South Korea Generic Injectables Market Size, Share, and COVID-19 Impact Analysis, By Formulation Type (Solution, Suspension, Emulsion, and Lyophilized), By Route of Administration (Intravenous, Intramuscular, Subcutaneous, and Intradermal), By Therapeutic Area (Oncology, Cardiovascular, Infectious Diseases, and Hormonal Disorders) and By Packaging Type (Vials, Ampoules, Pre-filled Syringes, and Bags), and South Korea Generic Injectables Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareSouth Korea Generic Injectables Market Insights Forecasts to 2035

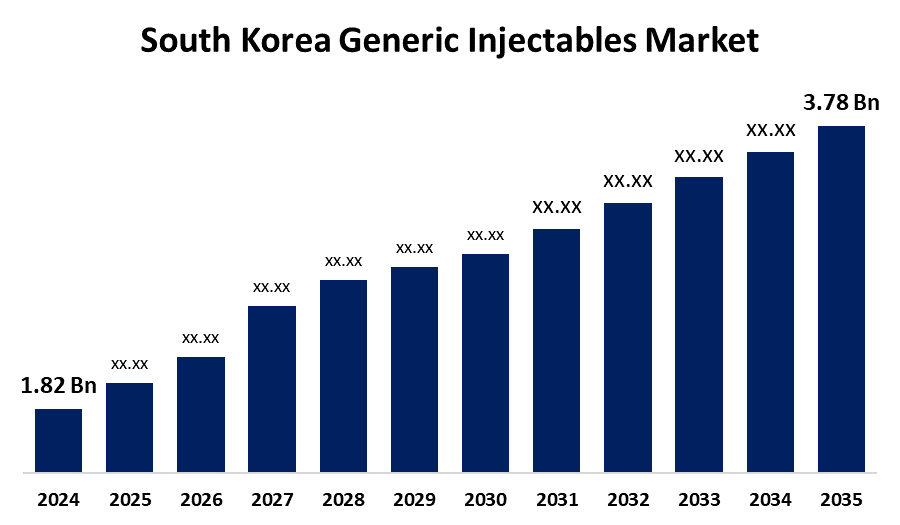

- The South Korea Generic Injectables Market Size Was Estimated at USD 1.82 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.87% from 2025 to 2035

- The South Korea Generic Injectables Market Size is Expected to Reach USD 3.78 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Generic Injectables Market is anticipated to reach USD 3.78 Billion by 2035, growing at a CAGR of 6.87% from 2025 to 2035. The growing emphasis on affordable healthcare solutions is driving significant demand in South Korea's generic injectables market. The main factors driving the industry are the government's efforts to provide universal healthcare and the increased focus on cutting healthcare costs.

Market Overview

Injectable pharmaceutical products that are less expensive than branded injectables and have the same active ingredients and therapeutic effects are included in the generic injectable market. There are several ways to administer these injectables, including subcutaneous, intramuscular, and intravenous injections. Because producers do not have to bear the early expenditures of research and development, generic injectables are usually less expensive than their branded counterparts. Patients and healthcare systems directly benefit from these cost savings, which may lower overall healthcare costs. Generic injectables are a more sustainable choice for addressing long-term healthcare requirements and treating chronic illnesses due to their cost-effectiveness. To guarantee that they are just as safe and effective as their name-brand equivalents, generic injectables must adhere to the same strict regulations. They have to show that they are bioequivalent, which means that they enter the bloodstream with the same quantity of medication as the name-brand pharmaceutical. The need for accessible and reasonably priced healthcare in many developing nations is driving the demand for generic injectables. The need for generic injectables is being driven by the global increase of chronic illnesses like diabetes, cardiovascular disease, and cancer. Preferential reimbursement and formularies that give generic injectables priority are two examples of government programs that frequently aim to encourage the use of generic medications in healthcare settings.

Report Coverage

This research report categorizes the market for South Korea generic injectables market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea generic injectables market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each South Korea generic injectables market sub-segment.

South Korea Generic Injectables Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.82 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.87% |

| 2035 Value Projection: | USD 3.78 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Formulation Type (Solution, Suspension, Emulsion, and Lyophilized), By Route of Administration (Intravenous, Intramuscular, Subcutaneous, and Intradermal), By Therapeutic Area (Oncology, Cardiovascular, Infectious Diseases, and Hormonal Disorders) and By Packaging Type (Vials, Ampoules, Pre-filled Syringes, and Bags) |

| Companies covered:: | Hanmi Pharmaceutical Co., Ltd., Chong Kun Dang Pharmaceutical Corp., Daewoong Pharmaceutical Co., Ltd., GC Biopharma (Green Cross Corporation), Yuhan Corporation, Samsung Biologics Co., Ltd., Ildong Pharmaceutical Co., Ltd., Dong-A ST Co., Ltd., REYON Pharmaceutical Co., Ltd., Hana Pharm Co., Ltd., Jeil Pharmaceutical Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The prevalence of diseases including diabetes, cardiovascular disease, and cancer is rising, which is driving up demand for injectable treatments in south Korea. The need for drugs to address age-related illnesses, many of which are treated with injectables, is increasing as the world's population ages. Compared to branded medications, generic injectables are more affordable, making them available to a larger patient base and lowering medical expenses. Generic equivalents of branded injectables can enter the market when patents on such products expire, and the creation of biosimilars generic versions of biologics is also driving market expansion.

Restraining Factors

Generic injectables are bioequivalent to branded medications, so strict quality control and manufacturing procedures are needed. It can take a long time and be difficult to get regulatory clearances for generic injectables, which could postpone market debut. Because of their perceived stability, proven safety and efficacy profiles, and mistrust of generic injectables, certain patients and prescribers may favor branded medications. Effective marketing and communication techniques are needed to overcome this preference and increase trust in the efficacy and quality of generic injectables.

Market Segmentation

The South Korea generic injectables market share is classified into formulation type, route of administration, therapeutic area, and packaging type.

- The solution segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korean generic injectable market is segmented by formulation type into solution, suspension, emulsion, and lyophilized. Among these, the solution segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Solutions are especially common because they offer a simple way to administer drugs and have high rates of absorption, which makes them crucial for a number of therapeutic uses.

- The intravenous segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea generic injectables market is segmented by route of administration into intravenous, intramuscular, subcutaneous, and intradermal. Among these, the intravenous segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is Because of its quick beginning of effect, intravenous administration is frequently chosen and is essential in emergency and critical care situations.

- The oncology segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea generic injectables market is segmented by therapeutic area into oncology, cardiovascular, infectious diseases, and hormonal disorders. Among these, the oncology segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because cancer is becoming more common in South Korea, oncology injectables which are essential for treating cancer dominate, leading to a move toward more affordable generic alternatives.

- The vials segment held a majority share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea generic injectables market is segmented by packaging type into vials, ampoules, pre-filled syringes, and bags. Among these, the vials segment held a majority share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because they may be used with a variety of pharmaceuticals and maintain the integrity of the drugs, vials are quite important in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea generic injectables market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hanmi Pharmaceutical Co., Ltd.

- Chong Kun Dang Pharmaceutical Corp.

- Daewoong Pharmaceutical Co., Ltd.

- GC Biopharma (Green Cross Corporation)

- Yuhan Corporation

- Samsung Biologics Co., Ltd.

- Ildong Pharmaceutical Co., Ltd.

- Dong-A ST Co., Ltd.

- REYON Pharmaceutical Co., Ltd.

- Hana Pharm Co., Ltd.

- Jeil Pharmaceutical Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea generic injectables market based on the below-mentioned segments:

South Korea Generic Injectables Market, By Formulation Type

- Solution

- Suspension

- Emulsion

- Lyophilized

South Korea Generic Injectables Market, By Route of Administration

- Intravenous

- Intramuscular

- Subcutaneous

- Intradermal

South Korea Generic Injectables Market, By Therapeutic Area

- Oncology

- Cardiovascular

- Infectious Diseases

- Hormonal Disorders

South Korea Generic Injectables Market, By Packaging Type

- Vials

- Ampoules,

- Pre-filled Syringes

- Bags

Need help to buy this report?