South Korea Graphite Market Size, Share, and COVID-19 Impact Analysis, By Form (Natural and Synthetic), By Application (Electrode, Refractory, Lubricant, Foundry, and Battery), and South Korea Graphite Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Graphite Market Size Insights Forecasts to 2035

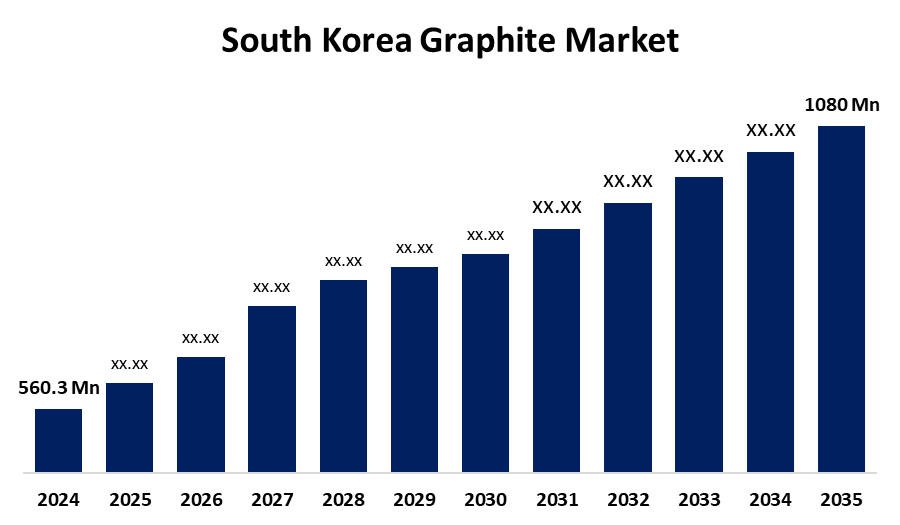

- The South Korea Graphite Market Size was estimated at USD 560.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.15% from 2025 to 2035

- The South Korea Graphite Market Size is Expected to Reach USD 1080 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Graphite Market Size is anticipated to reach USD 1080 million by 2035, growing at a CAGR of 6.15% from 2025 to 2035. Driven by the growing need for lithium-ion batteries in energy storage and electric car systems, which is being bolstered by robust government programs for green mobility. Furthermore, improvements in graphite recycling and processing technology are strengthening domestic production capacities, decreasing dependency on imports, and increasing market sustainability.

Market Overview

A key market for graphite in South Korea's advanced manufacturing and technology sectors, the market is largely driven by the growing demand for lithium-ion batteries used in renewable energy storage systems and electric vehicles (EVs). South Korea is a leader in battery production, with leading firms like LG Energy Solution, Samsung SDI, and SK Innovation supporting this demand even more. Additionally, the production of batteries has increased as a result of the South Korean government's aggressive promotion of the development of alternative energy sources and electric vehicles. The need for natural and synthetic graphite, which is a necessary component of lithium-ion batteries, is being driven by South Korea's well-established battery manufacturers increasing their capacity. Furthermore, by increasing the purity and effectiveness of graphite materials, advancements in graphite processing technology are revolutionizing the graphite market industry in South Korea. To meet the high purity standards needed for a variety of applications, particularly in electronics and battery manufacturing, South Korean businesses are increasingly implementing new extraction technologies and sophisticated purification techniques. Research funding for materials science has risen by 25% in recent years, according to the Ministry of Science and ICT, which is encouraging advancements in graphite processing. Moreover, this technological development positions South Korea as a leader in the production of high-quality graphite by increasing production capabilities and drawing in foreign investments. As a result, the market is anticipated to grow as these new technologies reduce costs and enhance performance, increasing South Korean graphite's competitiveness internationally.

Report Coverage

This research report categorizes the market for the South Korea graphite market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea graphite market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea graphite market.

South Korea Graphite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 560.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.15% |

| 2035 Value Projection: | USD 1080 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Form, By Application and COVID-19 Impact Analysis |

| Companies covered:: | SGL Carbon, GrafTech International, Imerys, BTR New Material Group Co., Ltd., Morgan Advanced Materials plc, Nippon Carbon Co. Ltd., and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South Korea's electronics industry is changing, especially as electric and smart devices become more popular. High-purity graphite is becoming more and more in demand for uses like semiconductors and thermal management materials. Expanding domestic mining operations can lessen reliance on imported graphite, which would be in line with national strategic objectives for resource security. This is one opportunity to investigate. Additionally, the industry has a great deal of potential for sustainable practices thanks to technological advancements in processes like recycling graphite from spent batteries. The graphite market has recently been impacted by sustainability initiatives and environmental regulations. While promoting innovation in graphite production methods, South Korea has been increasing its emphasis on environmentally friendly mining practices. The goal of this change is to encourage responsible sourcing and lessen environmental impact. Therefore, businesses that can align themselves with innovative technologies and sustainable practices stand a better chance of gaining market share. All things considered, the graphite market in South Korea is expected to expand due to the convergence of the country's industrial aspirations with sustainability initiatives and the demand for advanced materials.

Restraining Factors

The graphite market in South Korea is constrained by supply chain interruptions, geopolitical reliance, and mining and processing-related environmental issues. Market stability and self-sufficiency are further threatened by low domestic natural graphite reserves and a reliance on imports, particularly from China.

Market Segmentation

The South Korea graphite market share is classified into form and application.

- The synthetic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea graphite market is segmented by form into synthetic and natural. Among these, the synthetic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Synthetic graphite is a crucial component in high-performance applications where consistency and quality are crucial, like lubricants, steel production, and lithium-ion batteries. This is because it enables the customization of material properties.

- The battery segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea graphite market is segmented by form into application into electrode, refractory, lubricant, foundry, and battery. Among these, the battery segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. A major factor driving the growth of the South Korean graphite market is the battery segment, which is gaining traction quickly due to the rise in electric vehicle production and storage technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea graphite market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SGL Carbon

- GrafTech International

- Imerys

- BTR New Material Group Co., Ltd.

- Morgan Advanced Materials plc

- Nippon Carbon Co. Ltd.

- Others

Recent Developments:

- In July 2025 , OCI had announced that it had started initial deliveries of pitch for isotropic artificial graphite to IBIDEN Graphite Korea, the sole manufacturer of isotropic artificial graphite in Korea. This material was considered essential in the semiconductor and advanced materials sectors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Graphite Market based on the below-mentioned segments:

South Korea Graphite Market, By Form

- Natural

- Synthetic

South Korea Graphite Market, By Application

- Electrode

- Refractory

- Lubricant

- Foundry

- Battery

Need help to buy this report?