South Korea Insulin Market Size, Share, and COVID-19 Impact Analysis, By Type (Analogue Insulin and Traditional Human Insulin), By Diabetes Type (Diabetes 1 and Diabetes 2), By Distribution Channel (Hospital Pharmacy and Retail & Online Pharmacy), and South Korea Insulin Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Insulin Market Insights Forecasts to 2035

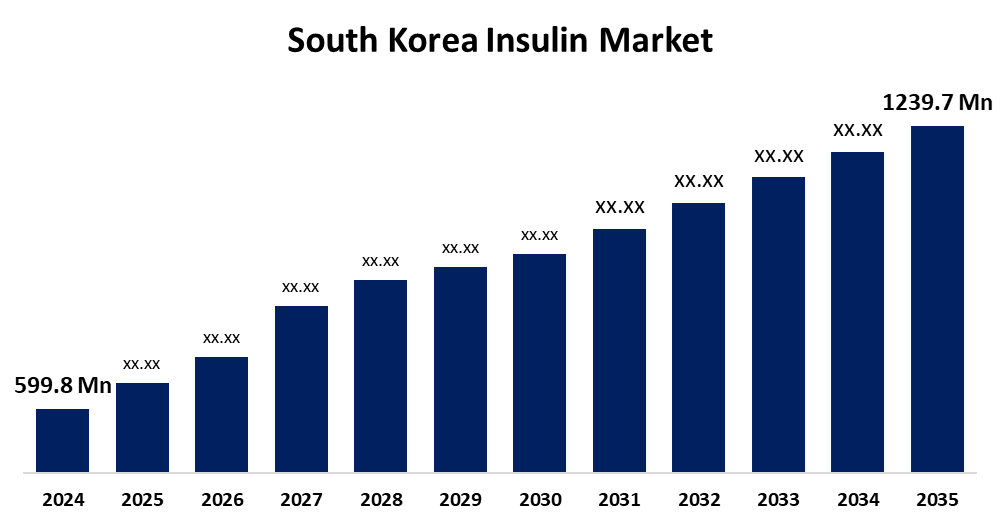

- The South Korea Insulin Market Size Was Estimated at USD 599.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.82% from 2025 to 2035

- The South Korea Insulin Market Size is Expected to Reach USD 1239.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Insulin Market Size is anticipated to reach USD 1239.7 Million by 2035, Growing at a CAGR of 6.82 % from 2025 to 2035. The demand is driven by the anticipated launch of pipeline medications and innovative insulin combinations, including once-weekly insulins like Efsitora alfa, Icodec, and IcoSema. By providing better glucose control, fewer injections, and more convenient delivery choices, these experimental treatments improve the management of diabetes. Patients with diabetes may have new therapy options as a result of their Phase 3 study success.

Market Overview

The Sales of Insulin Medications and associated delivery systems for the treatment of diabetes are included in the insulin market. The increasing prevalence of diabetes, especially Type 1 and Type 2, as well as the growing need for novel insulin formulations and delivery technologies, have made it a vital sector of the diabetes care industry. Insulin lowers the likelihood of both high and low blood sugar episodes and helps control blood sugar levels by maintaining them within a desired range. Regular blood sugar management reduces the risk of long-term diabetic consequences such as kidney disease, nerve damage, and cardiovascular disease. Better adherence to insulin therapy may result from the easier management of analog insulins due to their faster-acting and more predictable characteristics. People with diabetes may have a higher overall quality of life as a result of better blood sugar control and a lower risk of complications. It is anticipated that the number of people with diabetes will rise sharply, increasing the need for insulin therapy. Patient adherence and treatment results are being improved by better insulin analogs and intelligent administration methods. To prevent overpricing and make insulin more accessible to patients, governments are enacting price limits on the drug. Campaigns are started by governments and institutions such as the World Health Organization (WHO) to increase public awareness of diabetes and the significance of using insulin as directed.

Report Coverage

This research report categorizes the market for South Korea insulin market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea insulin market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each South Korea insulin market sub-segment.

South Korea Insulin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 599.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.82% |

| 2035 Value Projection: | USD 1239.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Diabetes Type, By Distribution Channel |

| Companies covered:: | Novo Nordisk, Eli Lilly and Company, Sanofi, Medtronic, Becton Dickinson (BD), Ypsomed, Dongkook Pharmaceutical, Yuhan Corporation, Daewoong Pharmaceutical, GC Biopharma (Green Cross Corporation), Samsung Biologics, Chong Kun Dang, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The number of persons with diabetes, especially type 2 diabetes, is rising as a result of sedentary lifestyles, poor diets, and changing lifestyles. The need for insulin therapy, the main treatment for controlling blood sugar levels, rises in direct proportion to the number of people with diabetes. Patients are finding insulin therapy more convenient and efficient thanks to significant developments in insulin delivery technologies, such as insulin pens and pumps. Together with the creation of novel insulin formulations, these developments are enhancing patient outcomes and propelling market expansion. The demand for insulin and related goods is rising as a result of supportive government policies and initiatives, as well as increased awareness of diabetes and the significance of early diagnosis and treatment. These programs frequently aim to increase a larger population's access to diabetes care and treatment, including insulin.

Restraining Factors

Access and affordability are restricted by the high cost of branded and patented basal insulin analogs, particularly in underdeveloped nations. Cost pressures can put a strain on healthcare resources, and many people without insurance or with inadequate insurance find it difficult to pay these drugs. Use of some insulin formulations may be discouraged by side effects such as hypoglycemia and allergic responses. One frequent side effect that can make pre-existing medical issues worse is hypoglycemia. Insulin adoption is hampered in underdeveloped countries by a lack of proper healthcare infrastructure, such as diabetic clinics, qualified medical staff, and cold storage. This problem is additionally exacerbated by low health literacy regarding insulin use.

Market Segmentation

The South Korea insulin market share is classified into type, diabetes type, and distribution channel.

- The analogue insulin segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea insulin market is segmented by type into analogue insulin and traditional human insulin. Among these, the analogue insulin segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing benefits that analogue insulin offers over conventional human insulin. Analogue insulin has better glucose control and medication adherence, per numerous published articles and whitepapers. Furthermore, the risk of hypoglycemia is lower than with conventional products. Analogue insulins are also insulins that function quickly and consistently.

- The diabetes 1 segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea insulin market is segmented by diabetes type into diabetes 1 and diabetes 2. Among these, the diabetes 1 segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising incidence of diabetes and the requirement for daily insulin injections to regulate blood glucose levels in individuals with type 1 diabetes.

- The retail & online pharmacy segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea insulin market is segmented by distribution channel into hospital pharmacy and retail & online pharmacy. Among these, the retail & online pharmacy segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. The retail and online pharmacy market segment is expected to grow as a result of the arrival of large corporations like Amazon and Walmart into the industry as well as the release of reasonably priced insulin products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea insulin market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- Medtronic

- Becton Dickinson (BD)

- Ypsomed

- Dongkook Pharmaceutical

- Yuhan Corporation

- Daewoong Pharmaceutical

- GC Biopharma (Green Cross Corporation)

- Samsung Biologics

- Chong Kun Dang

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea insulin market based on the below-mentioned segments:

South Korea Insulin Market, By Type

- Analogue Insulin

- Traditional Human Insulin

South Korea Insulin Market, By Diabetes Type

- Diabetes 1

- Diabetes 2

South Korea Insulin Market, By Distribution Channel

- Hospital Pharmacy

- Retail & Online Pharmacy

Need help to buy this report?