South Korea Hospital Outsourcing Market Size, Share, and COVID-19 Impact Analysis, By Service (Healthcare IT, Clinical Services, Business Services, and Transportation Services), By Type (Public and Private), and South Korea Hospital Outsourcing Market Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Hospital Outsourcing Market Insights Forecasts to 2035

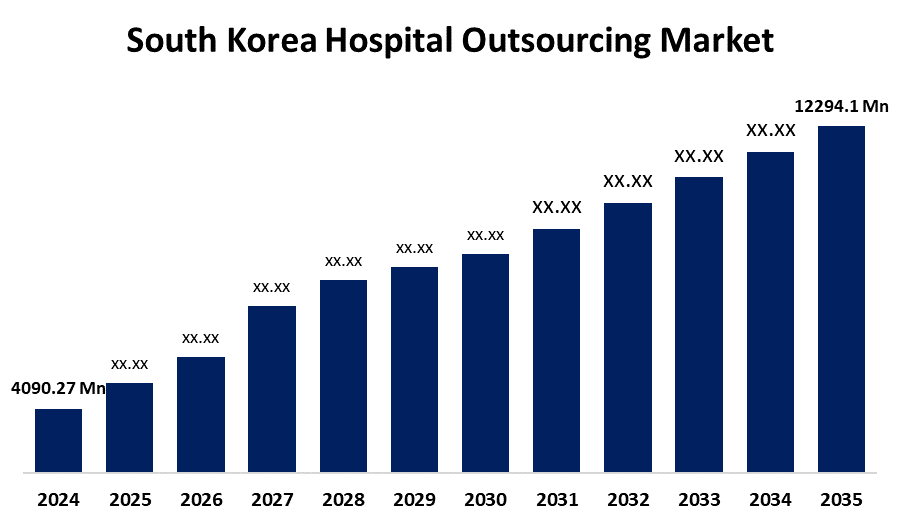

- The South Korea Hospital Outsourcing Market Size Was Estimated at USD 4090.27 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.52% from 2025 to 2035

- The South Korea Hospital Outsourcing Market Size is Expected to Reach USD 12294.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Hospital Outsourcing Market Size is anticipated to reach USD 12294.1 Million by 2035, growing at a CAGR of 10.52% from 2025 to 2035. Outsourcing non-core tasks like billing and IT services becomes a strategic choice as hospitals look to reduce operating costs while maintaining the quality of care. Healthcare institutions can achieve considerable cost savings by reinvesting cash in vital services that have a direct influence on patient care and outcomes, to specialized experience in these areas.

Market Overview

The hospital outsourcing market involves delegating non-core hospital services such as IT, clinical operations, administrative tasks, and facility management to third-party providers. This helps healthcare institutions focus on core medical services while improving efficiency and reducing operational costs. Key benefits include access to specialized expertise, enhanced patient care, scalability, and improved regulatory compliance. Growing demand for digital health solutions, telemedicine, and data security presents significant opportunities for outsourcing firms. Additionally, rising healthcare costs and staffing shortages drive market growth. Government initiatives in many countries, including South Korea, support healthcare digitalization, promote public-private partnerships, and invest in smart hospital infrastructure. These policies encourage hospitals to adopt outsourcing as a strategic approach to improve service quality, optimize resources, and meet increasing patient care demands.

Report Coverage

This research report categorizes the market for South Korea hospital outsourcing market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea hospital outsourcing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea hospital outsourcing market.

South Korea Hospital Outsourcing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4090.27 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.52% |

| 2035 Value Projection: | USD 12294.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Service and By Type |

| Companies covered:: | INFINITT Healthcare, Samsung Biologics, Celltrion, Samsung SDS, Samsung iMarketKorea, Genexine, Hanmi Pharmaceutical, SK Biopharmaceuticals, Welgene, SillaJen, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising pressure on healthcare systems to optimize costs and efficiency. Facilities increasingly outsource non-core functions from IT and operations to housekeeping and logistics, allowing medical staff to focus on patient care. Staffing shortages and regulatory complexity compel hospitals to tap external expertise and scale services flexibly. Moreover, rapid digital transformation in healthcare drives demand for outsourced healthcare IT and telemedicine solutions. Supportive government policies around smart hospital programs and public–private partnerships further accelerate adoption and growth.

Restraining Factors

The strict regulatory compliance and licensing requirements make it difficult to onboard foreign or new service providers. The high cost of operations and uncertainty around outsourcing service pricing, especially for clinical functions like nursing, limit financial attraction for hospitals. Talent shortages in specialized roles, including healthcare IT and clinical staffing, challenge providers' capacity to deliver outsourced services reliably.

Market Segmentation

The South Korea hospital outsourcing market share is classified into service and type.

- The healthcare IT segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea hospital outsourcing market is segmented by service into healthcare IT, clinical services, business services, and transportation services. Among these, the healthcare IT segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The increasing digitalization in healthcare and the need for efficient data management, telemedicine, and electronic health records. Hospitals outsource IT services to improve patient care, ensure regulatory compliance, and reduce operational costs. The rise in demand for cybersecurity, cloud-based solutions, and health analytics further fuels growth.

- The public segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea hospital outsourcing market is segmented by type into public and private. Among these, the public segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. Strong government support for improving public healthcare efficiency and reducing operational burdens. Public hospitals increasingly outsource non-core functions like IT, administration, and facility management to enhance service quality and focus on patient care. Budget constraints and rising patient volumes further drive the need for cost-effective outsourcing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea hospital outsourcing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INFINITT Healthcare

- Samsung Biologics

- Celltrion

- Samsung SDS

- Samsung iMarketKorea

- Genexine

- Hanmi Pharmaceutical

- SK Biopharmaceuticals

- Welgene

- SillaJen

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea hospital outsourcing market based on the below-mentioned segments:

South Korea Hospital Outsourcing Market, By Service

- Healthcare IT

- Clinical Services

- Business Services

- Transportation Services

South Korea Hospital Outsourcing Market, By Type

- Public

- Private

Need help to buy this report?