South Korea Healthcare Creditor Insurance Market Size, Share, and COVID-19 Impact Analysis, By Age Group (Pediatric, Adult, and Geriatric), By Distribution Channel (Direct Sales, Brokers & Individual Agents, and Bankers), and South Korea Healthcare Creditor Insurance Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Healthcare Creditor Insurance Market Insights Forecasts to 2035

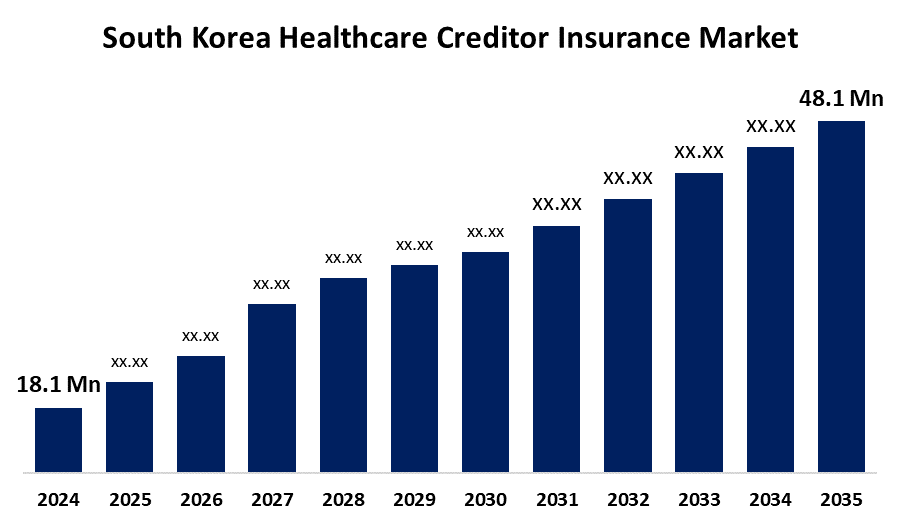

- The South Korea Healthcare Creditor Insurance Market Size Was Estimated at USD 18.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.29% from 2025 to 2035

- The South Korea Healthcare Creditor Insurance Market Size is Expected to Reach USD 48.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Healthcare Creditor Insurance Market Size is anticipated to reach USD 48.1 Million by 2035, growing at a CAGR of 9.29% from 2025 to 2035. The market's main development drivers are rising penetration brought on by related advantages including debt protection from unforeseen circumstances and financial stability. Additionally, the expansion of healthcare services and rising healthcare prices have driven this market's expansion.

Market Overview

Healthcare creditor insurance market refers to insurance products designed to protect borrowers by covering loan repayments if they become unable to pay due to illness, injury, or disability. This market benefits both lenders and borrowers by reducing financial risk and ensuring loan recovery while providing borrowers peace of mind during health challenges. Growing awareness of health-related financial risks and increasing loan uptake are creating opportunities for market expansion. Additionally, advances in digital technology enable streamlined policy issuance and claims processing. Governments worldwide support this market by implementing regulations to protect consumers and promote financial inclusion, often encouraging insurance adoption through incentives and awareness campaigns. These initiatives foster trust, enhance access, and contribute to market growth in healthcare creditor insurance.

Report Coverage

This research report categorizes the market for South Korea healthcare creditor insurance market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea healthcare creditor insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea healthcare creditor insurance market.

South Korea Healthcare Creditor Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 9.29% |

| 2035 Value Projection: | USD 48.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 280 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Age Group and By Distribution Channel |

| Companies covered:: | Samsung Life Insurance, Hanwha Life Insurance, Kyobo Life Insurance, DB Insurance, Hyundai Marine & Fire Insurance, Meritz Fire & Marine Insurance, NH NongHyup Life Insurance, Korean Life Insurance, Shinhan Life Insurance, Korean Reinsurance Company, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Technological advancements, such as artificial intelligence and data analytics, enable insurers to assess risk profiles, customize insurance plans, and streamline claims processing more accurately. Additionally, regulatory changes and healthcare reforms are driving the adoption of these insurance products. The increasing demand for healthcare services, coupled with rising healthcare costs, has led to a higher prevalence of medical debts, further driving the need for creditor insurance. Partnerships between insurers and healthcare providers are also contributing to market expansion by offering integrated financial solutions.

Restraining Factors

A primary concern is the high cost associated with these insurance products, including premiums and administrative expenses, which can limit accessibility for both consumers and providers. Additionally, the complexity of integrating healthcare creditor insurance with existing healthcare systems and policies poses significant hurdles. Regulatory uncertainties and the evolving nature of healthcare laws can create an unpredictable environment, discouraging investment and innovation in this sector.

Market Segmentation

The South Korea Healthcare Creditor Insurance Market share is classified into age group and distribution channel.

- The adult segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea healthcare creditor insurance market is segmented by age group into pediatric, adult, and geriatric. Among these, the adult segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. In most nations, adults usually comprise the greatest portion of the population. The adult segment accounts for a sizable component of the insured population due to the aging of populations in various regions of the world.

- The brokers & individual agents segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea healthcare creditor insurance market is segmented by distribution channel into direct sales, brokers & individual agents, and bankers. Among these, the brokers & individual agents segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Generally speaking, brokers and individual agents offer more individualized service than larger insurance firms. They can assist healthcare providers in navigating the intricacies of healthcare creditor insurance by providing them with tailored solutions and one-on-one support.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea healthcare creditor insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung Life Insurance

- Hanwha Life Insurance

- Kyobo Life Insurance

- DB Insurance

- Hyundai Marine & Fire Insurance

- Meritz Fire & Marine Insurance

- NH NongHyup Life Insurance

- Korean Life Insurance

- Shinhan Life Insurance

- Korean Reinsurance Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea healthcare creditor insurance market based on the below-mentioned segments:

South Korea Healthcare Creditor Insurance Market, By Age Group

- Pediatric

- Adult

- Geriatric

South Korea Healthcare Creditor Insurance Market, By Distribution Channel

- Direct Sales

- Brokers & Individual Agents

- Bankers

Need help to buy this report?