South Korea Inbound Logistics Market Size, Share, and COVID-19 Impact Analysis, By Mode of Transportation (Road, Rail, Air, and Sea), By End Use (Retail & e-commerce, Manufacturing, Automotive, and Pharmaceuticals), and South Korea Inbound Logistics Market, Industry Trend, Forecasts to 2035

Industry: Information & TechnologySouth Korea Inbound Logistics Market Insights Forecasts to 2035

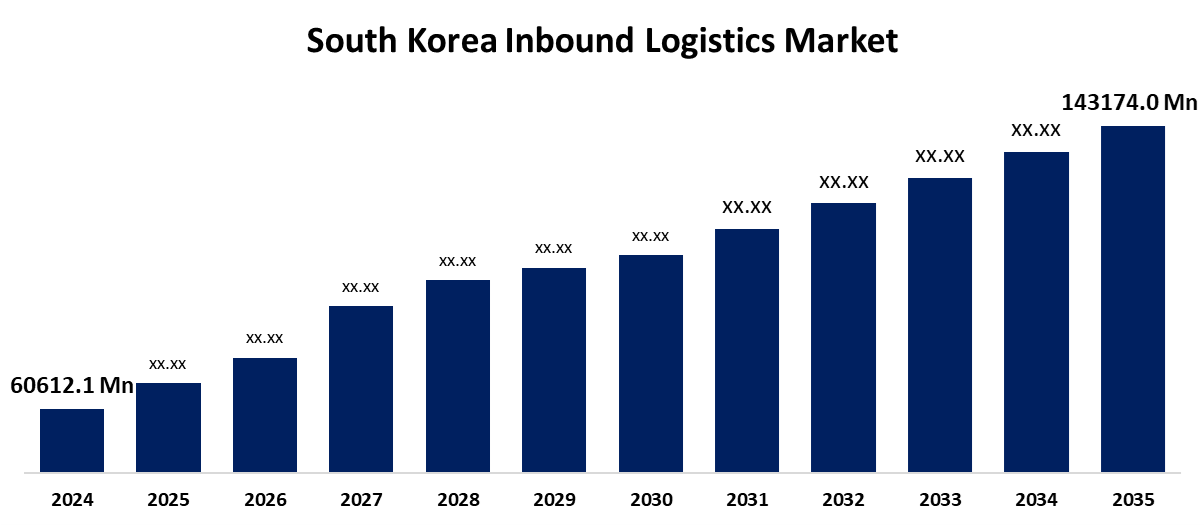

- The South Korea Inbound Logistics Market Size Was Estimated at USD 60612.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.13% from 2025 to 2035

- The South Korea Inbound Logistics Market Size is Expected to Reach USD 1,43,174.0 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Inbound Logistics Market Size is anticipated to Reach USD 143174.0 Million by 2035, Growing at a CAGR of 8.13% from 2025 to 2035. The inbound logistics market is expanding due to the globalization of supply chains. The challenge of handling inbound logistics has grown as companies extend their operations internationally. Cross-border trade and sourcing have increased as a result of globalization, necessitating the use of advanced logistics systems to oversee foreign suppliers and guarantee the prompt delivery of raw materials.

Market Overview

The process of controlling the flow of resources, information, and goods from suppliers to a business, including sourcing, purchasing, shipping, and storage, is known as inbound logistics. It is an essential component of supply chain management, guaranteeing that a company has the resources it needs to run effectively. Transportation costs can be reduced by backhaul shipment, freight consolidation, and effective route planning. The need for unnecessary storage space and related expenses can be reduced by improving inventory management and optimizing inventory levels. The growth of international trade, the rise in e-commerce, and the demand for effective inventory control and transportation are the main drivers of the market. To improve processes, the market is witnessing a boom in the use of technologies including automation, robotics, blockchain, and predictive analytics. Innovation in fields like IoT-enabled tracking, AI-powered demand forecasting, and robotics in warehousing is being derived by government assistance for technical developments in logistics, such as automation and digitization.

Report Coverage

This research report categorizes the market for South Korea inbound logistics market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea inbound logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea inbound logistics market.

South Korea Inbound Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 60612.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.13% |

| 2035 Value Projection: | USD 1,43,174.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Mode of Transportation, By End Use |

| Companies covered:: | CJ Logistics, Hyundai Glovis, Hanjin Transportation, LX Pantos, Korchina Logistics, Daesin Logistics, Dongbu Express, Hansol Logistics, Sunjin Logistics, Seino Korea, DHL Supply Chain Korea, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid growth of e-commerce has significantly increased the demand for efficient inbound logistics to handle the rising number of online orders. Technological advancements, such as automation, AI, IoT, and blockchain, have revolutionized logistics operations, allowing for smarter, more efficient inventory and transportation management.

Restraining Factors

High operational costs, including expenses related to advanced technology adoption and infrastructure development. Complex supply chain disruptions caused by geopolitical tensions, natural disasters, or pandemics hamper smooth inbound flow. Limited skilled workforce and labor shortages challenge efficient logistics management.

Market Segmentation

The South Korea inbound logistics market share is classified into mode of transportation and end use.

- The road segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea inbound logistics market is segmented by mode of transportation into road, rail, air, and sea. Among these, the road segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Road transportation's flexibility fuels the market's expansion. In localized supply chains, where products must be swiftly moved across short distances to satisfy the ever-changing needs of industrial and retail operations, flexibility is especially important.

- The retail & e-commerce segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea inbound logistics market is segmented by end use into retail & e-commerce, manufacturing, automotive, and pharmaceuticals. Among these, the retail & e-commerce segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. E-commerce's explosive growth is driving the retail sector's inbound logistics expansion. Logistics services are in high demand as a result of consumers' growing preference for online shopping, which is driven by advantages including price comparison, ease, and the availability of a large selection of goods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea inbound logistics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CJ Logistics

- Hyundai Glovis

- Hanjin Transportation

- LX Pantos

- Korchina Logistics

- Daesin Logistics

- Dongbu Express

- Hansol Logistics

- Sunjin Logistics

- Seino Korea

- DHL Supply Chain Korea

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea inbound logistics market based on the below-mentioned segments:

South Korea Inbound Logistics Market, By Mode Of Transportation

- Road

- Rail

- Air

- Sea

South Korea Inbound Logistics Market, By End Use

- Retail & e-commerce

- Manufacturing

- Automotive

- Pharmaceuticals

Need help to buy this report?