South Korea Gold Mining Market Size, Share, and COVID-19 Impact Analysis, By Mining Method (Surface Mining and Underground Mining), By Grade (Low, Average, and High), and South Korea Gold Mining Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerSouth Korea Gold Mining Market Insights Forecasts to 2035

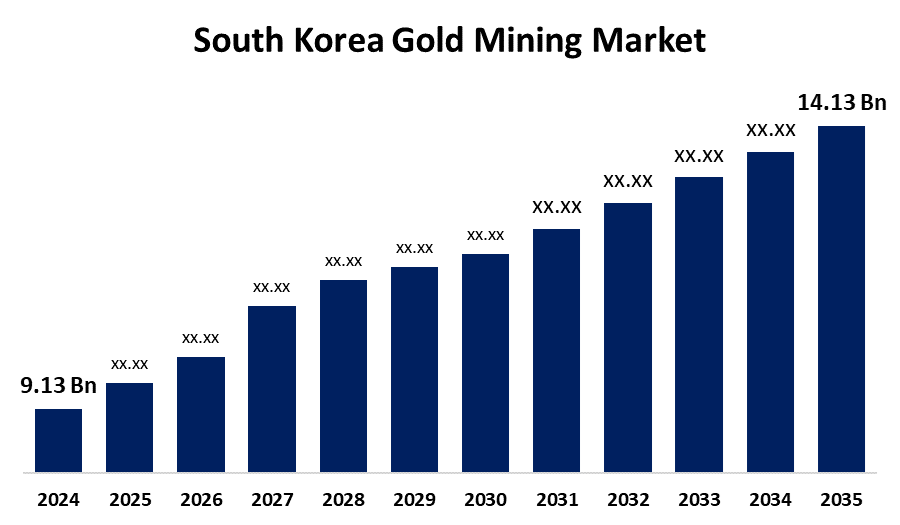

- The South Korea Gold Mining Market Size Was Estimated at USD 9.13 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.05% from 2025 to 2035

- The South Korea Gold Mining Market Size is Expected to Reach USD 14.13 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Gold Mining Market is anticipated to reach USD 14.13 Billion by 2035, growing at a CAGR of 4.05% from 2025 to 2035. Gold mining is the process of obtaining gold through a variety of techniques, including hard rock and placer mining. Both above and below the surface of the earth, the process of gold concentration takes place. The action of flowing water, typically rivers, has concentrated alluvial gold near the surface.

Market Overview

The gold mining market includes all operations associated with the extraction of gold from the soil. It encompasses both artisanal and small-scale (ASGM) and industrial-scale gold mining activities. From initial exploration and resource evaluation to final production and refinement, the gold mining market includes all operations associated with the extraction of gold from the soil. It encompasses both artisanal and small-scale (ASGM) and industrial-scale gold mining activities. Technological developments in the mining business have been fueled by gold mining. To increase the effectiveness and security of their operations, mining corporations spend money on research and development. New technologies, like remote monitoring systems and automated mining equipment, have been developed as a result of these advancements, increasing the productivity of mining operations. To promote domestic production and lessen dependency on imports, the government wants to streamline laws pertaining to gold mining, refining, and monetization. The business and investors both gain from initiatives aimed at increasing financial participation in the gold market.

Report Coverage

This research report categorizes the market for South Korea gold mining market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea gold mining market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea gold mining market.

South Korea Gold Mining Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.13 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.05% |

| 2035 Value Projection: | USD 9.13 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 88 |

| Segments covered: | By Mining Method, By Grade and COVID-19 Impact Analysis. |

| Companies covered:: | Korea Zinc Co., Ltd., LS-NIKKO Copper Inc., Samduck Precious Metals, SungEel HiTech, Torecom, Daejin Indus Co., Ltd., Do Sung Corporation, HwaSeong CJ Co., Ltd., Korea Metal Co., Ltd., Young Poong Group, CNK International, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing demand for gold as a safe haven asset, expanding interest in resource self-sufficiency, and rising gold prices. Improvements in mining and exploration technology have increased the effectiveness of extraction, attracting domestic investment. The market is also growing as a consequenc of encouraging government initiatives to revive the domestic mining industry. In order to establish South Korea as a major player in sustainable gold sourcing and refining, urban mining the recovery of precious metals from electronic waste is also essential.

Restraining Factors

The scarcity of domestic gold reserves is a major problem; many historic mines have been shut down for decades and will cost a lot of money to revive. Furthermore, large-scale operations are less feasible under the current legal framework due to the tiny size of mining blocks. New mining ventures are made more difficult by environmental issues and the requirement for thorough land use planning.

Market Segmentation

The South Korea gold mining market share is classified into mining method and grade.

- The surface mining segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea gold mining market is segmented by mining method into surface mining and underground mining. Among these, the surface mining segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. When ore deposits or mineral resources are reasonably close to the surface, the surface mining technique is employed. The term "quarries" can refer to open pit mining that generate stone measures and construction materials. In general, it is employed to gather coal, phosphates, aluminum, gold, crushed stone, sand, and rock.

- The low segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea gold mining market is segmented by grade into low, average, and high. Among these, the low segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The average reserve grade of the remaining ore body will drop, which will have a short-term positive economic impact. As the average grade of the ore body decreases, mining expenses continue to have an impact on mining life.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea gold mining market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Korea Zinc Co., Ltd.

- LS-NIKKO Copper Inc.

- Samduck Precious Metals

- SungEel HiTech

- Torecom

- Daejin Indus Co., Ltd.

- Do Sung Corporation

- HwaSeong CJ Co., Ltd.

- Korea Metal Co., Ltd.

- Young Poong Group

- CNK International

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea gold mining market based on the below-mentioned segments:

South Korea Gold Mining Market, By Mining Method

- Surface Mining

- Underground Mining

South Korea Gold Mining Market, By Grade

- Low

- Average

- High

Need help to buy this report?