South Korea Food Service Market Size, Share, and COVID-19 Impact Analysis, By Type (Full-Service Restaurants, Quick Service Restaurants, Institutes, Others), By Sector (Commercial, Non-Commercial), and South Korea Food Service Market Insights Forecasts to 2032

Industry: Food & BeveragesSouth Korea Food Service Market Insights Forecasts to 2032

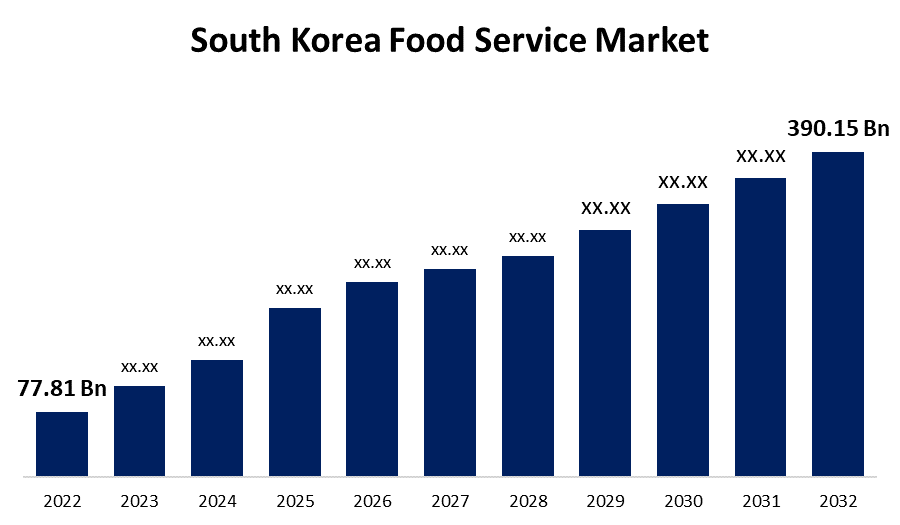

- The South Korea Food Service Market Size was valued at USD 77.81 Billion in 2022.

- The Market Size is Growing at a CAGR of 17.5% from 2022 to 2032.

- The South Korea Food Service Market Size is Expected to Reach USD 390.15 Billion by 2032.

Get more details on this report -

The South Korea Food Service Market Size is Expected to Reach USD 390.15 Billion by 2032, at a CAGR of 17.5% during the forecast period 2022 to 2032.

Market Overview

A food service establishment is any business that prepares and distributes food outside for on-premise consumption or takeaway delivery. Retailers, counter and table servers, and providers are all part of the food service industry. Fast food consumption is steadily increasing in South Korea owing to rising disposable incomes, the number of working women, and the convenience of fast food. Apart from these factors, the expansion of various-format fast food restaurants is also gaining popularity in major and emerging markets in South Korea, while franchising by companies like Domino's, McDonald's, and KFC remains one of the most popular growth models. The South Korean food industry is diverse, ranging from American-style fast-food chains to traditional family-owned restaurants. It is because, during the forecast period, Western influence has pushed South Korean consumers to prefer fusion foods and diverse cuisine blends. Restaurants and cafes across the country have adapted their menus to meet these changing tastes. Tourism in South Korea is also increasing, which adds to the demand for unique Korean dishes. Through factors such as brand familiarity, habit, and convenience, quick-service chain operators play a significant role in the market. The coffee market in South Korea has significant growth potential for cafes and bars in the coming years.

Report Coverage

This research report categorizes the market for South Korea’s food service market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea food service market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea food service market.

South Korea Food Service Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 77.81 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 17.5% |

| 2032 Value Projection: | USD 390.15 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Sector, and COVID-19 Impact Analysis. |

| Companies covered:: | Bumwood Co. Ltd., CJ Foodville Corporation, Genesis Co. Ltd, Kyochon Food&Beverage Co. Ltd, McDonald’s Corporation, Starbucks Corporation, CJ Foodville Corporation, Doctor’s Associate Inc., Domino’s Pizza Inc., Inspire Brands Inc., Isac Co. Ltd, Mom’s Touch & Co., MP DAESAN Inc., Restaurant Brands International Inc., Royal T Group Pte Ltd., Seven & I Holdings Co.Ltd., Shinsegae Food Co. Ltd, Yum! Brands Inc. and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising number of food courts and food malls is driving the growth of South Korea food service market growth during the forecast period. Shopping and dining malls have risen in popularity in South Korea. Shopping malls, which were previously limited to major cities, have recently spread to tier 2 and tier 3 cities. Customers frequently prefer to shop at multi-brand stores located under one roof. The customer wants everything under one roof, and businesses are capitalizing on this need by developing specialized multi-branded food courts/malls/halls. Designing F&B and leisure sections, including stand-alone food stalls and shops, is becoming increasingly important in new and expanded shopping center projects. Additionally, incorporating technology into the food and beverage industry is essential. By offering specialty drinks and customized coffee blends to general audiences, Starbucks and Dunkin' Donuts have significantly expanded the function and reach of traditional coffee shops. Starbucks, for example, initially used incorrect spellings of customers' names as part of their marketing strategy for them to write about it on social media and attract additional customers. Due to the social media uproar, many customers flocked to Starbucks to try it. Companies are constantly improving efficiency, identifying significant areas for R&D, and releasing new products to the market, which will fuel South Korea food service market growth during the forecast period.

Restraining Factors

Online food ordering is becoming more popular in the food service industry, and most consumer groups have adopted it. However, some of the disadvantages of online food ordering keep customers away. Along with the numerous advantages of food delivery, there are some drawbacks. One of the issues with food delivery, for example, is that the quality of the food delivered is frequently lower than the quality of the meal in a restaurant.

Market Segment

- In 2022, the full-service restaurants segment accounted for a major share over the forecast period.

Based on the type, the South Korea food service market is segmented into full-service restaurants, quick-service restaurants, institutes, and others. Among these, the full-service restaurants accounted for a major share over the forecast period. Full-service restaurants offer a comprehensive dining experience that adheres to South Korean cultural norms. These restaurants provide a one-of-a-kind cultural experience, including traditional seating arrangements and South Korean dining customs, and are popular with both locals and tourists looking for an authentic experience. Full-service restaurants place an emphasis on providing high-quality dining experiences. They appeal to customers looking for a sophisticated dining experience by combining excellent service, ambiance, and a diverse menu selection. These restaurants frequently feature diverse menus that include Korean cuisine, international dishes, and fusion options.

- In 2022, the commercial segment accounted fastest growth over the forecast period.

Based on sector, the South Korean food service market is segmented into commercial, and non-commercial. Among these, the commercial segment accounted fastest growth over the forecast period. In South Korea, the commercial segment emphasizes quality and service standards, ensuring a consistent and enjoyable dining experience for consumers. The commercial sector caters to a diverse consumer base by catering to various cultural influences and a growing acceptance of global cuisines in South Korean society. The commercial segment provides a variety of dining formats, such as casual dining, fast-casual dining, luxurious dining, and topical dining experiences, to cater to various dining occasions and consumer preferences.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea food service market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bumwood Co. Ltd.

- CJ Foodville Corporation

- Genesis Co. Ltd

- Kyochon Food&Beverage Co. Ltd

- McDonald's Corporation

- Starbucks Corporation

- CJ Foodville Corporation

- Doctor's Associate Inc.

- Domino's Pizza Inc.

- Inspire Brands Inc.

- Isac Co. Ltd

- Mom's Touch & Co.

- MP DAESAN Inc.

- Restaurant Brands International Inc.

- Royal T Group Pte Ltd.

- Seven & I Holdings Co.Ltd.

- Shinsegae Food Co. Ltd

- Yum! Brands Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, Shinsegae Food started Better Burger, a 100% plant-based burger. Instead of using animal products like milk and eggs, the burger uses plant-based meat, cheese, and buns made from soybeans and cashew nuts.

- In March 2023, Yum! Brands Inc. acquired KFC Korea Co. in collaboration with a Korean private equity fund.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korea food service market based on the below-mentioned segments:

South Korea Food Service Market, By Type

- Full-Service Restaurants

- Quick Service Restaurants

- Institutes

- Others

South Korea Food Service Market, By Sector

- Commercial

- Non-Commercial

Need help to buy this report?