South Korea IT Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Professional Services (System Integration and Consulting), Managed Services), By Enterprise Size (Small and Medium-sized Enterprises, Large Enterprises), and South Korea IT Services Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologySouth Korea IT Services Market Insights Forecasts to 2035

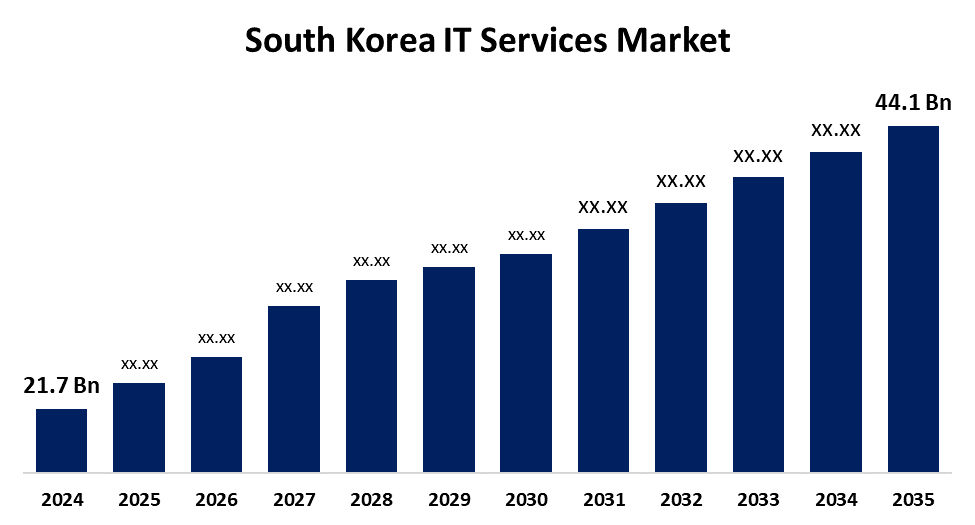

- The South Korea IT Services Market Size was estimated at USD 21.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.66% from 2025 to 2035

- The South Korea IT Services Market Size is Expected to Reach USD 44.1 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea IT Services Market Size is anticipated to reach USD 44.1 Billion by 2035, growing at a CAGR of 6.66% from 2025 to 2035. Some of the main factors propelling the market include the growing use of cutting-edge technologies like cloud computing, artificial intelligence (AI), and data analytics, the widespread adoption of remote working modules, and the growing dependence on e-commerce platforms.

Market Overview

The South Korea IT services market refers to the industry in South Korea that offers technology-based services for designing, managing, and optimizing digital infrastructure and information systems for companies and government organizations is known as the IT services market. Additionally, the nation's governing bodies are actively promoting the expansion of the IT industry. As such, they are implementing a number of programs, including the "Korea New Deal" and the "Digital New Deal," and investing large sums of money to boost innovation and digital infrastructure. Additionally, as 5G networks become more widely available, lucrative opportunities are being created for IT service providers to offer high-speed connectivity solutions, allowing businesses to take advantage of this next-generation technology. Accordingly, a positive market outlook is being provided by South Koreans' growing reliance on e-commerce platforms. E-commerce businesses can provide individualized shopping experiences, securely handle transactions, and effectively manage their platforms thanks to IT services.

Report Coverage

This research report categorizes the market for the South Korea IT services market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea IT services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea IT services market.

South Korea IT Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.66% |

| 2035 Value Projection: | USD 44.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Service Type, By Enterprise Size |

| Companies covered:: | Samsung SDS Co., Ltd., LG CNS Co., Ltd., SK C&C Co., Ltd, AhnLab, Inc., Douzone Bizon Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South Korea is seeing an increase in cyber threats and a rise in the digitalization of businesses. Because of this, a lot of businesses are spending money on cybersecurity services to safeguard their networks and private information. This is one of the main factors bolstering the country's market expansion, along with the growing use of remote work and collaboration tools. Aside from this, the market is expanding due to the growing use of cutting-edge technologies like cloud computing, artificial intelligence (AI), and data analytics to improve productivity, customer experiences, and decision-making. Accordingly, the growing need for IT services that can assist businesses in successfully navigating this digital shift is providing a positive market outlook.

Restraining Factors

As digital transformation speeds up, the demand for specialized talent has surpassed supply, forcing companies to outsource IT work to Southeast Asia, particularly Vietnam and Cambodia, to fill the skills gap in South Korea's IT services market.

Market Segmentation

The South Korea IT services market share is classified into service type and enterprise size.

- The professional services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea IT services market is segmented by service type into professional services (system integration and consulting) and managed services. Among these, the professional services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The nation's quick digital transformation, smart infrastructure initiatives, and enterprise modernization initiatives in industries like public administration, manufacturing, and finance have increased demand for these services.

- The large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea IT services market is segmented by enterprise size into small and medium-sized enterprises and large enterprises. Among these, the large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The demand for system integration, cloud migration, cybersecurity, and AI-powered services is fueled by their larger financial resources, sophisticated IT infrastructure, and strategic emphasis on digital transformation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea IT services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung SDS Co., Ltd.

- LG CNS Co., Ltd.

- SK C&C Co., Ltd

- AhnLab, Inc.

- Douzone Bizon Co., Ltd.

- Others

Recent Developments:

- In June 2025, A major highlight in South Korea’s IT services market was the $5.1 billion investment by SK Group and Amazon Web Services (AWS) to build the country’s largest AI data center in Ulsan. Announced in 2025, the project began construction in September and was expected to become fully operational by 2029, with an initial capacity of 100 megawatts and plans to scale up to 1 gigawatt.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea IT services Market based on the below-mentioned segments:

South Korea IT Services Market, By Service Type

- Professional Services (System Integration and Consulting)

- Managed Services

South Korea IT Services Market, By Enterprise Size

- Small and Medium-sized Enterprises

- Large Enterprises

Need help to buy this report?