South Korea Foreign Exchange Market Size, Share, and COVID-19 Impact Analysis, By Type (Currency Swap, Outright Forward and FX Swaps, FX Options), By Counterparty (Reporting Dealers, Non-Financial Customers, and Others), and South Korea Foreign Exchange Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSouth Korea Foreign Exchange Market Insights Forecasts to 2035.

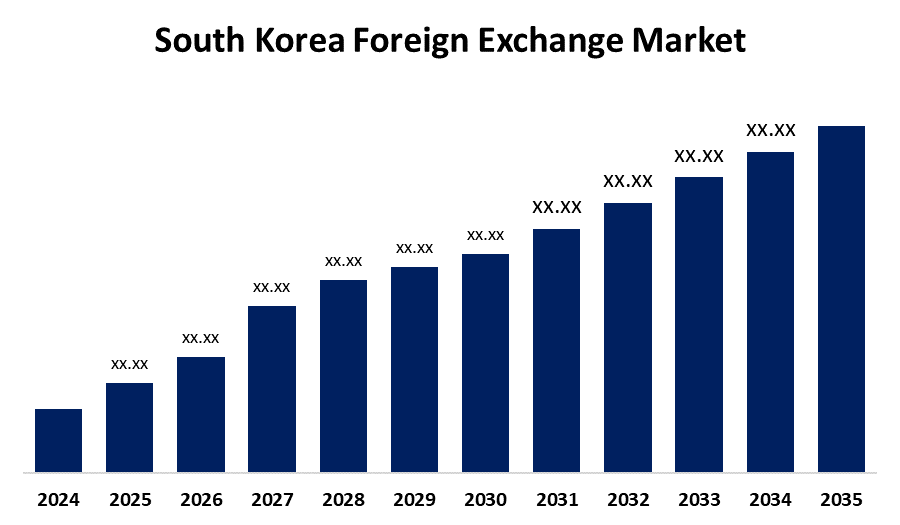

- The South Korea Foreign Exchange Market Size is Expected to Grow at a CAGR of around 10.00% from 2024 to 2035.

- The South Korea Foreign Exchange Market Size is Expected to reach a significant share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Foreign Exchange Market size is expected to grow 10.00% CAGR from 2024 to 2035, is expected to reach a significant share by 2035. The market is being driven by the growing number of traders in the forex market who frequently engage in speculative activities, purchasing and disposing of currencies based on expected future movements.

Market Overview

The South Korean foreign exchange market a key part of the country's financial system, the South Korean foreign exchange (FX) market makes it easier to exchange the South Korean won (KRW) for other currencies. It includes a range of transactions, mostly carried out in the onshore interbank market, such as spot trades, forwards, swaps, and options. The market supports global capital flows, trade, and investment in addition to allowing the Bank of Korea to efficiently carry out monetary policy. Additionally, the dynamics of regional trade, such as trade balances and tariffs, are crucial factors that influence market trends. Since news and information are disseminated quickly in our increasingly interconnected world, market sentiment is vulnerable to abrupt changes. The forex market is further driven by market innovations and technological advancements. The speed and effectiveness of currency transactions have been completely transformed by high-frequency trading, algorithmic trading, and electronic trading platforms. In order to obtain a competitive advantage, market players keep a close eye on these developments. The regional foreign exchange market is essentially a complex ecosystem where technological, political, and economic forces come together to create a dynamic environment that traders must traverse in order to make wise choices.

Report Coverage

This research report categorizes the market for the South Korea foreign exchange market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea foreign exchange market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea foreign exchange market.

South Korea Foreign Exchange Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 10.00% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 258 |

| Tables, Charts & Figures: | 94 |

| Segments covered: | By Type and By Counterparty |

| Companies covered:: | Seoul Money Brokerage Services, Ltd, Korea Money Broker Corporation, ICAP Foreign Exchange Brokerage Ltd, Tullett Prebon Money Brokerage (Korea) Ltd, GFI Korea Money Brokerage Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A wide range of factors combine to determine currency values in South Korea's dynamic foreign exchange market. Market dynamics are primarily shaped by economic indicators. One fundamental driver that affects currency values is interest rates, which central banks modify to manage inflation and promote economic expansion. Additionally, market volatility is influenced by economic data like manufacturing indices, GDP growth, and employment statistics. The forex market is also significantly impacted by political events. Geopolitical conflicts, elections, and policy choices can quickly change investor sentiment, which in turn affects currency values.

Restraining Factors

Remittances are one of the main sectors impacted by restrictions on currency transactions. Residents and citizens of South Korea are able to send money overseas, although the maximum amount that can be sent in a single transaction is limited. In general, the government doesn't require a lot of paperwork for remittances up to a certain amount. To stop money laundering and tax evasion, amounts over this limit might need further approvals.

Market Segmentation

The South Korea Foreign Exchange Market share is classified into type and counterparty

- The FX swaps segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea foreign exchange market is segmented by type into currency swap, outright forward and FX swaps, and FX options. Among these, the FX swaps segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is driven by increasing demand for short-term funding and liquidity management among financial institutions. The segment is expected to grow at a considerable CAGR, supported by rising cross-border trade and investment activities.

- The reporting dealers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea foreign exchange market is segmented by counterparty into reporting dealers, non-financial customers, and others. Among these, the reporting dealers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is attributed to their central role in interbank transactions and market-making activities. The segment is expected to grow at a considerable CAGR, supported by increasing financial market sophistication and cross-border capital flows.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea foreign exchange market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Seoul Money Brokerage Services, Ltd

- Korea Money Broker Corporation

- ICAP Foreign Exchange Brokerage Ltd

- Tullett Prebon Money Brokerage (Korea) Ltd

- GFI Korea Money Brokerage Ltd

- Others

Recent Developments:

- In May 2025, South Korea launched the Nextrade exchange in 2025, increasing competition with the established Korea Exchange by introducing longer trading hours, reduced transaction costs, and a broader range of financial products. Nextrade helped mitigate the "Korea discount" phenomenon while serving as a platform for financial sector reforms and improving market accessibility for international investors. Despite these advancements, operational challenges and regulatory gaps remained.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Foreign Exchange Market based on the below-mentioned segments:

South Korea Foreign Exchange Market, By Type

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

South Korea Foreign Exchange Market, By Counterparty

- Reporting Dealers

- Non-Financial Customers

- Others

Need help to buy this report?