South Korea Generic Drug Market Size, Share, and COVID-19 Impact Analysis, By Therapy Area (Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, and Others), By Drug Delivery (Oral, Injectables, Dermal/Topical, Inhalers), and South Korea Generic Drug Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Generic Drug Market Insights Forecasts to 2035

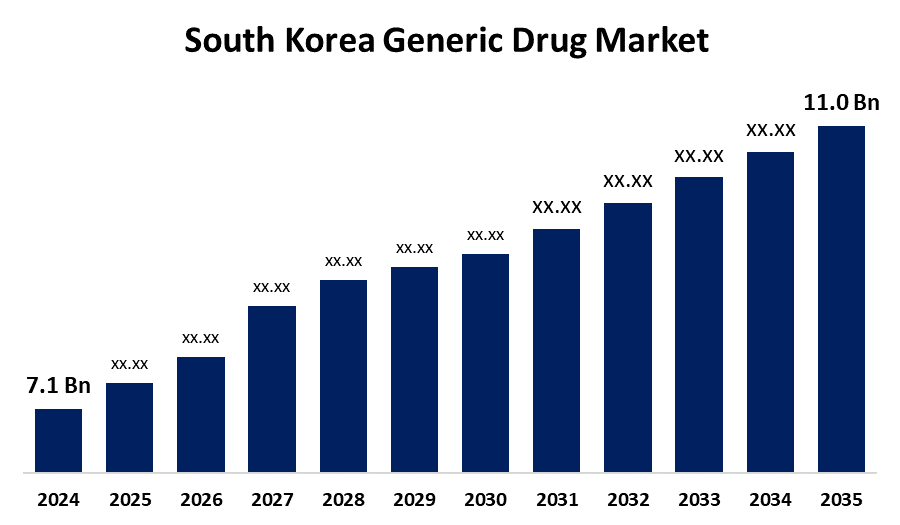

- The South Korea Generic Drug Market Size was Estimated at USD 7.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.06% from 2025 to 2035

- The South Korea Generic Drug Market Size is Expected to Reach USD 11.0 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Generic Drug Market Size is Anticipated to Reach USD 11.0 Billion by 2035, Growing at a CAGR of 4.06% from 2025 to 2035. Some of the major factors propelling the market are the expansion of the nation's pharmaceutical industry, the expiration of several branded medications, the implementation of advantageous government initiatives, and the growing need for reasonably priced treatment plans.

Market Overview

In South Korea, the term "generic drug market" refers to the industry that includes pharmaceutical products that are sold under their chemical names after the original patents have expired but are identical to brand-name medications in terms of dosage, strength, administration method, and intended use. Various manufacturers produce these generics, which are regulated to guarantee their quality, safety, and effectiveness. Additionally, The South Korean government has put in place a number of laws and programs to encourage the use of generic medications in an effort to lower medical expenses and make prescription drugs more affordable. The implementation of pricing mechanisms that encourage the use of generic medications, the promotion of generic substitution at pharmacies, and incentives for doctors to prescribe generics are some examples of these policies. Furthermore, rising healthcare and drug costs have become a major issue in South Korea. In order to solve this problem, generic drugs are becoming more and more popular among healthcare providers and the government as more affordable substitutes for name-brand drugs. Generic medications are becoming more and more popular as a result of this cost-conscious strategy.

Report Coverage

This research report categorizes the market for the South Korea generic drug market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea generic drug market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea generic drug market.

South Korea Generic Drug Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.1 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.06% |

| 2035 Value Projection: | USD 11.0 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Therapy Area, By Drug Delivery and COVID-19 Impact Analysis. |

| Companies covered:: | Hanmi Pharmaceutical, Chong Kun Dang Pharmaceutical, Dong-A ST, Ildong Pharmaceutical and Other Key Vendor. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The pharmaceutical sector has been growing and getting more competitive. To create high-quality generic drugs, domestic generic drug manufacturers are spending money on research and development. There are now more generic medication options available to consumers and healthcare providers as a result of the expansion of the local pharmaceutical industry. Additionally, South Korean medical professionals are growing more knowledgeable about the effectiveness and safety of generic medications. When appropriate, they are more likely to prescribe generic drugs, which encourages patients to accept and use them.

Restraining Factors

Pharmaceutical firms may use tactics like small formulation adjustments or novel delivery systems to prolong the patent life of medications. These tactics have the potential to keep drug prices higher by delaying generic competition.

Market Segmentation

The South Korea generic drug market share is classified into therapy area and drug delivery.

- The cardiovascular segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea generic drug market is segmented by therapy area into central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others. Among these, the cardiovascular segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. With the high incidence of heart-related diseases like hypertension and coronary artery disease, which fuel demand for reasonably priced generic drugs, this market is dominated.

- The oral segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea generic drug market is segmented by drug delivery into oral, injectables, dermal/topical, and inhalers. Among these, the oral segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The strong demand for tablets and capsules, which are extensively used for a variety of therapeutic areas, such as the treatment of diabetes, cardiovascular disease, and disorders of the central nervous system, is the reason this segment dominates. Because of their affordability, patient compliance, and ease of administration, oral medications are recommended.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea generic drug market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hanmi Pharmaceutical

- Chong Kun Dang Pharmaceutical

- Dong-A ST

- Ildong Pharmaceutical

- Others

Recent Developments:

- In February 2025, Boryung Pharmaceutical introduced Pomalin Capsule, the first generic multiple myeloma treatment in South Korea. The drug contained pomalidomide and was available in four dosages (1 mg, 2 mg, 3 mg, and 4 mg).

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Generic Drug Market based on the below-mentioned segments:

South Korea Generic Drug Market, By Therapy Area

- Central Nervous System

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology,

- Diabetes

- Oncology

- Others

South Korea Generic Drug Market, By Drug Delivery

- Oral

- Injectables

- Dermal/Topical

- Inhalers

Need help to buy this report?