South Korea Full-Service Carrier Market Size, Share, and COVID-19 Impact Analysis, By Service (Meals, Beverages, In Flight Entertainment, and Others), By Application (International Aviation, Domestic Aviation), and South Korea Full-Service Carrier Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationSouth Korea Full-Service Carrier Market Insights Forecasts to 2035

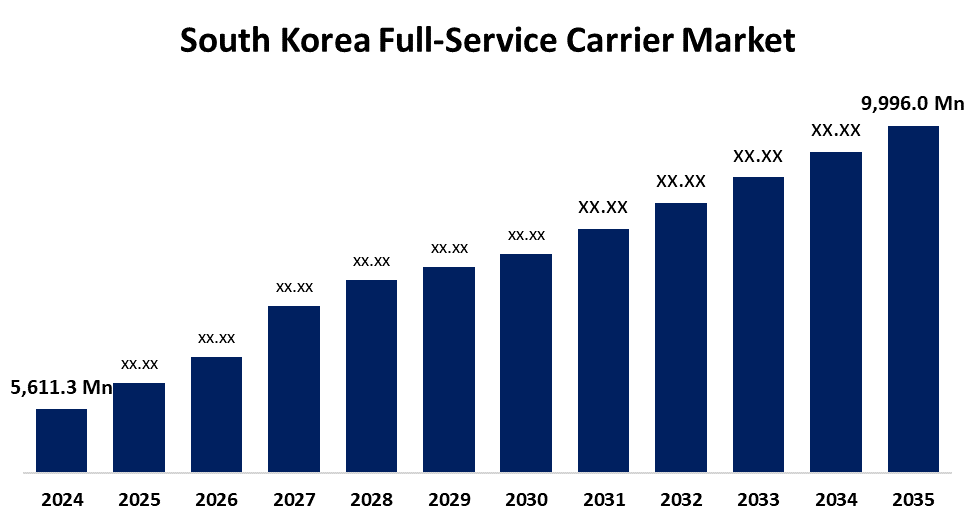

- The South Korea Full-Service Carrier Market Size was estimated at USD 5,611.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.39% from 2025 to 2035

- The South Korea Full-Service Carrier Market Size is Expected to Reach USD 9,996.0 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Full-Service Carrier Market Size is anticipated to reach USD 9,996.0 Million by 2035, growing at a CAGR of 5.39% from 2025 to 2035. Some of the main factors propelling the market are the growing travel and tourism sector and the introduction of advantageous policies by governmental entities to liberalize air travel.

Market Overview

The full-service carrier (FSC) market in South Korea is the area of the aviation sector made up of airlines that offer a wide range of first-rate services to travelers. Usually included in the ticket price, these services include checked baggage allowances, in-flight meals and drinks, lounge access, multiple seating classes, entertainment systems, and individualized customer service. Additionally, South Korean full-service airlines are adjusting to new trends by introducing cutting-edge in-flight entertainment systems, improving passenger comfort, and offering seamless connectivity. In addition, incorporating sustainable practices and emphasizing customer-focused services is in line with new developments in aviation. Full-service carriers are essential in determining the direction of air travel in South Korea, which is still establishing itself as a major player in the travel sector. As such, the regional market is anticipated to grow in the upcoming years.

Report Coverage

This research report categorizes the market for the South Korea full-service carrier market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea full-service carrier market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea full-service carrier market.

South Korea Full-Service Carrier Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5,611.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.39% |

| 2035 Value Projection: | USD 9,996.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service, By Application |

| Companies covered:: | Korean Air, Asiana Airlines, Air Premia, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The full-service carrier market in South Korea is influenced by a number of factors, including changing travel habits, technological developments, and the country's reputation as a business hub. Additionally, FSCs are essential in meeting the needs of business travelers and those taking lengthy trips, with a focus on long-haul flights and international connectivity. This is another important factor driving growth. In addition to this, South Korea's expanding tourism sector and tech-savvy populace increase demand for dependable and superior air travel services, which benefits the local market.

Restraining Factors

In South Korea's full-service carrier market, high operating costs are caused by costs such as skilled labor, fuel, and aircraft maintenance, which are particularly high on long-haul routes. These expenses raise the break-even point, which lowers profitability and makes it more difficult for airlines to stay competitive without raising ticket prices or sacrificing service quality.

Market Segmentation

The South Korea full-service carrier market share is classified into service and Application.

- The meals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea full-service carrier market is segmented by service into meals, beverages, inflight entertainment, and others. Among these, the meals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This domination is explained by the high cultural value placed on having a good meal, even when flying, and the competitive advantage that airlines gain from providing premium meals, particularly on long-haul and international flights.

- The international aviation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea full-service carrier market is segmented by application into international aviation and domestic aviation. Among these, the international aviation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Strong demand for outbound travel, the nation's advantageous position as a global transit hub, and the vast long-haul networks run by airlines like Korean Air and Asiana Airlines are the main drivers of this dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea full-service carrier market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Korean Air

- Asiana Airlines

- Air Premia

- Others

Recent Developments:

- In February 2024, Korean Air Co. and Asiana Airlines Inc. had entered the final stretch of sealing their proposed merger after winning approval by the European Union for the consolidation of South Korea's two full-service carriers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Full-Service Carrier Market based on the below-mentioned segments:

South Korea Full-Service Carrier Market, By Service

- Meals

- Beverages

- In Flight Entertainment

- Others

South Korea Full-Service Carrier Market, By Application

- International Aviation

- Domestic Aviation

Need help to buy this report?