South Korea Insulin Drugs and Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Insulin Drugs (Rapid-Acting Insulin, Long-Acting Insulin), By Insulin Delivery Devices (Insulin Syringes, Insulin Pens), and South Korea Insulin Drugs and Delivery Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Insulin Drugs and Delivery Devices Market Insights Forecasts to 2035

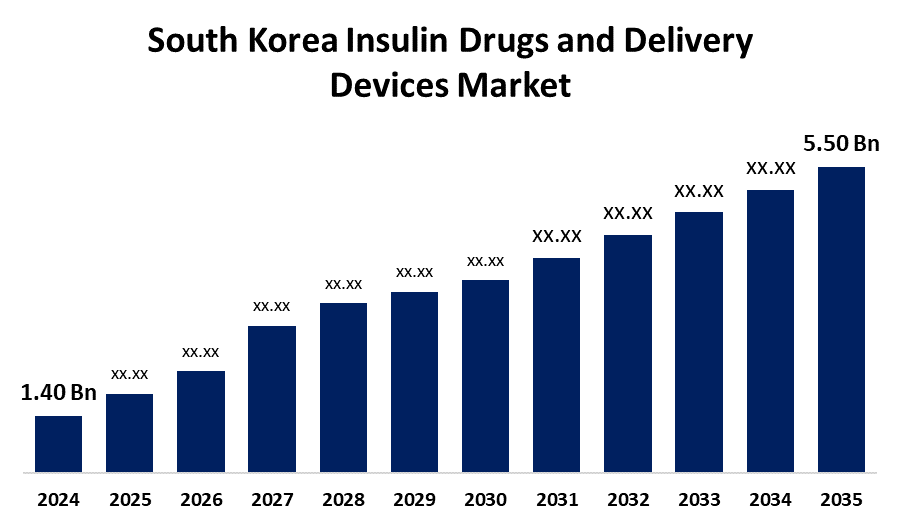

- The South Korea Insulin Drugs and Delivery Devices Market Size was estimated at USD 1.40 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.25% from 2025 to 2035

- The South Korea Insulin Drugs and Delivery Devices Market Size is Expected to Reach USD 5.50 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Insulin Drugs and Delivery Devices Market Size is anticipated to reach USD 5.50 Billion by 2035, growing at a CAGR of 13.25% from 2025 to 2035. South Korea is facing a growing incidence of diabetes, especially in the elderly population. This development is creating more demand for insulin therapy and delivery systems.

Market Overview

South Korea insulin drugs and delivery devices market is the pharmaceutical and medical devices industry in South Korea that deals with diabetes control by insulin treatment and its related delivery systems. In addition, new insulin delivery technologies are revolutionizing diabetes care in South Korea. The market is being propelled by a shift towards more convenient, efficient, and accurate insulin administration systems, including insulin pumps and pens. Healthcare technology advancements have been invested in by the Ministry of Health and Welfare, driving the adoption of intelligent equipment such as continuous glucose monitors and insulin pumps. These gadgets offer real-time glucose monitoring and more accurate insulin delivery, which enables patients to stay within diabetes control guidelines. This is expected to persist as medical professionals become more concerned with personalized medication and treatment options.

Report Coverage

This research report categorizes the market for the South Korea insulin drugs and delivery devices market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea insulin drugs and delivery devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea insulin drugs and delivery devices market.

South Korea Insulin Drugs and Delivery Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.40 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 13.25% |

| 2035 Value Projection: | USD 5.50 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 271 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Insulin Drugs and By Insulin Delivery Devices |

| Companies covered:: | Novo Nordisk, Sanofi, Becton Dickinson, Medtronic, Roche, Eli Lilly and Company, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South Korea's sophisticated healthcare system, with well-equipped modern hospitals and specialized staff, facilitates the efficient provision of diabetes care. Such infrastructure provides patients with access to up-to-date insulin therapy and devices of delivery. Furthermore, the initiatives by the South Korean government to raise diabetes awareness and increase healthcare accessibility are instrumental in propelling market growth. Initiatives such as the National Diabetes Quality Assessment Program are designed to increase the quality of diabetes care nationwide.

Restraining Factors

The approval process for new insulin products and delivery devices in South Korea is sometimes lengthy and complicated. Delays in approval can slow market access for new therapies, impacting overall market dynamics

Market Segmentation

The South Korea insulin drugs and delivery devices market share is classified into insulin drugs and insulin delivery devices.

- The long-acting segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea insulin drugs and delivery devices market is segmented by insulin drugs into rapid-acting insulin, long-acting insulin. Among these, the long-acting segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. As per the Korea National Health and Nutrition Examination Survey (KNHANES), long-acting insulins are often administered for those patients who need sustained glucose control over an extended period of time. Long-acting insulins are favored because they can provide steady insulin levels throughout the day or at night, reducing the frequency of injections and maximizing patient compliance with treatment regimens.

- The insulin pens segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea insulin drugs and delivery devices market is segmented by insulin delivery devices into insulin syringes, insulin pens. Among these, the insulin pens segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The demand for insulin pens has been rising because they are easy to use, enabling easier administration of insulin and patient compliance with therapy. The shift towards insulin pens is also characteristic of a larger shift in South Korea towards convenient and efficient means of diabetes treatment. This is likely to increase as healthcare providers and patients strive to find easier and more efficient methods of controlling diabetes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea insulin drugs and delivery devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk

- Sanofi

- Becton Dickinson

- Medtronic

- Roche

- Eli Lilly and Company

- Others

Recent Developments:

- In January 2024, Medtronic announced the release of its MiniMed™ 780G Insulin Pump System in South Korea. The system, integrated with continuous glucose monitoring (CGM), offered automated insulin adjustments to help patients maintain near-normal glucose levels. This development aimed to transform diabetes treatment by providing enhanced accuracy and greater convenience for Type 1 and Type 2 diabetes patients in South Korea.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea insulin drugs and delivery devices market based on the below-mentioned segments:

South Korea Insulin Drugs and Delivery Devices Market, By Insulin Drugs

- Rapid-Acting Insulin

- Long-Acting Insulin

South Korea Insulin Drugs and Delivery Devices Market, By Insulin Delivery Devices

- Insulin Syringes

- Insulin Pens

Need help to buy this report?