing at a CAGR of 9.33% from 2025 to 2035. The development of faster and more dependable communication networks, in conjunction with the increasing demand for high-speed data transmission, is the main factor propelling the market expansion nationwide.

Market Overview

The industry that deals with the design, production, and use of laser diodes in South Korea is known as the "South Korea laser diode market." Because of their small size, accuracy, and efficiency, laser diodes semiconductor devices that produce coherent light when current passes through them are essential to many different industries. Additionally, the laser diode market in South Korea is at the forefront of technological innovation, demonstrating the nation's proficiency in semiconductor manufacturing and its noteworthy contributions to a range of industries. As essential parts of optical communication systems, these devices are vital to the nation's telecommunications infrastructure. They have established themselves as crucial components of the country's sophisticated infrastructures due to their capacity to transmit information quickly and precisely.

Report Coverage

This research report categorizes the market for the South Korea laser diode market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea laser diode market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea laser diode market.

South Korea Laser Diode Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 240.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.33% |

| 2035 Value Projection: | USD 642.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type (Injection Laser Diode (ILD), Optically Pumped Semiconductor Laser (OPSL)), By Application (Optical Storage and Communication, Industrial Applications, Medical Applications, Military and Defence Applications, Instrumentation and Sensor Applications, and Others) |

| Companies covered:: | QSI, K2 Laser System Inc., HIL Lab Inc., RB-Weld, Media Tech Co. Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Laser diodes are widely used in optical storage devices, barcode readers, laser printing, and laser pointers, all of which improve the functionality and efficiency of various technologies. The dedication of the South Korean laser diode market to improving manufacturing techniques and materials is one of its noteworthy features. In addition, the benefits of laser diodes such as their compact size, low power consumption, high efficiency, and quick modulation capabilities are driving the market's expansion. They are essential in applications where accuracy, dependability, and energy efficiency are crucial due to these characteristics.

Restraining Factors

As laser diodes are used, their performance and efficiency deteriorate, resulting in a shorter lifespan and decreased reliability. This presents difficulties for applications like medical devices or military equipment that need to run continuously and for an extended period of time.

Market Segmentation

The South Korea laser diode market share is classified into product type and application.

- The injection laser diode (ILD) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea laser diode market is segmented by product type into injection laser diode (ILD) and optically pumped semiconductor laser (OPSL). Among these, the injection laser diode (ILD) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. ILDs' high efficiency, small size, and proven dependability make them popular in fields like consumer electronics, fiber optic communication, and optical storage. ILDs are currently the most widely used product type in the laser diode market, which is in line with global trends.

- The optical storage and communication segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea laser diode market is segmented by application into optical storage and communication, industrial applications, medical applications, military and defence applications, instrumentation and sensor applications, and others. Among these, the optical storage and communication segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The nation's sophisticated telecommunications infrastructure, high-speed data transfer requirements, and robust demand for optical storage solutions in consumer electronics are the main drivers of this. Continuous advancements in semiconductor manufacturing and fiber-optic technology are advantageous to the segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea laser diode market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- QSI

- K2 Laser System Inc.

- HIL Lab Inc.

- RB-Weld

- Media Tech Co. Ltd.

- Others

Recent Developments:

- In October 2023, The Block-I laser weapon system, the latest air defense invention from South Korean defense manufacturer Hanwha Aerospace, was displayed at the Aerospace and Defense Exhibition (ADEX) 2023 in South Korea. This state-of-the-art technology offered deployment adaptability by mounting on a variety of platforms, such as big trucks, light vehicles, and container

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea laser diode market based on the below-mentioned segments:

South Korea Laser Diode Market, By Product Type

- Injection Laser Diode (ILD)

- Optically Pumped Semiconductor Laser (OPSL)

South Korea Laser Diode Market, By Application

- Optical Storage and Communication

- Industrial Applications

- Medical Applications

- Military and Defence Applications

- Instrumentation and Sensor Applications

- Others

Need help to buy this report?