South Korea Freight Market Size, Share, and COVID-19 Impact Analysis, By Truck Type (Dry Van and Box Truck, Refrigerated Truck, Tanker Truck, Flatbed Truck, and Others), By Cargo Type (Dry Bulk Goods, Oil and Diesel, Postal, and Others), and South Korea Freight Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationSouth Korea Freight Market Insights Forecasts to 2035

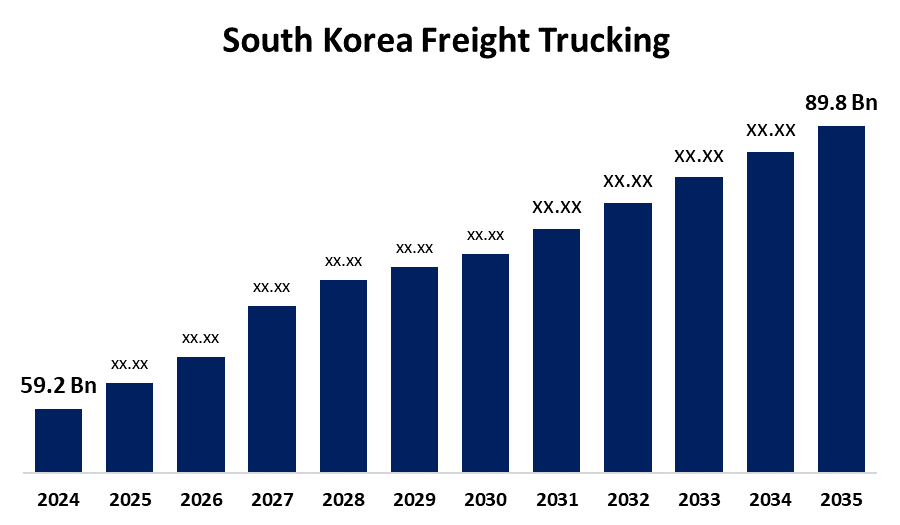

- The South Korea Freight Market Size was Estimated at USD 59.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.86% from 2025 to 2035

- The South Korea Freight Market Size is Expected to Reach USD 89.8 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Freight Trucking Size is Anticipated to Reach USD 89.8 Billion by 2035, Growing at a CAGR of 3.86% from 2025 to 2035. Some of the major factors propelling the market are the expanding demands of the textile and apparel sector, the growing dependence on cutting-edge technologies such as telematics, fleet management systems, and global positioning system (GPS) tracking, and the growing use of waste collection and disposal services.

Market Overview

The South Korea freight market refers to the movement and management of goods via domestic and international routes using a variety of transportation modes mostly air, sea, rail, and road is referred to as the South Korean freight market. It includes services like customs clearance, cargo handling, freight forwarding, and multimodal logistics coordination. Furthermore, the country's market growth is being supported by the growing use of freight trucks in the textile and apparel sector for the distribution of clothing, fashion items, and textiles. Moreover, real-time shipment tracking, route optimization, and improved fleet management are made possible by the increasing use of technologies such as telematics, fleet management systems, and global positioning system (GPS) tracking. Enhancing user experience and operational efficiency is another benefit of using digital platforms and smartphone apps for shipment tracking and booking. Additionally, the nation's market expansion is being bolstered by the growing use of freight trucks in waste collection and disposal services to move waste materials from commercial, industrial, and residential areas to waste disposal facilities.

Report Coverage

This research report categorizes the market for the South Korea freight market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea freight market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea freight market.

South Korea Freight Trucking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 59.2 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.86% |

| 2035 Value Projection: | USD 89.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Truck Type, By Cargo Type and COVID-19 Impact Analysis. |

| Companies covered:: | WeFreight Shipping & Logistics Korea Limited, KALTSTART LOGISTICS, ValuelinkU, J World Logistics Korea and Other |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The market is growing as a result of the growing emphasis on modernizing and enlarging road networks, such as highways and expressways, to enable the efficient transportation of goods and improve the effectiveness of trucking operations. Additionally, intermodal transportation which combines several modes of transportation, such as trucks and rail or sea transportation is becoming more and more popular throughout the nation. Through route optimization and a reduction in the total transportation distance, this method provides both financial and environmental advantages. Aside from this, the use of cleaner and more fuel-efficient vehicles is growing as a result of the increased enforcement of stringent emissions standards and regulations to lessen the environmental impact of transportation.

Restraining Factors

Even with its highly developed logistics system, South Korea occasionally experiences bottlenecks, particularly during busy periods or as a result of natural disasters. Making investments in infrastructure upgrades is essential to guaranteeing seamless and effective supply chain operations.

Market Segmentation

The South Korea freight market share is classified into truck type and cargo type.

- The dry van and box trucks segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea freight market is segmented by truck type into dry van and box truck, refrigerated truck, tanker truck, flatbed truck, and others. Among these, the dry van and box truckssegment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. These trucks' ability to move a wide variety of cargo makes them popular, particularly in urban and intercity logistics where theft and weather protection are crucial.

- The dry bulk goods segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea freight market is segmented by cargo type into dry bulk goods, oil and diesel, postal, and others. Among these, the dry bulk goods segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. driven by consistent export volumes of raw materials and intermediate goods, as well as strong domestic demand from industrial and construction activities. The trucking network's effective integration with port and rail infrastructure, which permits seamless multimodal logistics throughout the nation, lends additional support to this.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea freight market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- WeFreight Shipping & Logistics Korea Limited

- KALTSTART LOGISTICS

- ValuelinkU

- J World Logistics Korea

- Others

Recent Developments:

- In April 2025, In Q1 2025, the trucking industry in South Korea faced significant challenges due to the imposition of U.S. tariffs. These tariffs prompted South Korean exporters to explore alternative markets, impacted logistics patterns, and affected demand for trucking services. The need to adjust to new trade routes introduced volatility but also created opportunities for market expansion.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Freight Market based on the below-mentioned segments:

South Korea Freight Trucking Market, By Truck Type

- Dry Van and Box Truck

- Refrigerated Truck

- Tanker Truck

- Flatbed Truck

- Others

South Korea Freight Trucking Market, By Cargo Type

- Dry Bulk Goods

- Oil and Diesel

- Postal

- Others

Need help to buy this report?