South Korea Ice Cream Market Size, Share, and COVID-19 Impact Analysis, By Flavor (Vanilla, Chocolate, Fruit, and Others), By Category (Impulse Ice Cream, Take-Home Ice Cream, and Artisanal Ice Cream), and South Korea Ice Cream Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesSouth Korea Ice Cream Market Insights Forecasts to 2035

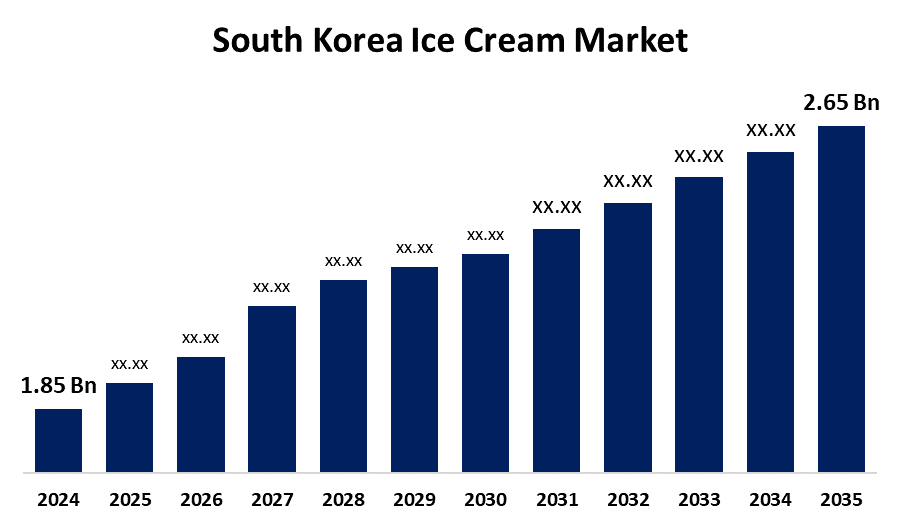

- The South Korea Ice Cream Market Size was Estimated at USD 1.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.32% from 2025 to 2035

- The South Korea Ice Cream Market Size is Expected to Reach USD 2.65 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Ice Cream Market Size is anticipated to reach USD 2.65 Billion by 2035, growing at a CAGR of 3.32% from 2025 to 2035. Increasing technological advancements in freezing and packaging, growing demand for healthier options like lactose-free, low-fat, and low-calorie varieties, and improvements in manufacturing and cold chain logistics to ensure effective production, storage, and distribution are some of the major factors propelling the market.

Market Overview

The South Korean ice cream market encompasses the production, distribution, and consumption of frozen dessert goods in South Korea are all included in the country's ice cream market. It offers a wide range of products to suit a variety of palates, from classic flavors to creative and health-conscious choices. Additionally, customers can now purchase ice cream more easily thanks to the growth of online grocery shopping and home delivery services brought about by the growing digitization of services. Aside from this, the nation's market is expanding due to the growing demand for quick and easy food options, such as ice cream, among people with hectic schedules. Additionally, the market is being positively impacted by the increasing number of ice cream shops and themed cafes that provide distinctive experiences like personalizing ice cream flavors, mix-ins, and the chance to take part in the creation process. Furthermore, consumers who are lactose intolerant and those who follow vegan or plant-based diets are being catered to by the growing demand for milk substitutes such as non-dairy ice cream made from almond milk, soy milk, or coconut milk. Furthermore, effective ice cream production, storage, and distribution procedures are being ensured by growing developments in manufacturing and cold chain logistics.

Report Coverage

This research report categorizes the market for the South Korea ice cream market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea ice cream market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea ice cream market.

South Korea Ice Cream Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.85 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.32% |

| 2035 Value Projection: | USD 2.65 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 268 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Flavor and By Category |

| Companies covered:: | Lotte Confectionery Co., Ltd., Binggrae Co. Ltd., BR IP Holder LLC, Unilever plc, Haitai Confectionery and Foods Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The current market growth in South Korea is being driven by the growing demand from health-conscious consumers for healthier ice cream options, such as low-fat, low-calorie, and lactose-free varieties. The market expansion is also being supported by the growing use of ice cream as a component in well-known Korean desserts like bingsu, a shaved ice treat. Additionally, the nation's market is being positively impacted by the expanding selection of ice cream flavors that correspond with seasonal celebrations and holidays, such as red bean ice cream or pumpkin-flavored ice cream in the fall. Aside from this, improved product quality and a longer shelf life are made possible by growing technological developments in freezing and packaging. Further, ice cream companies' increasing use of influencer marketing to boost sales and engage with their target audience is providing a positive market outlook.

Restraining Factors

The overall consumer base is declining as such of South Korea's rapidly aging and declining population. Since fewer young people are joining the market, this demographic shift is helping to lower demand for ice cream products.

Market Segmentation

The South Korea Ice Cream Market share is classified into flavor and category.

- The vanilla segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea ice cream market is segmented by flavor into vanilla, chocolate, fruit, and others. Among these, the vanilla segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. " Vanilla continues to rule the market because of its broad appeal and adaptability in a variety of ice cream products, such as cones, cups, and high-end options.

- The impulse ice cream segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea ice cream market is segmented by category into impulse ice cream, take-home ice cream, and artisanal ice cream. Among these, the impulse ice cream segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. driven by a strong desire among consumers for single serve, convenient options. Cones, bars, and cups are among the items in this category that are frequently found in supermarkets and convenience stores.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea ice cream market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lotte Confectionery Co., Ltd.

- Binggrae Co. Ltd.

- BR IP Holder LLC

- Unilever plc

- Haitai Confectionery and Foods Co., Ltd.

- Others

Recent Developments:

- In May 2025, Hanwha Galleria entered Korea's ice cream market with the launch of Benson, a brand inspired by the creamy, topping-rich ice creams that were popular in the United States.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Ice Cream Market based on the below-mentioned segments:

South Korea Ice Cream Market, By Flavor

- Vanilla

- Chocolate

- Fruit

- Others

South Korea Ice Cream Market, By Category

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

Need help to buy this report?