South Korea Heavy Construction Equipment Market Size, Share, and COVID-19 Impact Analysis, By Type (Earthmoving Equipment, Material Handling, Heavy Vehicles, Crushers, and Others), By Application (Excavation Demolition, Material Handling, Heavy Lifting, Recycling Waste Management, and Tunneling), and South Korea Heavy Construction Equipment Market Insights, Industry Trend, Forecasts to 2035.

Industry: Construction & ManufacturingSouth Korea Heavy Construction Equipment Market Insights Forecasts to 2035.

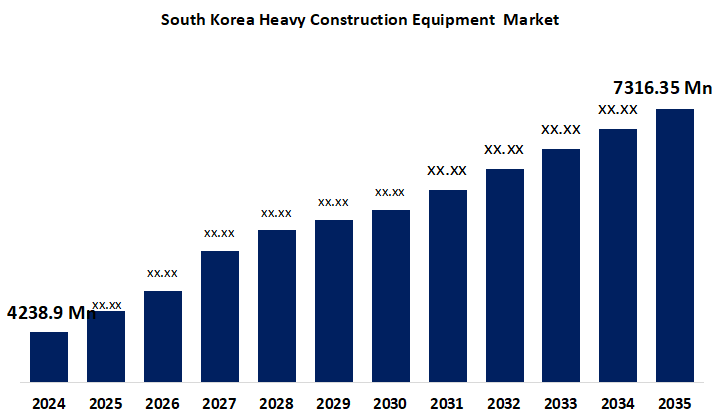

- The South Korea Heavy Construction Equipment Market Size was estimated at USD 4238.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.09% from 2025 to 2035

- The South Korea Heavy Construction Equipment Market Size is Expected to Reach USD 7316.35 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Heavy Construction Equipment Market is anticipated to reach USD 7316.35 million by 2035, growing at a CAGR of 5.09% from 2025 to 2035. As a result of extensive infrastructure investments, smart city development, and fast urbanization. Long-term growth is being driven by the growing need for sophisticated machinery in energy, transportation, and industrial projects as well as the adoption of automated and environmentally friendly equipment.

Market Overview

The South Korea heavy construction equipment market refers the industry sector that produces, distributes, and uses large-scale machinery for mining, infrastructure development, urban construction, and industrial projects is known as the heavy construction equipment market in South Korea. This includes tools that are necessary for jobs like earthmoving, material handling, demolition, and site preparation, such as excavators, bulldozers, cranes, loaders, and dump trucks. Additionally, This market has a lot of room to grow, particularly in the areas of smart city initiatives and urbanization. The majority of heavy construction equipment manufacturers and service providers have a lot of opportunities given South Korea's economic development strategy, which focuses on smart transportation systems and green building initiatives. The use of heavy construction equipment will increase as public transportation systems, particularly rail and bus rapid transit, expand. Additionally, there seems to be a greater inclination to rent heavy construction equipment. Given the state of the economy, this trend allows construction companies to cut back on capital expenditures and operational rigidity.

Report Coverage

This research report categorizes the market for the South Korea heavy construction equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea heavy construction equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea heavy construction equipment market.

South Korea Heavy Construction Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4238.9 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.09% |

| 2035 Value Projection: | USD 7316.35 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Korea Heavy Industry, Hanjin Heavy Industries, Hansung Engineering, LG Engineering and Construction, POSCO Engineering, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for heavy construction equipment in South Korea is changing due to modernization and improved productivity. In order to support the nation's growth, which is crucial for market development, the South Korean government has been concentrating on improving infrastructure. New equipment with Internet of Things capabilities that offer predictive maintenance and data monitoring is in high demand. This results from the need for reduced downtime and increased operational efficiency. Additionally, the increased emphasis on sustainability is a significant market driver that boosts the use of energy-efficient appliances and environmentally friendly equipment.

Restraining Factors

South Korea's stricter environmental regulations force producers of heavy construction equipment to adhere to sustainability objectives and low-emission standards. Businesses must spend more on cleaner equipment and cutting-edge technologies to comply, which pushes back production schedules and increases development expenses.

Market Segmentation

The South Korea heavy construction equipment market share is classified into type and application.

- The material handling segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea heavy construction equipment market is segmented by type into earthmoving equipment, material handling, heavy vehicles, crushers, and others. Among these, the material handling segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rise in logistics, e-commerce, and infrastructure projects led to a high demand for cranes, forklifts, and telescopic handlers. Due to mining and urbanization, earthmoving equipment comes in second.

- The excavation demolition segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea heavy construction equipment market is segmented by application into excavation demolition, material handling, heavy lifting, recycling waste management, and tunnelling. Among these, the excavation demolition segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is fueled by high-rise construction projects that necessitate extensive site preparation and structural removal, as well as rapid urban redevelopment and infrastructure upgrades. Strong government investment in transportation networks and smart cities benefits the sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea heavy construction equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Korea Heavy Industry

- Hanjin Heavy Industries

- Hansung Engineering

- LG Engineering and Construction

- POSCO Engineering

- Others

Recent Developments:

- In June 2024, D Hyundai Construction Equipment, HD Hyundai Infracore, and Doosan Bobcat ramped up their efforts to penetrate emerging markets. While North America and Europe remained major revenue sources, they invested more in local production and distribution networks across high-growth countries such as India, Brazil, and Mexico, where infrastructure development was booming and demand for relatively larger construction machinery had surged.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Heavy Construction Equipment Market based on the below-mentioned segments:

- South Korea Heavy Construction Equipment Market, By Type

- Earthmoving Equipment

- Material Handling

- Heavy Vehicles

- Crushers

- Others

- South Korea Heavy Construction Equipment Market, By Application

- Excavation Demolition

- Material Handling

- Heavy Lifting

- Recycling Waste Management

- Tunneling

Need help to buy this report?