South Korea Hedge Fund Software Market Size, Share, And COVID-19 Impact Analysis, By Deployment Mode (Cloud, On-Premises), By Company Size (Large Enterprises and Small and Medium-sized Enterprises) and South Korea Hedge Fund Software Market Insights, Industry Trend, Forecasts To 2035

Industry: Banking & FinancialSouth Korea Hedge Fund Software Market Insights Forecasts to 2035

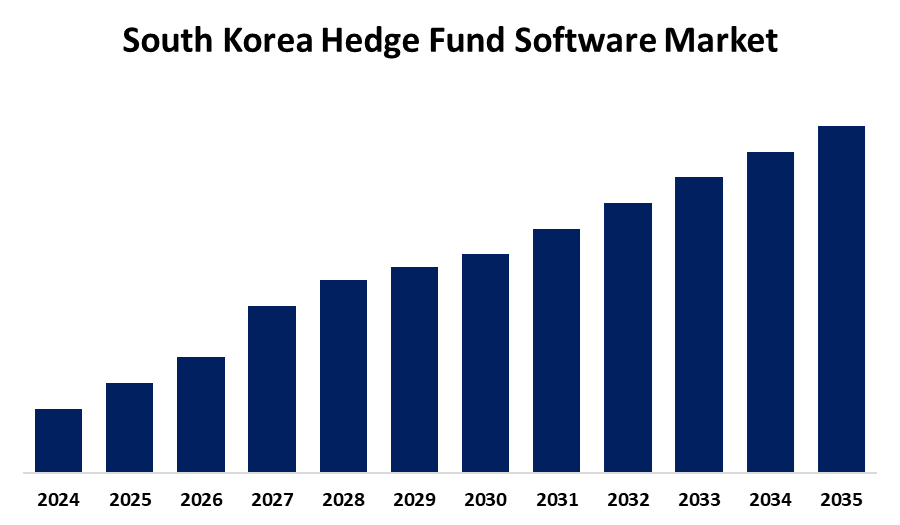

- The South Korea Hedge Fund Software Market size is Expected to Grow at a CAGR of around 11.6% from 2025 to 2035

- The South Korea Hedge Fund Software Market size is expected to hold a significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Hedge Fund Software Market Size is anticipated to Grow at a CAGR of 11.6% from 2025 to 2035. The market is driven by the adoption of advanced technologies like AI and machine learning to enhance investment analysis and trading strategies. Additionally, increasing regulatory requirements for compliance and data security boost demand for robust hedge fund software solutions.

Market Overview

A hedge fund is an informal group of investors. Money from the investor is collectively pooled and controlled by sophisticated fund managers and invested in securities and investments. It is an investment strategy that applies hedging strategies to lower volatility in a portfolio. Hedge funds are structured as offshore investment corporations or private investment partnerships. They are less controlled and have greater autonomy to seek investments that will enhance the risk of loss. Hedge funds are aimed at high-net-worth investors and big institutional investors such as pension funds, or savvy investors who are capable of meeting specified income or asset thresholds. Advantages of hedge funds are professional management, hedging against potential losses, portfolio diversification, and potentially high returns. The hedge fund software comprises a list of applications that aid hedge funds in portfolio management, risk detection, compliance, and upgraded trading techniques. The software has advantages, including making decisions in an informed manner, simplifying the process, and minimizing errors. The main drivers of growth in the hedge fund software market are the increased sophistication in financial deals and the requirements of regulatory compliance. Whereas the size and transactions of hedge funds are growing, the conventional method of management is not applicable anymore, and companies are turning towards sophisticated software solutions.

Report Coverage

This research report categorizes the market for the South Korea hedge fund software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea hedge fund software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea hedge fund software market.

South Korea Hedge Fund Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 11.6% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Deployment Mode, By Company Size |

| Companies covered:: | Fund Count, Backstop Solutions, Meta Trader 5, Dynamo, Hedge Guard, Linedata, Puritas, Bipsync, Hedge Tek, Portfolio Shop, Northstar Risk, Octopus, Liquidity Calendar, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korea hedge fund software industry is transforming with asset management companies and hedge funds embracing technology-led solutions to operate best and comply with regulations. Hedge fund managers are increasingly making the most of sophisticated platforms for real-time risk monitoring, order execution, and portfolio optimisation. The robust fintech ecosystem of Korea, with participants such as Koscom, Qraft Technologies, and TmaxSoft, plays a key role in providing localised solutions. Other than that, the need for AI-powered and cloud-based hedge fund platforms is rising with more complexity in the strategies, rising quant funds, and a greater need for compliance by the Financial Supervisory Service (FSS).

Restraining Factors

Despite the optimistic outlook, complexity integration with legacy systems, as well as reluctance on the part of smaller fund operators to spend money on costly enterprise software, are issues in the market. Data privacy concerns and changing cybersecurity threats also necessitate companies tightening up their IT governance, something that tends to slow adoption in cautious companies.

Market Segmentation

The South Korea Hedge Fund Software Market share is classified into deployment mode and company size.

- The cloud-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea hedge fund software market is segmented by deployment mode into cloud and on-premises. Among these, the cloud-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Cloud-based hedge fund platforms are becoming increasingly popular in South Korea because they carry the attributes of scalability, cost-effectiveness, and live access. These systems allow hedge fund managers to automate processes like trade execution, risk analysis, and reporting on compliance without the cost infrastructure of on-premise systems. Since compliance updates demand flexible reporting, most firms, predominantly emerging and medium-sized funds are migrating toward cloud-native platforms.

- The large enterprises segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea hedge fund software market is segmented by company size into large enterprises and small and medium-sized enterprises. Among these, the large enterprises segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Large institutions like the Korea Investment Corporation (KIC), giant asset managers, and pension funds use enterprise-level software with end-to-end functionalities. They have integrated risk, trade lifecycle management, reporting, and AI analytics platforms. Due to their huge asset base and diversified portfolios, large institutions need to have strong, configurable, and secure platforms with geographies and asset classes processing capabilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea hedge fund software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fund Count

- Backstop Solutions

- Meta Trader 5

- Dynamo

- Hedge Guard

- Linedata

- Puritas

- Bipsync

- Hedge Tek

- Portfolio Shop

- Northstar Risk

- Octopus

- Liquidity Calendar

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Hedge Fund Software Market based on the below-mentioned segments:

South Korea Hedge Fund Software Market, By Deployment Mode

- Cloud-Based

- On-Premise

South Korea Hedge Fund Software Market, By Company Size

- Large Enterprises

- Small and Medium-sized Enterprises

Need help to buy this report?