South Korea Gabapentin Market Size, Share, and COVID-19 Impact Analysis, By Dosage Form (Tablet, Capsule, and Oral Solution), By Type (Generic and Branded), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and South Korea Gabapentin Market Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Gabapentin Market Size Insights Forecasts to 2035

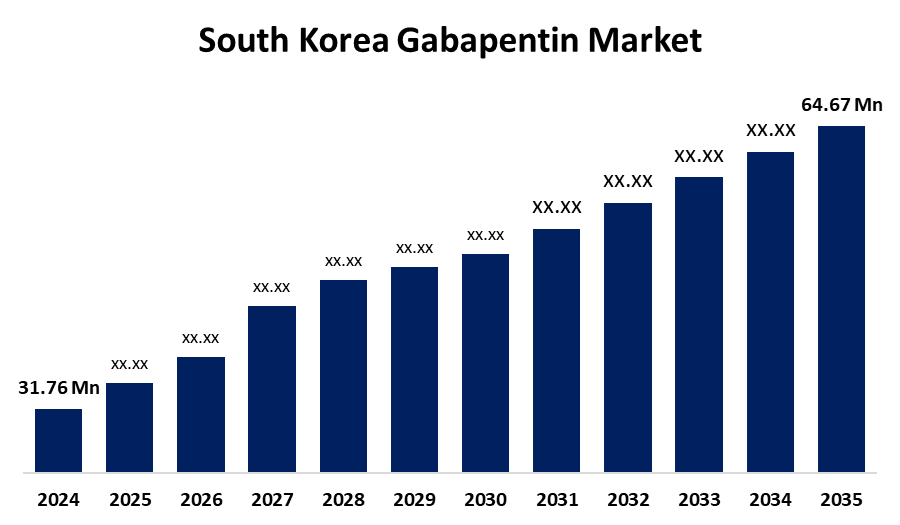

- The South Korea Gabapentin Market Size Was Estimated at USD 31.76 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.68% from 2025 to 2035

- The South Korea Gabapentin Market Size is Expected to Reach USD 64.67 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Gabapentin Market Size is anticipated to reach USD 64.67 million by 2035, growing at a CAGR of 6.68% from 2025 to 2035. Gabapentin’s expanding applications beyond its original indication for epilepsy have gained traction. Medical professionals are increasingly prescribing the drug off-label for conditions such as anxiety and bipolar disorder, thus broadening its market appeal. Moreover, healthcare providers are favouring Gabapentin over traditional opioids as a pain management strategy.

Market Overview

The gabapentin market refers to the industry involved in the production, distribution, and sale of gabapentin, a medication primarily used to treat neuropathic pain, epilepsy, and restless leg syndrome. The effective nerve pain relief, seizure control, and improved quality of life for patients with chronic neurological disorders. The increasing prevalence of such conditions, aging populations, and growing awareness. The expanding generic drug production, telemedicine-based prescriptions, and rising demand in emerging regions. In South Korea, government initiatives such as support for affordable generics, expanded insurance coverage, and investment in neurological research further boost market growth. These strategies aim to enhance healthcare accessibility and reduce treatment costs, strengthening the country’s pharmaceutical sector.

Report Coverage

This research report categorizes the market for South Korea gabapentin market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea gabapentin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea gabapentin market.

Market Segmentation

The South Korea gabapentin market share is classified into dosage form, type, and distribution channel.

- The tablet segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea gabapentin market is segmented by dosage form into tablet, capsule, and oral solution. Among these, the tablet segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Its ease of administration, accurate dosing, and patient compliance. Tablets are preferred in both hospital and outpatient settings for their convenience in storage, transportation, and longer shelf life. Additionally, pharmaceutical companies increasingly favor tablets for mass production, ensuring availability and cost-effectiveness.

- The generic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea gabapentin market is segmented by type into generic and branded. Among these, the generic segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its affordability and widespread availability. With increasing healthcare cost awareness and national insurance coverage favoring cost-effective treatments, generics are highly preferred by both patients and providers. Additionally, the expiration of key patents has boosted generic production. The equivalent therapeutic efficacy of generics compared to branded drugs further drives their acceptance.

- The hospital pharmacies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea gabapentin market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and online Pharmacies. Among these, the hospital pharmacies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period the drug’s common use in managing post-operative pain and neurological conditions treated in hospitals. Physicians prefer prescribing gabapentin during inpatient care, ensuring immediate access through hospital pharmacies. These settings also offer better medication management, professional supervision, and reimbursement support. As hospital admissions for neuropathic conditions rise.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea Gabapentin Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hanmi Pharm Co., Ltd.

- Daewoong Pharmaceutical Co., Ltd.

- Chong Kun Dang Pharmaceutical Corp.

- Yuhan Corporation

- Celltrion, Inc.

- Samsung Biologics Co., Ltd.

- Adalvo (partner in gabapentin ER)

- Lotus Pharmaceutical (with Adalvo collaboration)

- DongBang Future Tech & Life Co., Ltd.

- GC Pharma (Green Cross Pharma)

- Others

Recent Developments:

- In September 2023, Gabapentin ER has been launched in collaboration with Adalvo's sister company Lotus, an international pharmaceutical company with global presence, focused on commercializing novel and generic pharmaceuticals, offering patients better, safe and more accessible medicines.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea gabapentin market based on the below-mentioned segments:

South Korea Gabapentin Market, By Dosage Form

- Tablet

- Capsule

- Oral Solution

South Korea Gabapentin Market, By Type

- Generic

- Branded

South Korea Gabapentin Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Need help to buy this report?