South Korea Hedge Fund Industry Market Size, Share, and COVID-19 Impact Analysis, By Strategy (Long/Short Equity, Event-Driven, Macro, Quantitative, and Others), By Investor Type (Institutional, High Net Worth Individuals, Family Offices, and Others), and South Korea Hedge Fund Industry Market Insights, Industry Trend, Forecasts To 2035

Industry: Banking & FinancialSouth Korea Hedge Fund Industry Market Insights Forecasts to 2035

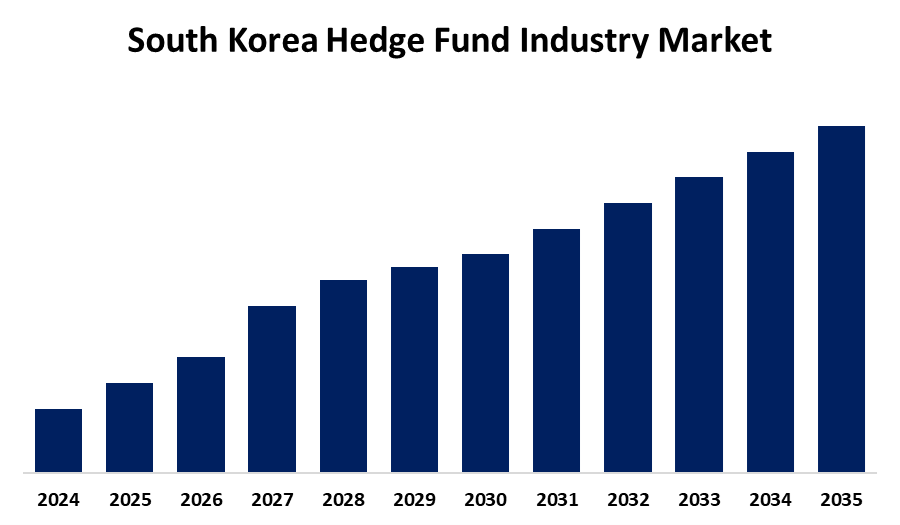

- The South Korea Hedge Fund Industry Market Size is Expected to Grow at a CAGR of around 6.9% from 2025 to 2035

- The South Korea Hedge Fund Industry Market Size is Expected to hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Hedge Fund Industry Market Size is anticipated to Grow at a CAGR of 6.9% from 2025 to 2035. The market is driven by regulatory liberalization under the Financial Investment Services and Capital Markets Act, encouraging new fund launches and the growing institutional investment from entities like NPS and KIC and rising interest in AI-based quantitative strategies are accelerating market expansion.

Market Overview

The South Korean Hedge Fund business is expanding firmly as a niche but expanding part of the country's alternative investment scene. Because of a relatively prudent financial marketplace in the past, investors' requirement for diversified, high-returning products and regulatory reforms have spurred hedge fund growth in the country. Reforms to South Korea's Financial Investment Services and Capital Markets Act (FSCMA) reduced entry barriers and regulatory hurdles for local managers, driving the launch of local funds. Seoul is becoming a regional hub for hedge funds as institutional investors such as the National Pension Service and Korea Investment Corporation are boosting their exposure to alternatives. Asset management firms are embracing best practices in compliance, risk, and strategy diversification globally. The market is also facing interest from foreign operators in the form of local partnerships. However, risk aversion and transparency requirements among retail investors hold back aggressive expansion in comparison to Western markets.

Report Coverage

This research report categorizes the market for the South Korea hedge fund industry market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea hedge fund industry market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea hedge fund industry market.

South Korea Hedge Fund Industry Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.9% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 204 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Strategy, By Investor Type |

| Companies covered:: | VegaX Holdings, Glenwood Private Equity, NH-Amundi Asset Management, LHCINVEST, QUAD ventures, Entropy Trading Group, Fibonacci Asset Management, Mercury Value Partners, Mercury Value Partners Co., Ltd, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing institutional investor demand for alternative investments is fueling the growth of South Korea's hedge fund industry. Regulation of opening up, such as easing of regulations on fundraising and derivative exposures, has been supportive of hedge fund development. Advanced capital markets in the nation, combined with rising technological sophistication and prowess in algorithmic trading, offer a sound base for quantitative and macro strategies. Also, post-COVID market volatility in the core markets and overall economic volatility have resulted in heightened investment into long/short and multi-strategy hedge funds as a risk-managed return enhancer.

Restraining Factors

South Korea's hedge fund industry faces several reatraints such as, inadequate retail investor participation induced by risk aversion and ignorance. Uncertainty regarding valuation practices and restricted performance reporting erode investors' confidence. A shallow pool of seasoned hedge fund managers and excessive regulation also cripple the industry by discouraging adaptive fund operations. Foreign capital controls and global economic uncertainty also dampen growth momentum.

Market Segmentation

The South Korea Hedge Fund Industry Market share is classified into strategy and investor type.

- The quantitative segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea hedge fund industry market is segmented by strategy into long/short equity, event-driven, macro, quantitative, and others. Among these, the quantitative segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. South Korean quantitative hedge funds are growing quickly based on advances in artificial intelligence and algorithmic trading technologies. These hedge funds utilize data-driven algorithms to select trading opportunities and execute high-frequency trades. Firms such as Qraft Technologies and leading asset managers are using machine learning to generate returns. Institutional investors are drawn to the strategy because it is objective, scalable, and performs consistently.

- The institutional dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea hedge fund industry market is segmented by investor type into institutional, high net worth individuals, family offices, and others. Among these, the institutional segment dominated the market share in 2024. Institutional investors such as the National Pension Service (NPS) and Korea Investment Corporation (KIC) have a commanding presence of hedge fund investments in South Korea. They invest a large proportion of their portfolios in hedge funds to achieve diversification and optimize risk-adjusted return. Institutional backing has played a crucial role in establishing legitimacy and driving the development of the hedge fund business in South Korea.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea hedge fund industry market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- VegaX Holdings

- Glenwood Private Equity

- NH-Amundi Asset Management

- LHCINVEST

- QUAD ventures

- Entropy Trading Group

- Fibonacci Asset Management

- Mercury Value Partners

- Mercury Value Partners Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea hedge fund industry market based on the below-mentioned segments:

South Korea Hedge Fund Industry Market, By Strategy

- Long/Short Equity

- Event-Driven

- Macro

- Quantitative

- Others

South Korea Hedge Fund Industry Market, By Investor Type

- Institutional

- High Net Worth Individuals

- Family Offices

- Others

Need help to buy this report?