South Korea Fund Accounting Software Market Size, Share, And COVID-19 Impact Analysis, By Deployment Mode (Cloud-Based, On-Premise), By Application (Asset Management Companies, Insurance Firms, Banks, Pension Funds, and Others), and South Korea Fund Accounting Software Market Insights, Industry Trend, Forecasts To 2035

Industry: Banking & FinancialSouth Korea Fund Accounting Software Market Insights Forecasts to 2035

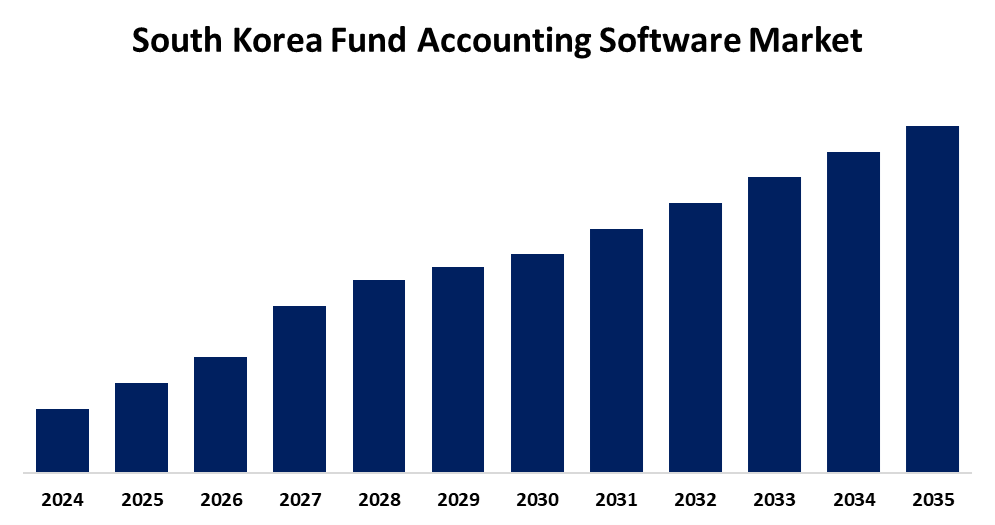

- The South Korea Fund Accounting Software Market Size is Expected to Grow at a CAGR of around 5.9% from 2025 to 2035

- The South Korea Fund Accounting Software Market Size is expected to hold a significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Fund Accounting Software Market Size is anticipated to Grow at a CAGR of 5.9% from 2025 to 2035. The market is driven by expanding institutional investments, rising demand for operational transparency, and increasing compliance mandates. The market benefits from digital transformation initiatives within the financial sector and the adoption of AI-powered analytics in fund operations.

Market Overview

The South Korea Fund Accounting Software Market Size is rapidly transforming as banking institutions move towards automating their processes. fund accounting software facilitates close monitoring and reporting of financial information of mutual funds, pension schemes, and other collective investments. with increasingly robust regulatory requirements, there is an increased need for accurate and compliant financial reporting. large insurance firms and asset managers are implementing cloud-based, ai-driven fund accounting systems in an effort to cut costs and lower the threat of human mistake. South Koreas role as an investment regional hub with growing retail and institutional involvement also encourages software installation. digital platform growth, fintech investment, and government promotion for financial innovation all drive expansion. besides, there is increasingly rising demand for esg (environmental, social, and governance) investment, which requires software to provide nuanced and tailored reporting, making demanding investment companies and banks.

Report Coverage

This research report categorizes the market for the South Korea fund accounting software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea fund accounting software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea fund accounting software market.

South Korea Fund Accounting Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.9% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Deployment Mode, By Application |

| Companies covered:: | LG Energy Solution, Samsung SDI, GS Energy, Kokam Co., Ltd., SK Ecoplant, Enertech International, Narada Power, Hitachi Chemical Energy Technology, Toshiba Corporation, Amperex Technology Limited (ATL), and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising complexity of multi-asset portfolios and growing institutional investor inflows are fueling demand for sophisticated accounting solutions. cloud-based fund accounting systems are gaining popularity based on their scalability, flexibility, and cost-effectiveness. regulatory requirements for timely and accurate fund disclosures spur adoption. the south korean government's attention to financial digital transformation, combined with increased need for real-time reporting and analytics tool integration, is driving the growth of markets. also, worldwide interest in esg-compliant funds requires effective, transparent reporting systems, which creates additional demand for software.

Restraining Factors

Barring the growth, the market is hampered by the high installation cost, difficulties in fitting into legacy systems, and shortage of new technology expertise. Small asset management companies can be driven out of a migration from legacy systems. Security concerns with cloud-based products and requirements to comply with changing domestic and foreign regulations will also impede take-up.

Market Segmentation

The South Korea fund accounting software market share is classified into deployment mode and application.

- The cloud-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea fund accounting software market is segmented by deployment mode into cloud-based and on-premise. Among these, the cloud-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This expansion is largely contributed to by the scalability, adaptability, and cost-effectiveness of cloud deployment. Banks are gradually making the move to cloud solutions because they can offer real-time availability, auto-updates, and improved integration with artificial intelligence and analytics software. Such systems do away with on-site infrastructure needs and cut IT maintenance expenses, hence attracting big companies as well as small and medium-sized asset managers looking for effective digitalization.

- The asset management companies segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea fund accounting software market is segmented by application into asset management companies, insurance firms, banks, pension funds, and others. Among these, the asset management companies segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the increased need for automated and precise fund operations for more sophisticated portfolios. Asset managers are provided with fund accounting software featuring real-time data analysis, monitoring of performance, and compliance reporting -- all critical in a setting of heightened investor expectations and regulatory scrutiny. Moreover, the increasing number of South Korean domestic and offshore fund managers drives the demand for sophisticated accounting systems that support multi-asset strategies and international reporting requirements like IFRS and K-GAAP.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea fund accounting software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG Energy Solution

- Samsung SDI

- GS Energy

- Kokam Co., Ltd.

- SK Ecoplant

- Enertech International

- Narada Power

- Hitachi Chemical Energy Technology

- Toshiba Corporation

- Amperex Technology Limited (ATL)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Fund Accounting Software Market based on the below-mentioned segments:

South Korea Fund Accounting Software Market, By Deployment Mode

- Cloud-Based

- On-Premise

South Korea Fund Accounting Software Market, By Application

- Asset Management Companies

- Insurance Firms

- Banks

- Pension Funds

- Others

Need help to buy this report?