South Korea Infertility Market Size, Share, and COVID-19 Impact Analysis, By Diagnosis (Men Diagnostic Tests, Women Diagnostic Tests, and General Diagnostic Test), By Drugs (Clomiphene Citrate, Letrozole, Serophene, Hormone Treatment, and Others), and South Korea Infertility Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Infertility Market Size Insights Forecasts to 2035

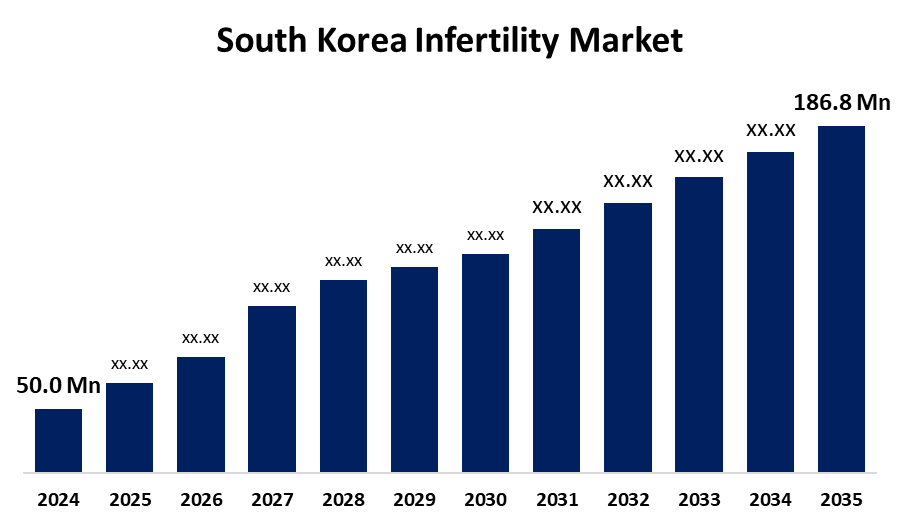

- The South Korea Infertility Market Size was estimated at USD 50.0 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.73% from 2025 to 2035

- The South Korea Infertility Market Size is Expected to Reach USD 186.8 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Infertility Market Size is anticipated to reach USD 186.8 million by 2035, growing at a CAGR of 12.73% from 2025 to 2035. Driven by delayed parenthood, increased infertility rates, and shifting social norms that support seeking treatment. Government grants, improved knowledge of fertility options, and cutting-edge reproductive technologies like IVF are all contributing to the market's rapid growth.

Market Overview

The South Korea infertility market encompasses the range of diagnostic procedures, medications, therapies, and assisted reproductive technologies (ART) intended to treat infertility issues in individuals and couples is included in the South Korean infertility market. Additionally, growing interest in holistic, individualized fertility solutions that meet specific needs is evident in recent trends. A trend toward more integrated treatment methods is evident in the large number of couples looking for comprehensive fertility programs that include wellness resources and lifestyle coaching. Furthermore, success rates are rising and more people are considering these options due to advancements in medical technology, particularly in vitro fertilization and pre-implantation genetic testing. Stakeholders in the South Korean infertility market have many opportunities, especially in the creation of more reasonably priced treatment programs and the growth of telehealth services.

Report Coverage

This research report categorizes the market for the South Korea infertility market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea infertility market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea infertility market.

South Korea Infertility Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 50.0 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.73% |

| 2035 Value Projection: | USD 186.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 148 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Diagnosis, By Drugs and COVID-19 Impact Analysis |

| Companies covered:: | CHA Fertility Center, Maria Fertility Hospital, Dream I Women’s Hospital, Trinium Women’s Hospital, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Reproductive technology advancements are a major factor driving the infertility market in South Korea. The results of infertility treatments have improved with the advent of cutting-edge methods like egg freezing, preimplantation genetic testing (PGT), and improved embryology techniques. Furthermore, a Korea Food and Drug Administration research indicates that the number of fertility clinics using this state-of-the-art technology is continuously increasing. Reports of higher success rates indicate that PGT can raise the chance of a successful pregnancy by over 50%, underscoring the importance of these advancements in driving market growth.

Restraining Factors

In South Korea's infertility market, major barriers include high treatment costs, psychological strain, social stigma, inadequate insurance coverage, and physical discomfort from procedures. These factors impede long-term engagement and decrease accessibility, particularly for low-income couples and rural populations.

Market Segmentation

The South Korea infertility market share is classified into diagnosis and drugs.

- The women diagnostic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea infertility market is segmented by diagnosis into men diagnostic tests, women diagnostic tests, and general diagnostic test. Among these, the women diagnostic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Effective fertility treatments depend on women's diagnostic tests, which frequently include imaging studies, ovulation monitoring, and hormone level evaluations to assess ovarian reserve and reproductive health.

- The clomiphene citrate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea infertility market is segmented by drugs into clomiphene citrate, letrozole, serophene, hormone treatment, and others. Among these, the clomiphene citrate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. With its ability to help women undergoing fertility treatments, clomiphene citrate has become a popular option for ovulation induction.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea infertility market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CHA Fertility Center

- Maria Fertility Hospital

- Dream I Women’s Hospital

- Trinium Women’s Hospital

- Others

Recent Developments:

- In March 2023, The Seoul Metropolitan Government had announced plans to support married couples who were having difficulty conceiving children, as Korea’s birth rate dropped to a new low and became the lowest in the OECD.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Infertility Market based on the below-mentioned segments:

South Korea Infertility Market, By Diagnosis

- Men Diagnostic Tests

- Women Diagnostic Tests

- General Diagnostic Test

South Korea Infertility Market, By Drugs

- Clomiphene Citrate

- Letrozole

- Serophene

- Hormone Treatment

- Others

Need help to buy this report?