South Korea Kitchen Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product (Refrigerator, Air Conditioner and Heater, Entertainment and Information Appliances, Washing Machine, Cleaning Appliance, Cooktop, Cooking Range, Microwave and Oven), By Technology (Conventional, Smart Appliances), By Application (Commercial, Residential), By Distribution Channel (Online, Offline), and South Korea Kitchen Appliances Market Insights Forecasts 2022 - 2032

Industry: Consumer GoodsSouth Korea Kitchen Appliances Market Size Insights Forecasts to 2032

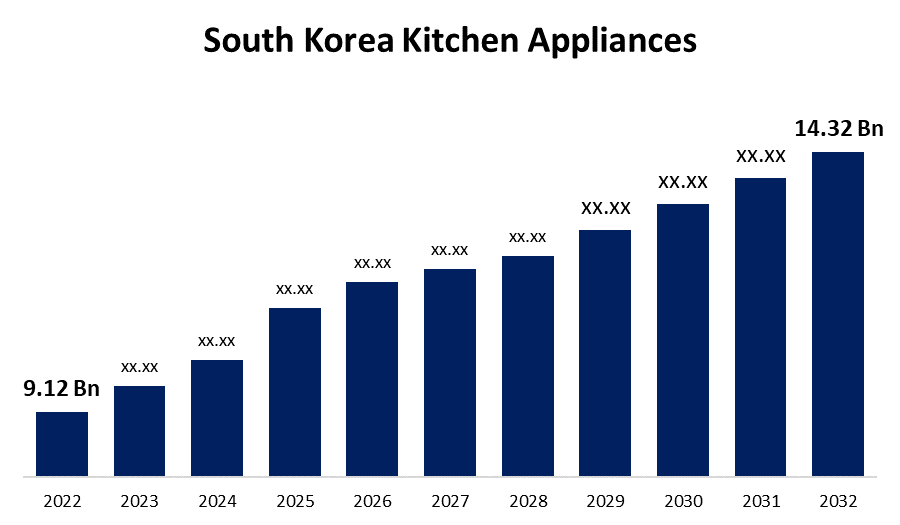

- The South Korea Kitchen Appliances Market Size was valued at USD 9.12 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.62% from 2022 to 2032.

- The South Korea Kitchen Appliances Market Size is Expected to Reach USD 14.32 Billion by 2032.

Get more details on this report -

The South Korea Kitchen Appliances Market Size is Expected to Reach USD 14.32 Billion by 2032, at a CAGR of 4.62% during the forecast period 2022 to 2032.

Market Overview

The kitchen appliances market is the industry that manufactures, distributes, and sells a variety of electrical and electronic appliances designed specifically for use in kitchens. Refrigerators, ovens, microwaves, dishwashers, cooktops, and other small kitchen appliances such as blenders, toasters, and coffee makers are examples of these appliances. They are intended to help with cooking, food storage, and kitchen maintenance, making them indispensable in modern homes. In recent years, the South Korean kitchen appliances market has grown strongly, owing to factors such as technological advancements, changing consumer lifestyles, and the growing popularity of smart appliances.

Report Coverage

This research report categorizes the market for the South Korea kitchen appliances market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea kitchen appliances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea kitchen appliances market.

South Korea Kitchen Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 9.12 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.62% |

| 2032 Value Projection: | USD 14.32 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Technology, By Application, By Distribution Channel |

| Companies covered:: | Samsung Electronics Co. Ltd, LG Electronics Inc, Panasonic Corp, Hitachi Ltd, Winia Electronics, Phillips, Cuckoo Electronics, Shinil Electronics, Haier Group, Whirlpool Corporation, and other key vendors. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

South Korea's economy is expanding, and disposable income levels are rising, resulting in increased consumer spending on kitchen appliances. Consumers are eager to spend money on technologically advanced products that provide convenience and efficiency. Furthermore, rapid technological advancements have transformed the kitchen appliance market. The incorporation of smart features, touchscreens, voice control, and IoT connectivity into appliances has increased their functionality and convenience, and sparked consumer interest.

Restraining Factors

The kitchen appliances market in South Korea is highly competitive, with both domestic and international players competing for market share. Consumer spending patterns can be influenced by economic fluctuations and uncertain market conditions. Consumers may postpone or reduce their purchases of kitchen appliances during financial crises, affecting market growth.

Market Segment

- In 2022, the refrigerator segment accounted for the largest revenue share over the forecast period.

Based on the product, the South Korea kitchen appliances market is segmented into refrigerators, air conditioners and heater, entertainment and information appliances, washing machines, cleaning appliances, cooktop, cooking range, microwave, and oven. Among these, the refrigerator segment has the largest revenue share over the forecast period. The availability of smart and energy-efficient refrigerator units, rising disposable income, and an expanding base of nuclear families are all contributing factors. With professional kitchens being among the most vulnerable to the current energy market's volatility, efficient appliances can help offset the sustained spike in utility bills, and minimizing food waste is a top priority, with commercial refrigeration playing an important role.

- In 2022, the conventional segment accounted for a significant revenue share over the forecast period.

Based on technology, the South Korea kitchen appliances market is segmented into conventional, and smart appliances. Among these, the conventional segment accounted for a significant revenue share over the forecast period. A large portion of the consumer population prefers the familiarity and ease of use of traditional appliances. Many people are accustomed to traditional designs and functionalities, making them feel at ease and confident in their use. Furthermore, the lower cost of conventional appliances compared to their more advanced counterparts drives their demand. Because of this, they are accessible to a wide range of consumers, including those on a tight budget.

- In 2022, the residential segment accounted for the largest revenue share over the forecast period.

Based on the application, the South Korea kitchen appliances market is segmented into commercial, and residential. Among these, the residential segment has the largest revenue share over the forecast period. Rising population and urbanization have resulted in an increase in residential construction and housing projects, resulting in a larger customer base for kitchen appliances. As more people move into new homes or renovate existing ones, there is a greater demand for modern and energy-efficient kitchen appliances.

- In 2022, the offline segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the South Korea kitchen appliances market is segmented into online, and offline. Among these, the offline segment accounted for the largest revenue share over the forecast period. Consumers prefer to buy electronic devices from specialty stores because they can better understand the product features in person from sales representatives. Furthermore, the provision of discounts and offers on various products by such stores is likely to entice people to purchase kitchen appliances from such stores. These factors are likely to boost the growth of the offline segment in the coming years.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea Kitchen Appliances Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung Electronics Co. Ltd

- LG Electronics Inc

- Panasonic Corp

- Hitachi Ltd

- Winia Electronics

- Phillips

- Cuckoo Electronics

- Shinil Electronics

- Haier Group

- Whirlpool Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, The mobile carrier and the home appliance rental company, KT and Coway decided to form a partnership to collaborate on an artificial intelligence (AI)-based home appliance business. The two companies stated that they decided to collaborate to improve the quality of life of their customers by combining their smart home appliance-related technologies.

- In June 2022, SEOUL, South Korea, Tuya Smart (NYSE: TUYA), a leading global Internet of Things (IoT) development platform provider, and Lock & Lock, a world-renowned producer of kitchen and household goods, collaborated to create smart appliances that deliver extraordinary experiences to consumers.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korea Kitchen Appliances Market based on the below-mentioned segments:

South Korea Kitchen Appliances Market, By Product

- Refrigerator

- Air Conditioner and Heater

- Entertainment and Information Appliances

- Washing Machine

- Cleaning Appliance

- Cooktop

- Cooking Range

- Microwave and Oven

South Korea Kitchen Appliances Market, By Technology

- Conventional

- Smart Appliances

South Korea Kitchen Appliances Market, By Application

- Commercial

- Residential

South Korea Kitchen Appliances Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?